Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

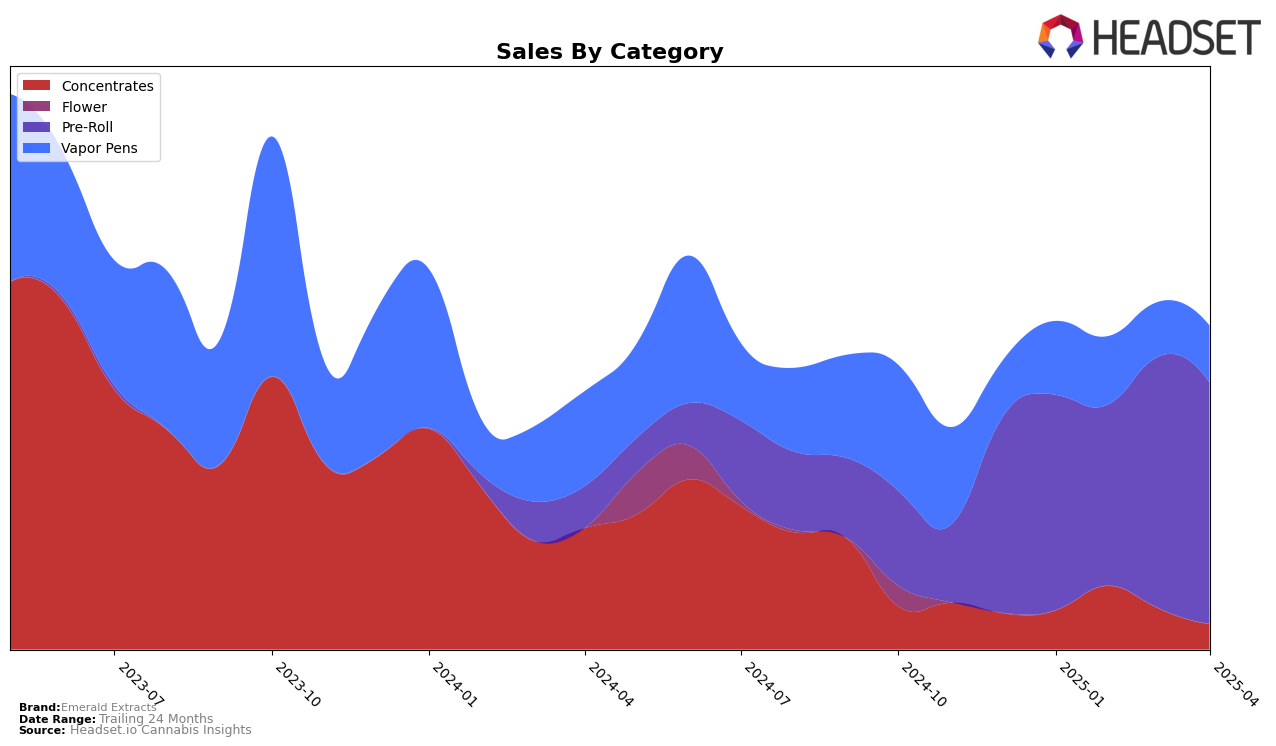

Emerald Extracts has shown varied performance across different product categories in Oregon. In the Concentrates category, the brand experienced fluctuations in its rankings, starting at 53rd in January 2025, improving to 41st in February, but then dropping to 52nd and further to 63rd by April. This decline is mirrored in their sales figures, which peaked in February but saw a sharp decrease by April. The Vapor Pens category also presented challenges, with Emerald Extracts not making it into the top 30 throughout the first four months of 2025. Their ranking slipped from 58th in January to 63rd in April, indicating a need for strategic adjustments in this category.

On a more positive note, Emerald Extracts maintained a more stable presence in the Pre-Roll category within Oregon. They consistently ranked within the top 30, starting the year at 27th and ending at 29th by April. Despite a slight dip in February, their sales in this category remained relatively robust, particularly with a notable increase in March. This stability in the Pre-Roll category suggests that Emerald Extracts has a strong foothold here, unlike their more volatile performance in Concentrates and Vapor Pens. The brand's ability to maintain a top 30 position in Pre-Rolls could be a key area of focus for sustaining growth in the competitive Oregon market.

Competitive Landscape

In the competitive landscape of the Oregon pre-roll market, Emerald Extracts has experienced a dynamic shift in its ranking and sales performance from January to April 2025. Starting at rank 27 in January, Emerald Extracts climbed to 26 in March before slipping to 29 in April. This fluctuation is notable when compared to competitors like Grown Rogue, which improved its rank from 39 in January to 27 in April, and Concrete Jungle, which consistently improved its position from 43 to 31 over the same period. Despite these changes, Emerald Extracts maintained strong sales, peaking in March, although it faced a slight decline in April. The brand's performance is also contrasted with Smokes / The Grow, which saw a significant drop in rank from 16 to 28 by April, indicating a volatile market environment. These insights suggest that while Emerald Extracts is holding its ground in terms of sales, the competitive pressure is intense, and strategic adjustments may be necessary to regain and sustain a higher market position.

Notable Products

In April 2025, Emerald Extracts' top-performing product was the Apple Sherbert x Banana Bomb Diamond Infused Pre-Roll 2-Pack (1.5g), maintaining its consistent first-place ranking for the fourth consecutive month, with sales reaching 3,581 units. The Apples and Bananas x Garlikoff Infused Pre-Roll 2-Pack (1.5g) secured the second position, holding steady from March. Candied Lemons x Strawguava Infused Pre-Roll 2-Pack (1.5g) ranked third, showing a slight decline in sales compared to March but maintaining its position. Goldilocks x College Park Infused Pre-Roll 2-Pack (1.5g) remained in fourth place, experiencing a decrease in sales from the previous month. Lastly, the Root Beer Float x Banana Cooler Diamond Infused Pre-Roll 2-Pack (1.5g) re-entered the rankings at fifth place, marking its return after a two-month absence.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.