Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

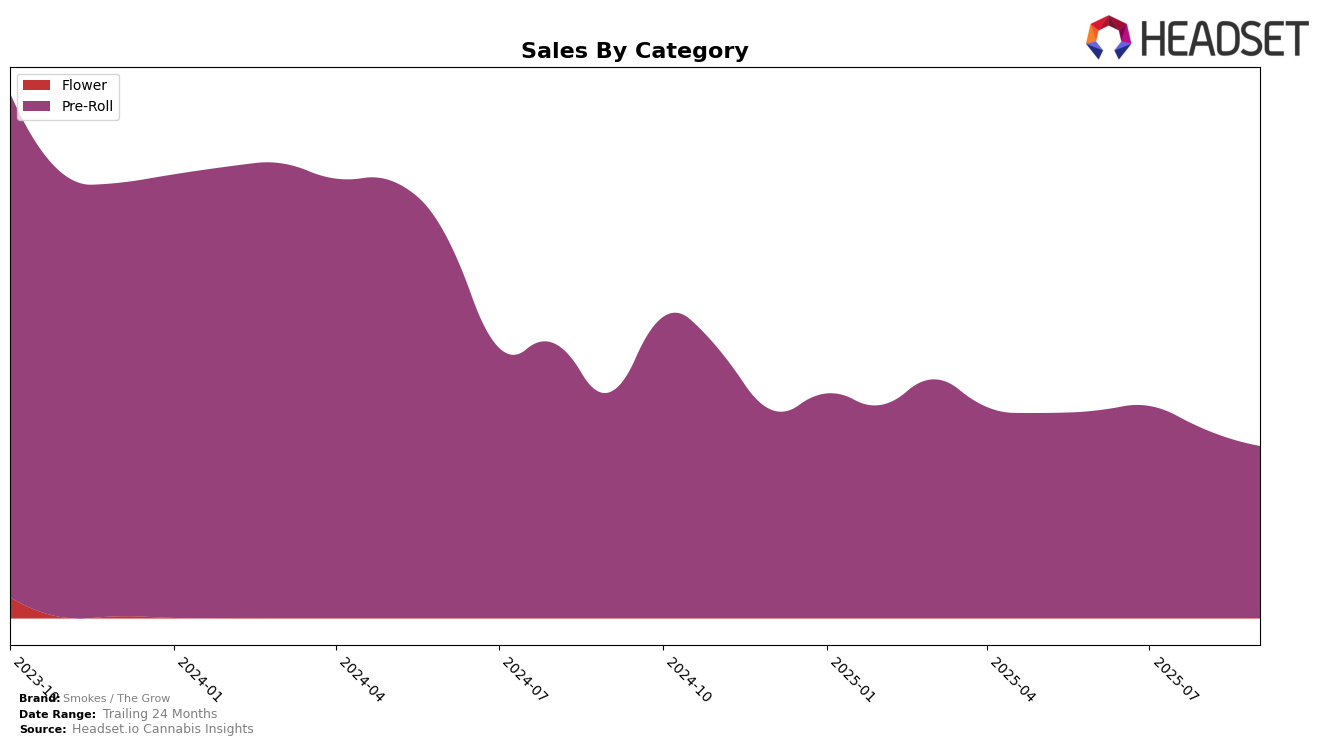

Smokes / The Grow has shown a consistent presence in the Oregon market, specifically within the Pre-Roll category. Over the past four months, the brand's ranking has experienced some fluctuations, starting at 23rd in June 2025 and dropping to 29th by September 2025. This decline in ranking could be attributed to a decrease in sales from $149,288 in June to $124,396 in September, indicating a potential challenge in maintaining market share within the competitive landscape of Oregon's Pre-Roll category. Despite these challenges, maintaining a presence within the top 30 is a testament to the brand's resilience and potential for future growth.

It's important to note that Smokes / The Grow's ability to stay within the top 30 rankings in Oregon's Pre-Roll category highlights its relative strength and brand recognition in this particular market. However, the downward trend in both rankings and sales suggests there might be underlying issues that need addressing, such as increased competition or changing consumer preferences. The absence of rankings in other states or categories could indicate that the brand is either not present or not performing as strongly outside of Oregon's Pre-Roll market, which might present opportunities for strategic expansion or diversification. More detailed insights could provide a clearer picture of the brand's performance and potential strategies for improvement.

Competitive Landscape

In the competitive landscape of the Oregon pre-roll category, Smokes / The Grow has experienced notable fluctuations in its market position from June to September 2025. Initially ranked 23rd in June, the brand saw a slight improvement to 22nd in July, but then experienced a decline to 25th in August and further to 29th by September. This downward trend in rank coincides with a decrease in sales, suggesting potential challenges in maintaining market share. In contrast, East Fork Cultivars has shown consistent improvement, moving from 34th to 27th place, indicating a strengthening position in the market. Similarly, Yin Yang made a significant leap from 39th to 28th, suggesting a positive shift in consumer preference. Meanwhile, SugarTop Buddery and Altered Alchemy have shown more volatility, with ranks fluctuating significantly over the months. These dynamics highlight the competitive pressures faced by Smokes / The Grow and underscore the importance of strategic adjustments to regain and sustain a competitive edge in the Oregon pre-roll market.

Notable Products

In September 2025, the top-performing product for Smokes / The Grow was Beach Bum Pre-Roll 10-Pack (5g) in the Pre-Roll category, which ascended from fourth place in August to secure the top spot with sales reaching 701 units. Following closely, Tropical Cookies Pre-Roll 10-Pack (5g) maintained its second-place ranking from the previous month, with a notable sales figure of 543 units. Higher Altitude Pre-Roll 10-Pack (5g) consistently held the third position across both August and September. Castaway Pre-Roll 10-Pack (5g) returned to fourth place, a position it held in June, after being unranked in August. Purple Panic Pre-Roll 10-Pack (5g) dropped from second place in July to fifth in September, indicating a decline in sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.