Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

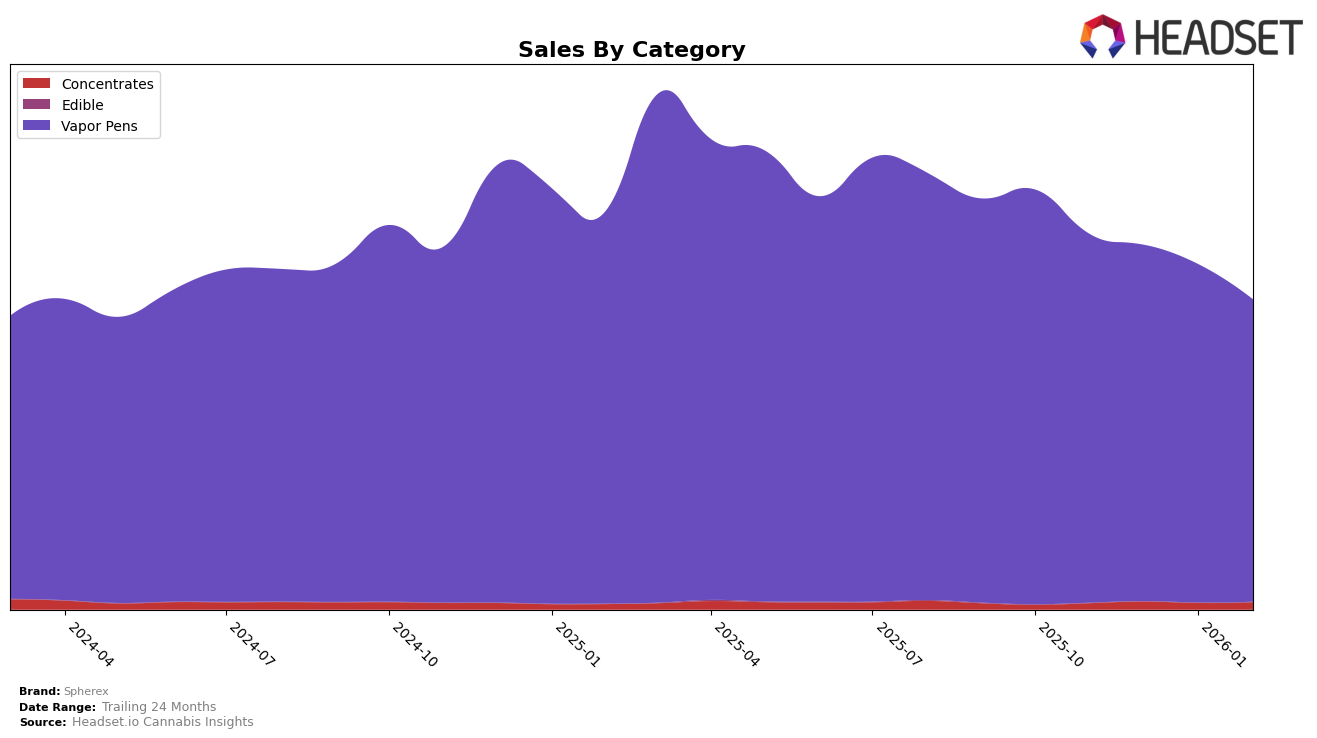

Spherex has shown varied performance across different categories and states, reflecting a dynamic presence in the cannabis market. In the Concentrates category in Colorado, Spherex was ranked 32nd in December 2025 but managed to climb to 31st by February 2026. This movement, while modest, indicates a slight recovery in their position after not being in the top 30 in November 2025 and January 2026, suggesting a fluctuating but potentially improving market presence. However, the absence from the top 30 in two out of the four months observed might be a point of concern for stakeholders looking for consistent performance in this category.

In contrast, Spherex has maintained a strong and stable position in the Vapor Pens category in Colorado. The brand consistently held the top two spots from November 2025 through February 2026, peaking at the number one spot in December 2025. Despite a slight decline in sales over these months, Spherex's ability to retain such high rankings signifies its strong foothold and popularity in the Vapor Pens market. This consistency is a positive indicator of brand loyalty and market influence, especially in a competitive landscape where maintaining a top position can be challenging.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Spherex has maintained a strong presence, consistently ranking within the top three from November 2025 to February 2026. Notably, Spherex achieved the top position in December 2025, surpassing Bonanza Cannabis Company, which held the first rank in November 2025 and January 2026. However, by February 2026, Spherex was overtaken by PAX, which climbed to the top position, indicating a competitive shift. Despite these fluctuations, Spherex has consistently outperformed Craft / Craft 710, which remained in the lower ranks throughout the period. The data suggests that while Spherex is a dominant player, the competitive dynamics with brands like Bonanza Cannabis Company and PAX could influence its future rank and sales trajectory in the Colorado vapor pen market.

Notable Products

In February 2026, the top-performing product from Spherex was X Vapes - Strawguava Distillate Cartridge (1g) in the Vapor Pens category, maintaining its position at rank 1 with sales of 17,459. This product has consistently held the top spot since December 2025. X Vapes - Tropical Runtz Distillate Cartridge (1g) remained steady at rank 2, following its rise from rank 2 in December 2025. X Vapes - Blueberry Cake Distillate Cartridge (1g) stayed at rank 3, consistently maintaining this position since January 2026. The new entries, X Vapes - Melon Baller and X Vapes - Northern Lights, both held ranks 4 and 5 respectively, showing a positive trend from their first appearance in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.