Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

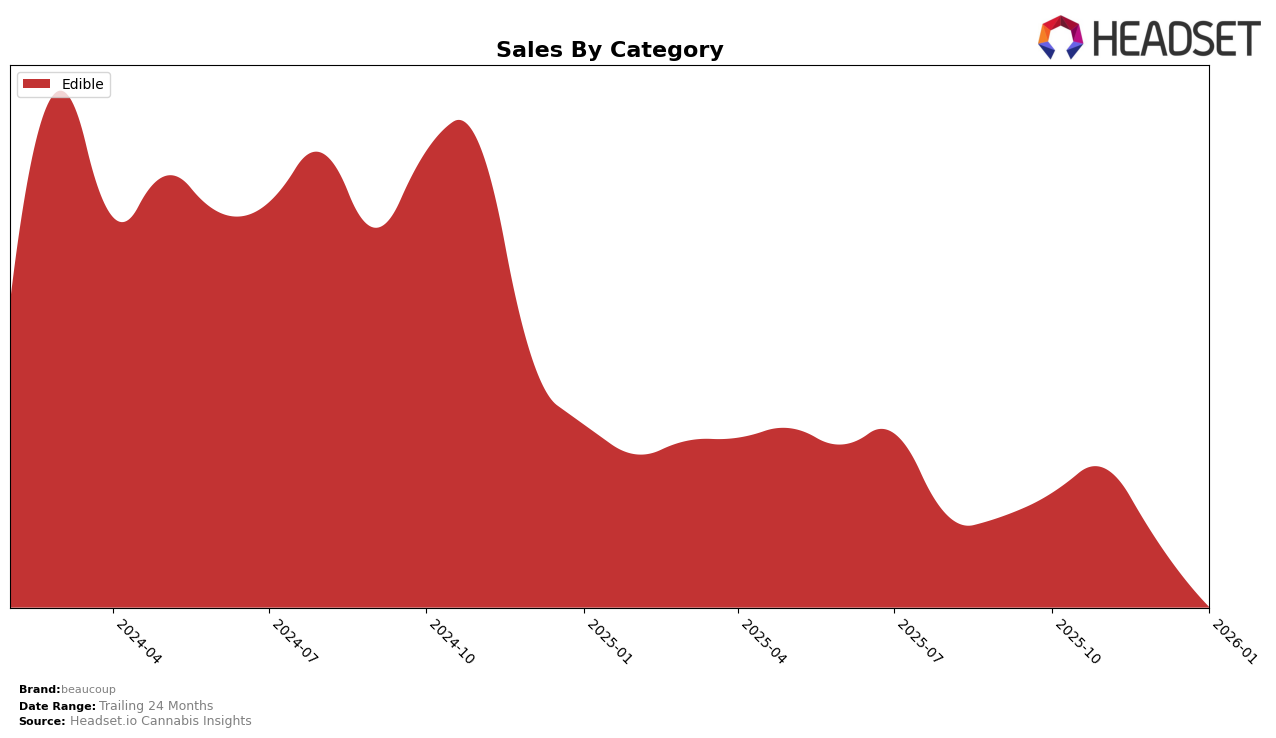

Beaucoup's performance across various categories and states demonstrates a mixed trajectory, with some promising movements and areas of concern. In the Edible category within Oregon, beaucoup experienced a fluctuating ranking throughout the end of 2025 and into early 2026. Starting from the 23rd position in October 2025, the brand slightly improved to 21st in November, but then slipped back to 25th in December, finishing January 2026 just within the top 30 at 30th place. This downward trend in rankings is paired with a noticeable decline in sales, indicating potential challenges in maintaining market share or consumer interest in this category.

The movement in Oregon's Edible category suggests that while beaucoup managed to maintain a presence in the top 30, the decline in both ranking and sales signifies a need for strategic adjustments to regain momentum. The drop from November to January, particularly, points to competitive pressures or shifts in consumer preferences that beaucoup will need to address. Maintaining a spot in the top 30 is crucial, but the brand's ability to reverse the current trend could determine its future success in this market. The data suggests that while there are areas of strength, particularly earlier in the period, the brand faces significant challenges to sustain and improve its position.

