Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

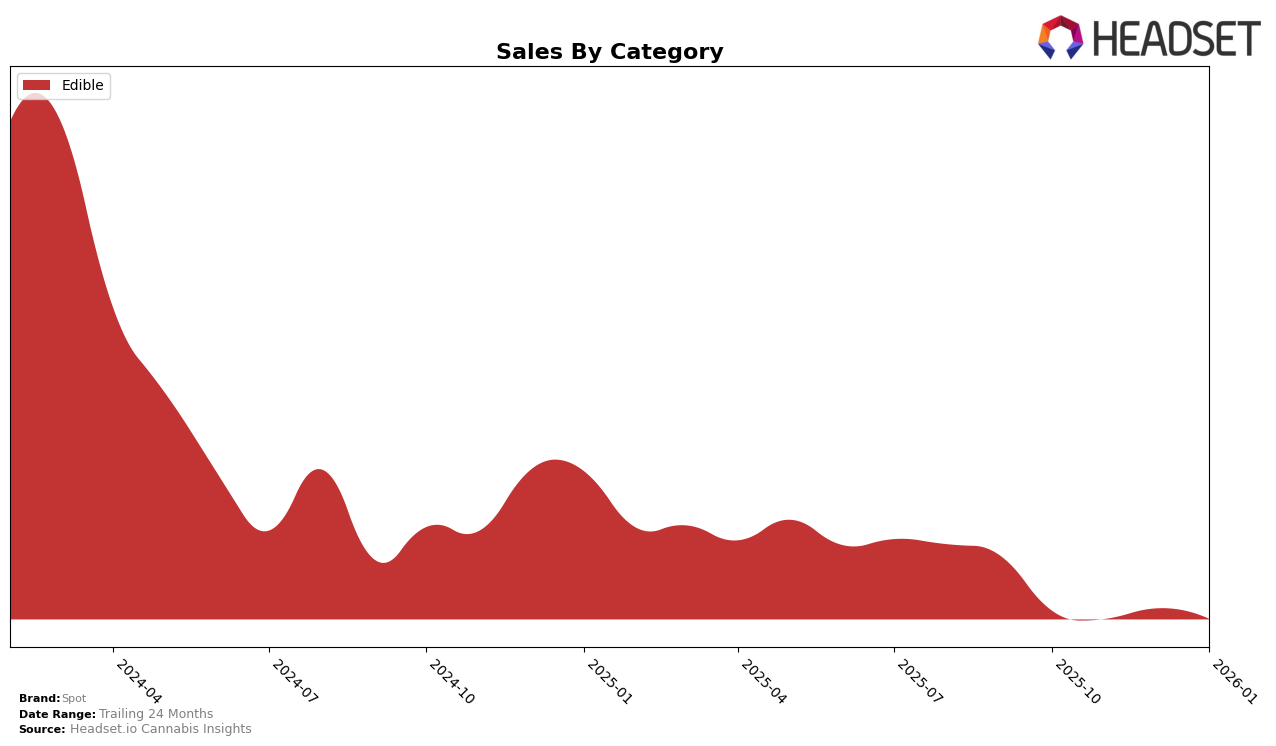

Spot has shown consistent performance in the Ontario market, particularly within the Edible category. Over the past few months, Spot has maintained its presence within the top 30 brands, with rankings fluctuating slightly between 28th and 29th position. This suggests a steady market presence, although there is room for improvement to climb higher in the rankings. The sales figures have shown some variability, with a peak in December 2025, indicating a potential seasonal trend or successful marketing effort during that period. However, the slight dip in sales in November 2025 and January 2026 suggests that maintaining consistent growth could be challenging.

Spot's ability to remain within the top 30 brands in Ontario's Edible category is commendable, especially considering the competitive nature of the cannabis market. However, the brand's inability to break into higher ranks could indicate either a plateau in their current strategy or increased competition from other brands. The fact that Spot has not fallen out of the top 30 is a positive sign, but the brand may need to explore new strategies or product innovations to gain a more substantial foothold and elevate its ranking further. The consistency in ranking suggests a loyal customer base, but tapping into new market segments could be key to achieving higher growth.

Competitive Landscape

In the Ontario edible market, Spot has consistently hovered around the 28th and 29th ranks from October 2025 to January 2026, indicating a stable but modest position. Despite a slight fluctuation in sales, Spot's rank has remained relatively unchanged, suggesting a loyal customer base but limited growth in market share. In contrast, Wildflower has shown a significant upward trajectory, moving from 33rd to 26th place, with sales peaking in December 2025. Edison Cannabis Co also improved its rank from 34th to 27th, surpassing Spot in December, though it fell back slightly in January. Meanwhile, Aurora Drift experienced a decline, dropping from 23rd to 29th, aligning with Spot's position by January 2026, possibly due to a significant drop in sales. NightNight, a newer entrant, emerged in December at 35th and quickly climbed to 27th by January, indicating rapid growth that could pose a future challenge to Spot. This competitive landscape highlights Spot's need to innovate or enhance its offerings to maintain and potentially improve its market position amidst dynamic competitors.

Notable Products

In January 2026, Spot's top-performing product was Sativa Sour Citrus Splash Soft Chews (10mg) in the Edible category, maintaining its rank at number one with sales reaching 2384 units. This product consistently held a top position, having ranked first in October and December 2025, and only briefly dropped to second in November 2025. The CBG:THC 4:1 Gooseberry Soft Chews 2-Pack (40mg CBG, 10mg THC) followed closely, ranking second in January 2026, which is a slight decline from its first-place rank in November and December 2025. Despite the drop, this product demonstrated strong sales performance with 1784 units sold in January. Overall, Spot's Edible products continue to dominate the sales rankings, showcasing their consistent popularity among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.