Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

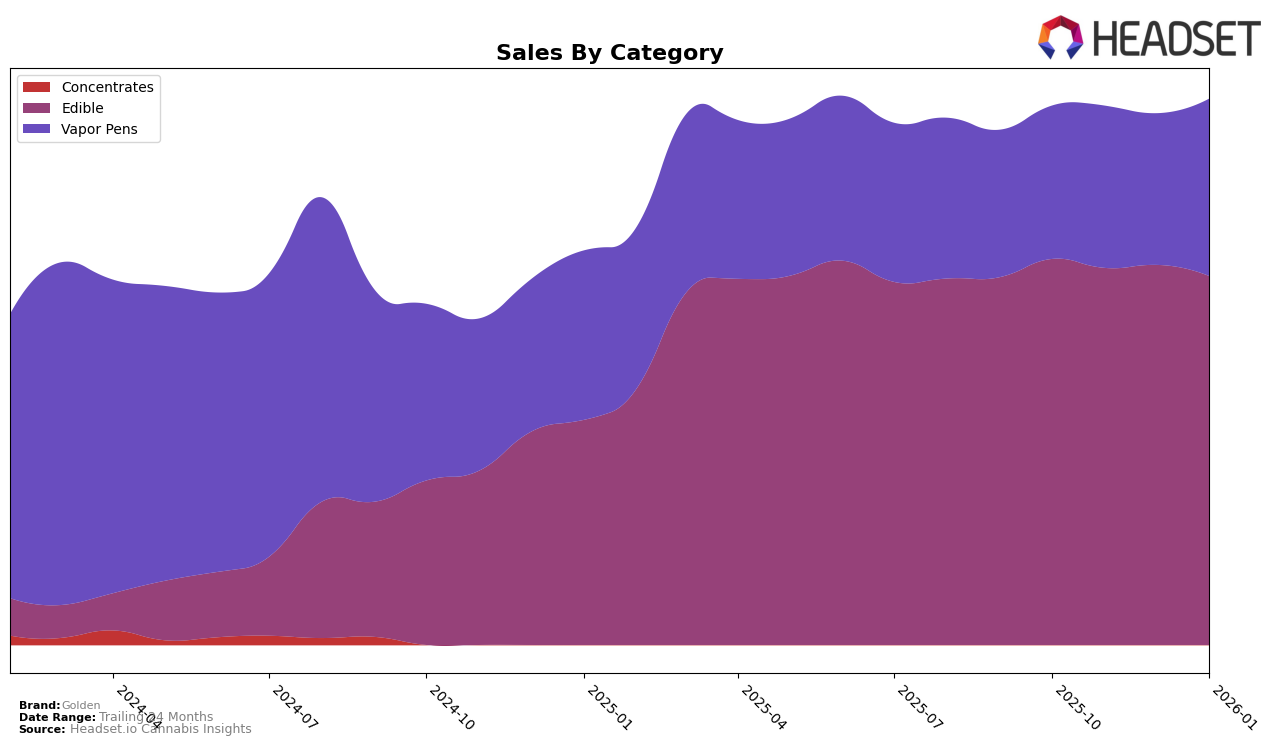

In the state of Oregon, Golden has maintained a consistent performance in the Edible category, holding steady at the 16th rank from October 2025 through January 2026. This stability suggests a reliable consumer base and a strong market presence in this category. However, the sales figures show a slight downward trend, with a decrease from $96,943 in October 2025 to $92,642 in January 2026, indicating potential challenges in maintaining sales momentum despite stable rankings. This could be an area of focus for Golden to investigate the factors affecting sales volume while maintaining their ranking.

In the Vapor Pens category, Golden's performance in Oregon shows a more dynamic movement. The brand improved its position from 58th in October 2025 to 52nd by January 2026, suggesting a positive reception and growing popularity in this segment. Notably, this upward trend in rankings is supported by an increase in sales, moving from $38,456 in October 2025 to $44,537 in January 2026. This indicates a successful strategy in capturing market share and increasing consumer interest in their vapor pen products. The absence of Golden in the top 30 of other categories might be an opportunity for expansion or a strategic focus on consolidating their strengths in existing categories.

Competitive Landscape

In the competitive landscape of the Oregon edible cannabis market, Golden has maintained a consistent rank at 16th place from October 2025 through January 2026. This stability in rank suggests a steady presence in the market despite facing competition from brands like Hapy Kitchen and Bitz & Botz, which have experienced fluctuations in their rankings. Notably, Hapy Kitchen held a higher rank than Golden throughout this period, although its sales showed a downward trend, suggesting potential vulnerability. Meanwhile, Mellow Vibes (formerly Head Trip) and Joyibles have remained below Golden in rank, with Mellow Vibes showing a significant sales increase in January 2026, indicating a possible upward trajectory. Golden's consistent ranking amidst these dynamics highlights its resilience, although the slight decline in sales over the months suggests a need for strategic initiatives to bolster growth and maintain its competitive edge.

Notable Products

In January 2026, Golden's top-performing product was the CBN/THC 3:1 Chamomile Peach Fruit Chews 10-Pack, maintaining its first-place rank from December despite a decrease in sales to 1702 units. The CBD/CBN/CBG/THC 3:3:3:1 Brown Butter Apricot Fruit Chews 10-Pack climbed to second place, showing a consistent upward trend from previous months with increasing sales figures. Hybrid Apple Solutely The Best Fruit Chew Blast dropped to third place, reflecting a decline in sales. The Private Stash Legacy Line - Maui Wowie Distillate Cartridge held steady in fourth place, while the Jack Herer Distillate Cartridge made its debut in fifth place. Notably, the Jack Herer cartridge's entry into the rankings suggests a growing interest in vapor pens within Golden's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.