Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

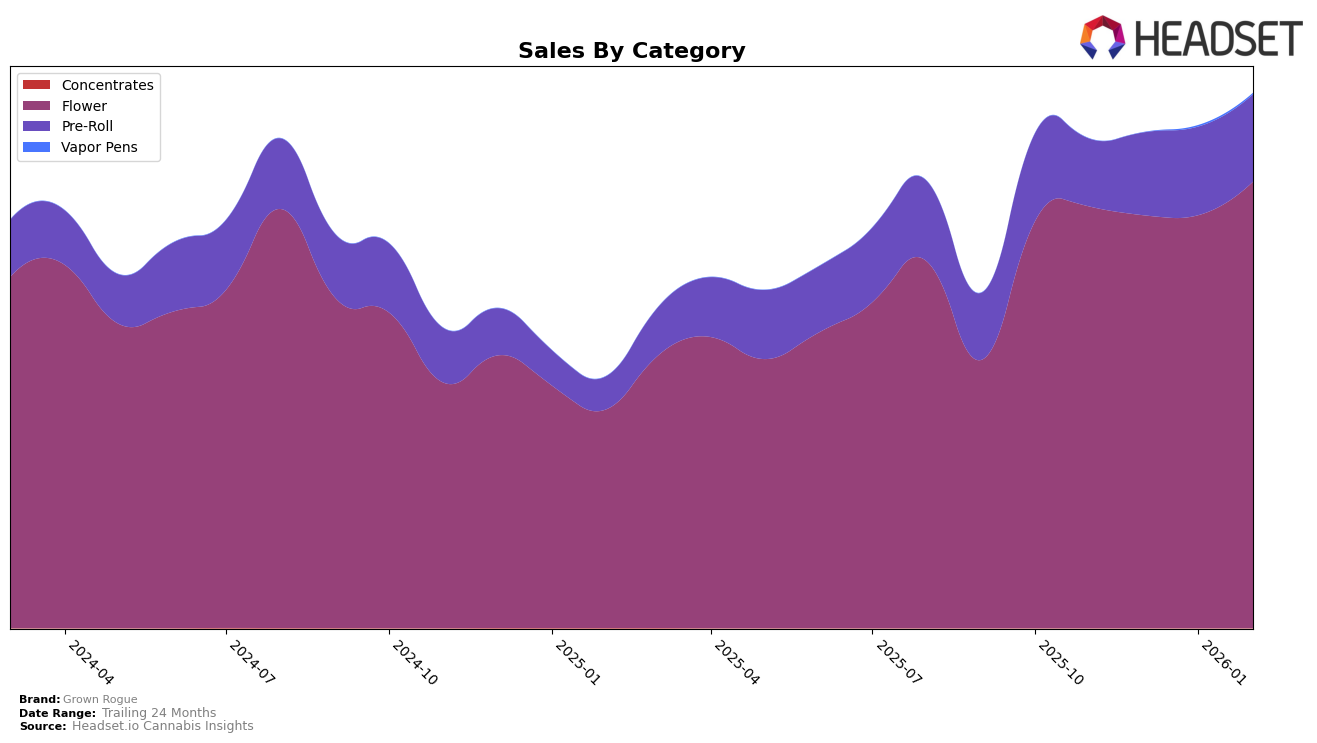

Grown Rogue has shown a dynamic performance across various states and product categories. In Michigan, the brand's Flower category has maintained a consistent presence in the top 10, with rankings fluctuating slightly between 9th and 11th position over the past few months. This stability indicates a strong foothold in the market. The Pre-Roll category in Michigan, however, has seen a more dramatic rise, moving from 68th position in November 2025 to 34th by February 2026, showcasing a significant upward trend. This could potentially signal increasing consumer interest or effective marketing strategies in place for this product line.

In New Jersey, Grown Rogue's Flower products have shown a gradual improvement, climbing from 19th to 15th place. This steady ascent suggests a growing acceptance and possibly an expanding customer base. Meanwhile, the Pre-Roll category has seen a notable rise as well, improving from 17th to 11th, which might reflect a shift in consumer preferences. In Oregon, Grown Rogue's Flower products have been particularly strong, achieving a high of 2nd place in February 2026, despite a brief dip in December. The Pre-Roll category in Oregon has also improved its standing, moving from 23rd to 18th. The absence of ranking in certain months for some categories in other states suggests areas for potential growth or market penetration challenges that the brand might need to address.

Competitive Landscape

In the competitive landscape of Michigan's flower category, Grown Rogue has demonstrated a consistent performance, maintaining a rank within the top 11 brands from November 2025 to February 2026. Despite facing stiff competition, Grown Rogue improved its rank from 11th in November 2025 to 9th in December 2025 and February 2026, indicating a positive trend in market presence. Notably, Common Citizen consistently outperformed Grown Rogue, holding a steady position within the top 7, which suggests a stronger market foothold. Meanwhile, NOBO showed significant volatility, peaking at 4th place in January 2026 before dropping to 8th in February 2026, highlighting potential instability in their market strategy. Additionally, Hytek and Grip have shown upward trends, with Hytek breaking into the top 15 by February 2026 and Grip closely trailing Grown Rogue. These dynamics suggest that while Grown Rogue is holding its ground, there is a need for strategic initiatives to enhance its competitive edge against brands like Common Citizen and capitalize on the fluctuations of others like NOBO.

Notable Products

In February 2026, Blue Runtz (Bulk) maintained its position as the top-performing product for Grown Rogue, continuing its streak from previous months with impressive sales of 33,021 units. Blue Runtz (3.5g) also held steady in second place, mirroring its consistent ranking from November and December 2025. Dante's Inferno (Bulk) emerged as a new contender, securing the third spot, while Washington Apple (1g) and Cherry Paloma (1g) followed in fourth and fifth places, respectively. Notably, the introduction of Dante's Inferno (Bulk) and the debut of Washington Apple (1g) and Cherry Paloma (1g) in the rankings indicate a shift in consumer preference towards these new offerings. Overall, Blue Runtz products continue to dominate the sales landscape for Grown Rogue.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.