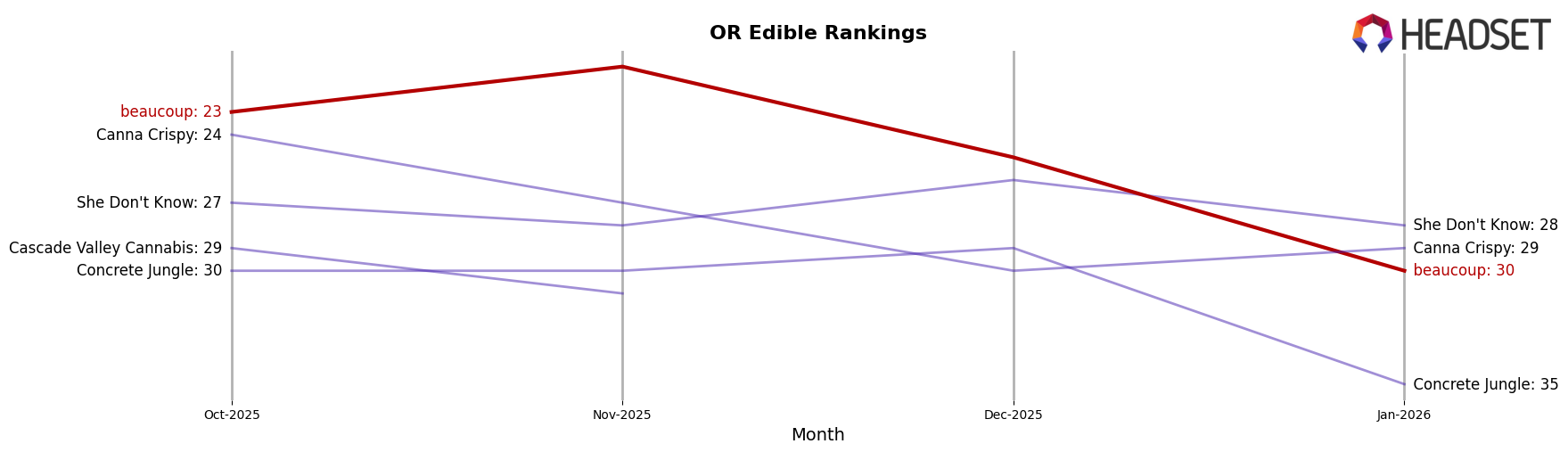

Competitive Landscape

In the Oregon edible market, beaucoup has experienced notable fluctuations in its rank and sales over the past few months. Starting from a strong position at rank 23 in October 2025, beaucoup climbed to rank 21 in November, indicating a positive momentum. However, by December, it slipped to rank 25, and further to rank 30 in January 2026. This decline in rank coincides with a decrease in sales from a high in November. In comparison, She Don't Know maintained a more stable performance, consistently ranking in the mid to high 20s, with sales peaking in December. Meanwhile, Canna Crispy and Concrete Jungle both experienced lower sales and ranks, with Concrete Jungle notably dropping out of the top 30 by January. The data suggests that while beaucoup initially outperformed many competitors, maintaining its market position will require addressing the recent downward trend in both rank and sales.

Notable Products

In January 2026, Sativa Strawberry Gummies (100mg) reclaimed the top spot for beaucoup, moving up from third place in December 2025 with sales of 848 units. The CBD/THC 1:1 Peach Gummy (100mg CBD, 100mg THC) secured the second position, dropping from its previous first position in November 2025. Huckleberry Gummy (100mg), which was the leader in December 2025, fell to third place this month. Blackberry Pomegranate Gummy (100mg) remained consistent at fourth place since November 2025. Notably, the Blackberry Pomegranate Down Gummy (50mg) maintained its position at fifth place since its debut in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.