Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

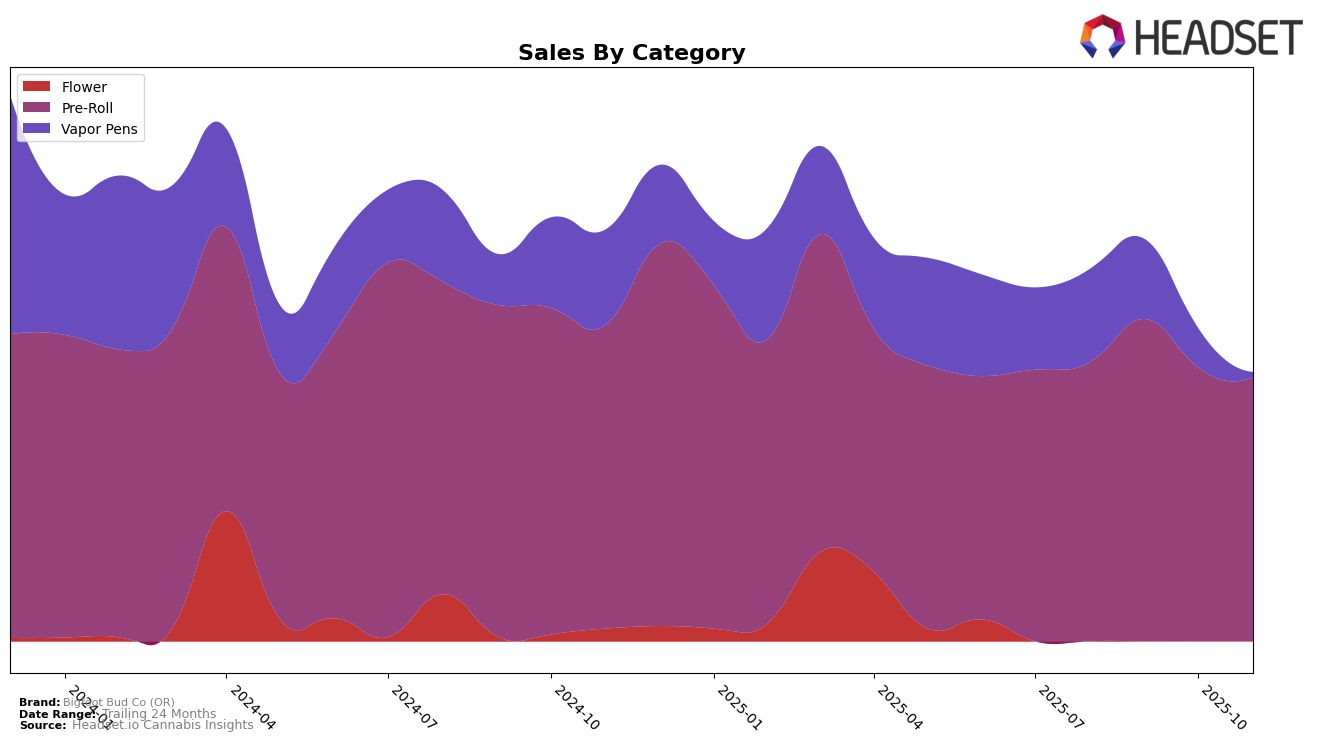

Bigfoot Bud Co (OR) has shown notable fluctuations in its performance across different categories in the state of Oregon. In the Pre-Roll category, the brand experienced a positive movement, climbing from 33rd place in August 2025 to 28th in September, before dropping slightly out of the top 30 in October, and then recovering to 30th in November 2025. This pattern indicates a dynamic market presence, with the brand managing to regain its footing by the end of the period. Despite the ups and downs, the Pre-Roll category seems to be a relatively stable area for Bigfoot Bud Co, with consistent sales figures that suggest a solid consumer base.

The Vapor Pens category paints a different picture, with Bigfoot Bud Co (OR) not making it into the top 30 rankings by November 2025. The brand maintained a steady 60th place in August and September, but saw a significant drop to 76th in October, eventually falling off the chart. This decline hints at challenges within this category, perhaps due to increased competition or shifting consumer preferences. The sales figures reflect this downward trend, with a marked decrease from September to October, highlighting potential areas for strategic improvement if the brand aims to regain market share in the Vapor Pens segment in Oregon.

Competitive Landscape

In the competitive landscape of Oregon's Pre-Roll category, Bigfoot Bud Co (OR) has experienced notable fluctuations in its rankings over the past few months. Starting at 33rd place in August 2025, the brand climbed to 28th in September, only to fall to 35th in October before recovering slightly to 30th in November. This volatility in rank suggests a dynamic market environment where competitors like Eugreen Farms and East Fork Cultivars are also vying for consumer attention. Notably, Eugreen Farms improved its position from 41st in August to 28th in November, indicating a positive trend in sales performance. Meanwhile, Piff Stixs showed a significant jump to 24th in October before dropping to 34th in November, reflecting a competitive push that may have temporarily impacted Bigfoot Bud Co (OR)'s market share. These shifts highlight the importance for Bigfoot Bud Co (OR) to continuously innovate and adapt its strategies to maintain and improve its standing in the Oregon Pre-Roll market.

Notable Products

In November 2025, Sherbanger Pre-Roll (0.5g) from Bigfoot Bud Co (OR) reclaimed the top spot in the Pre-Roll category with sales reaching 4,254 units, demonstrating its strong performance after dropping to second place in October. Hash Burger Pre-Roll (0.5g) emerged as a new contender, securing the second rank with notable sales figures. The Soap Pre-Roll (0.5g) followed closely in third place, marking its debut in the top ranks. Dulce De Uva Pre-Roll (0.5g) and Kiwi Sherbert Pre-Roll (0.5g) rounded out the top five, both maintaining consistent sales that earned them fourth and fifth positions, respectively. This month saw shifts in rankings with new entries and consistent performers, highlighting a dynamic market for Bigfoot Bud Co (OR).

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.