Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

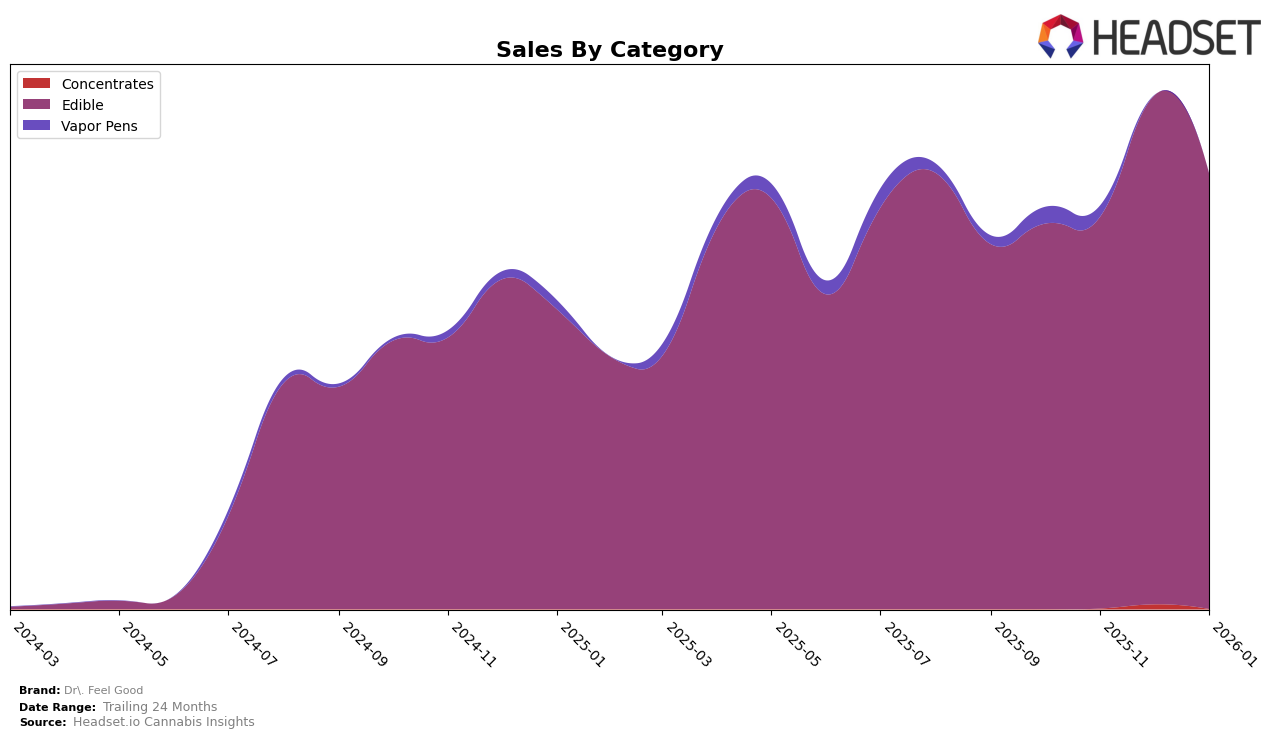

Dr. Feel Good has shown a consistent presence in the Oregon market, particularly within the Edible category. Over the observed months from October 2025 to January 2026, the brand maintained a steady ranking, starting at 15th place in October and November, climbing to 12th in December, and slightly dropping to 13th in January. This movement indicates a strong performance in the Edible category, with a noteworthy increase in sales during December, suggesting a possible seasonal boost or successful promotional efforts during the holiday period. The brand's ability to remain in the top 15 consistently highlights its stable market presence in Oregon's competitive landscape.

However, Dr. Feel Good's absence from the top 30 rankings in other states or categories could be a point of concern or an opportunity for growth. This indicates that while the brand is performing well in Oregon's Edible market, there might be untapped potential or challenges in other regions or product categories that could be explored. The data suggests a need for strategic expansion or enhancement of their product offerings to capture a broader audience and improve their standing outside of Oregon. This focus on a single market could either be a strategic choice or a limitation that the brand might want to address to maximize its overall market footprint.

Competitive Landscape

In the Oregon edible market, Dr. Feel Good has shown a notable fluctuation in its rankings and sales over the past few months. Starting from a rank of 15 in October 2025, Dr. Feel Good improved to 12 by December, before slightly dropping to 13 in January 2026. This movement reflects a dynamic competitive landscape where brands like Verdant Leaf Farms consistently maintained a stronger position, holding steady at rank 11 from November to January. Meanwhile, Hapy Kitchen experienced a decline from rank 12 in October to 14 in January, indicating potential challenges in maintaining market share. Interestingly, Feel Goods showed a positive trend, climbing from rank 14 in December to 12 in January, surpassing Dr. Feel Good. These shifts suggest that while Dr. Feel Good managed a significant sales boost in December, it faces stiff competition from both rising and established brands, emphasizing the need for strategic marketing efforts to enhance its market position.

Notable Products

In January 2026, the top-performing product for Dr. Feel Good was the Peach Mango Rosin Gummy (100mg), which reclaimed its number one spot after being ranked second in the previous two months, with sales reaching 2718 units. The Ginger Pear Distillate Gummy (100mg) made a notable jump from fourth place in December to second place in January, indicating a resurgence in popularity. The Blueberry Lemonade Distillate Gummy (100mg), although dropping to third place, had previously held the top rank for two consecutive months. The Indica Blood Orange Hash Rosin Gummies 10-Pack (100mg) maintained a stable position, consistently ranking fourth since November. Lastly, the Pineapple Passionfruit Gummies 10-Pack (100mg) remained in fifth place, showing steady performance throughout the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.