Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

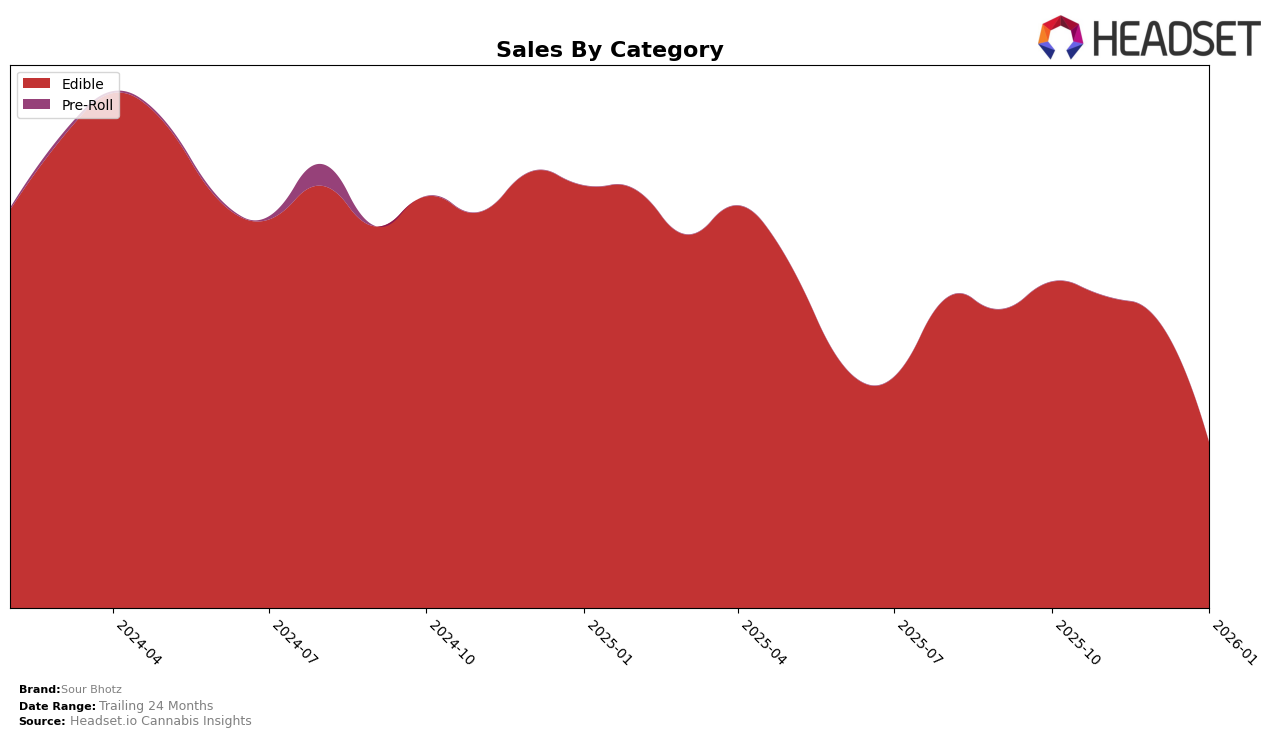

Sour Bhotz, a prominent player in the cannabis edible market, has experienced notable shifts in its rankings across different states and categories. In Oregon, the brand has shown a downward trend in the edible category, moving from the 19th position in October 2025 to the 25th position by January 2026. This decline in ranking could be indicative of increased competition or changing consumer preferences within the state. The drop in rankings is accompanied by a decrease in sales, which halved from October 2025 to January 2026, suggesting a potential need for strategic adjustments to regain market share.

While Sour Bhotz maintains a presence in Oregon, the absence of rankings in other states or provinces highlights a limitation in its market penetration. Not being in the top 30 brands in any other state or category could be seen as a missed opportunity for growth and diversification. This data suggests that while Sour Bhotz has a foothold in Oregon, there's significant room for expansion and improvement in other regions. Understanding the competitive landscape and consumer preferences in these untapped markets could be crucial for Sour Bhotz to enhance its brand presence and performance across the broader cannabis market.

Competitive Landscape

In the competitive landscape of the edible cannabis category in Oregon, Sour Bhotz has experienced notable shifts in both rank and sales over the past few months. Starting from October 2025, Sour Bhotz held a strong position at rank 19, but by January 2026, it had dropped to rank 25. This decline in rank coincides with a significant decrease in sales, from a high in October to a much lower figure by January. In contrast, Chompd Edibles improved its rank from 26 to 23 over the same period, with a corresponding increase in sales, suggesting a growing consumer preference for their products. Meanwhile, Fire Dept. Cannabis and Tasty's (OR) have maintained relatively stable ranks, with slight fluctuations, indicating consistent market performance. The competitive pressure from these brands, particularly the upward trajectory of Chompd Edibles, presents a challenge for Sour Bhotz as it seeks to regain its previous market position and boost sales in the Oregon edible market.

Notable Products

In January 2026, the top-performing product from Sour Bhotz was Blue Razz Gummy (100mg), securing the number one rank with sales of 2216 units. Indica Cherry Cola Gummy (100mg) maintained its strong performance, holding steady at the second position with 2074 units sold, showing consistency from December 2025. Baja Blasted Gummy (100mg) experienced a decline, falling to third place from a first-place ranking in October and November 2025. Fruit Punch Gummy (100mg) saw a significant drop in sales, moving from first place in December 2025 to fourth place in January 2026. Marionberry Gummy (100mg) entered the rankings for the first time in January 2026, capturing the fifth spot with modest sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.