Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

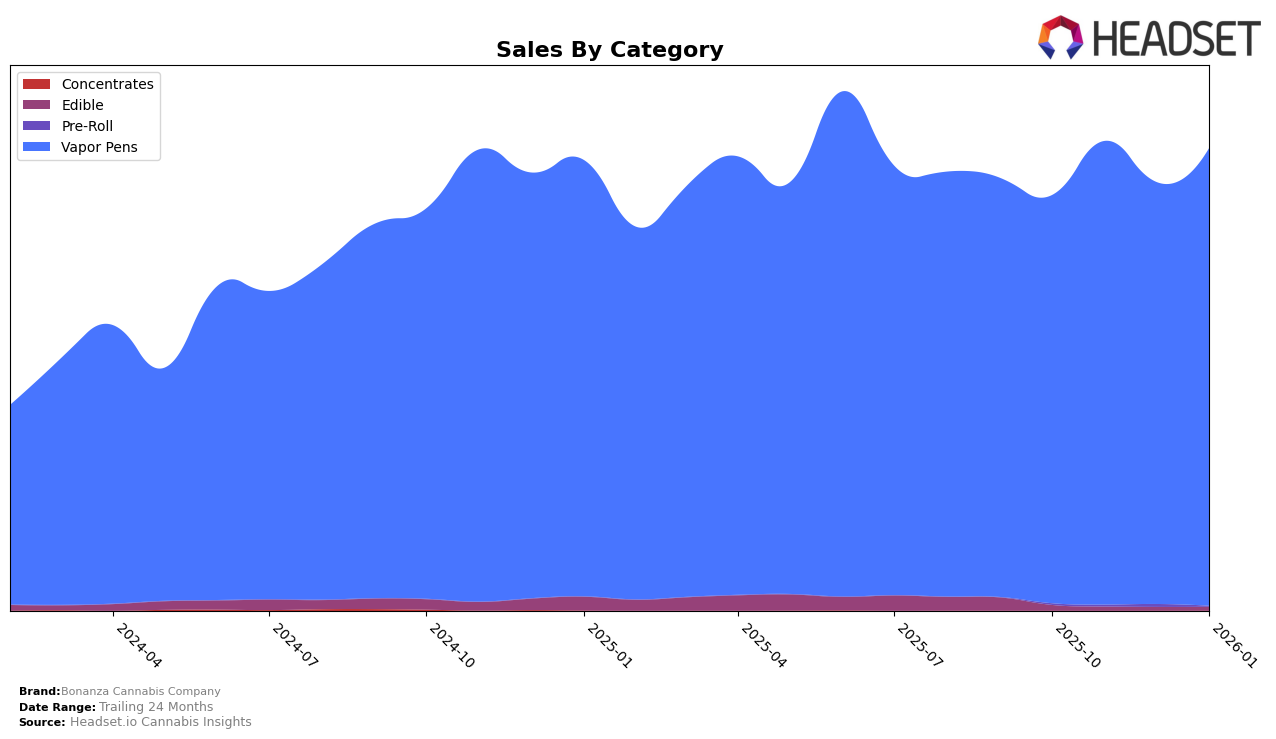

Bonanza Cannabis Company has shown a strong performance in the vapor pens category across multiple states. In Colorado, the brand has consistently maintained a top position, oscillating between first and second place from October 2025 through January 2026. This indicates a solid market presence and consumer preference in the state. The brand's sales in Colorado also reflect this dominance, with a peak in November 2025. Meanwhile, in New York, Bonanza Cannabis Company has been gradually improving its rank, moving from 33rd place in October 2025 to 31st by January 2026. This upward trend suggests growing recognition and potential for increased market share in the state.

In contrast, Bonanza Cannabis Company's presence in Nevada is less prominent, as the brand only appeared in the top 30 rankings starting December 2025, securing the 28th position and later moving to 23rd by January 2026. This late entry into the rankings could be seen as a challenge, indicating that the brand might need to enhance its competitive strategies to capture a larger segment of the market. The absence from the top 30 in the earlier months highlights the competitive landscape in Nevada, where other brands may have a stronger foothold. Nonetheless, the positive trajectory in rankings suggests that Bonanza Cannabis Company is making strides in expanding its influence in the state.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Bonanza Cannabis Company has demonstrated a dynamic performance, frequently alternating between the first and second positions from October 2025 to January 2026. This fluctuation in rank, often trading places with Spherex, highlights a competitive rivalry that has significant implications for market share and consumer perception. Despite the competition, Bonanza Cannabis Company managed to secure the top position in November 2025 and January 2026, indicating strong sales momentum during these months. Meanwhile, PAX consistently held the third position, suggesting a stable yet less competitive threat compared to Spherex. The ability of Bonanza Cannabis Company to reclaim the top spot after being overtaken by Spherex underscores its resilience and effective market strategies, positioning it as a formidable player in the Colorado vapor pen market.

Notable Products

In January 2026, the top-performing product for Bonanza Cannabis Company was the Pink Mango Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place ranking from December 2025, with sales reaching an impressive 6328 units. The Pineapple Express Distillate Cartridge (1g) secured the second position, consistent with its ranking in December, showing a strong performance with 5368 units sold. Watermelon Kush Distillate Cartridge (1g) held steady at third place, mirroring its December 2025 rank. Maui Wowie Distillate Cartridge (1g) experienced a decline, dropping to fourth place from its previous top spot in October and November 2025. Dream Berry Distillate Cartridge (1g) rounded out the top five, a new entry in December 2025, maintaining its position in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.