Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

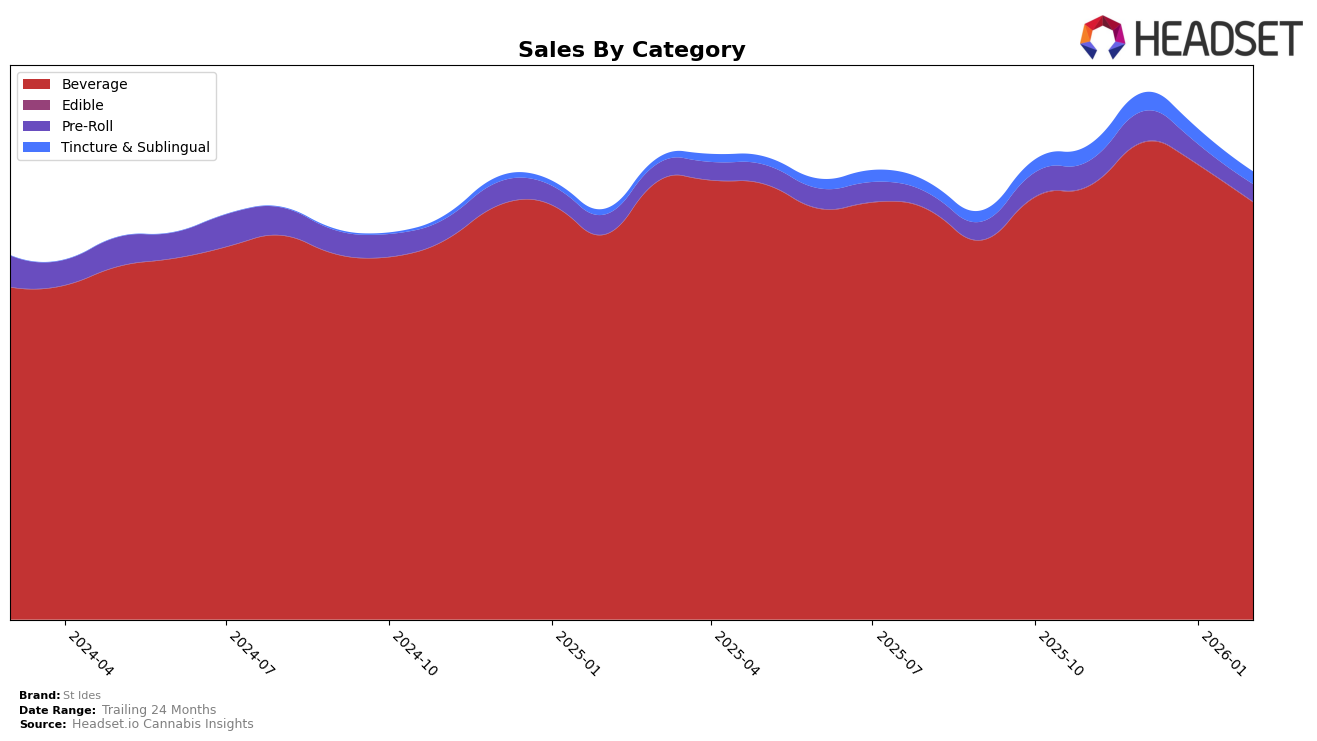

St Ides has shown a robust performance in the California market, particularly in the Beverage category, where it consistently holds the top position from November 2025 through February 2026. This dominance in the Beverage category underscores the brand's strong foothold and consumer preference in this segment. However, in the Pre-Roll category, St Ides is noticeably absent from the top 30, indicating a potential area for improvement or a strategic focus elsewhere. The Tincture & Sublingual category shows a steady presence, with rankings fluctuating slightly but maintaining a solid stance within the top 15. This suggests a stable market position, though there's room for upward movement.

While the Beverage category remains a stronghold for St Ides in California, the brand's performance in Pre-Rolls has been less prominent, with rankings not breaking into the top 30. This might reflect a strategic choice to focus on other categories or a competitive market landscape. On the other hand, the Tincture & Sublingual category highlights a consistent performance, suggesting that while not leading, St Ides has a loyal customer base that maintains its position. The variations in sales figures across these categories could provide deeper insights into consumer behavior and potential growth opportunities, particularly if the brand aims to expand its influence beyond its current stronghold in beverages.

Competitive Landscape

In the competitive landscape of the beverage category in California, St Ides has consistently maintained its leading position, holding the number one rank from November 2025 through February 2026. This unwavering top rank underscores its dominance and strong consumer loyalty in the market. Despite fluctuations in sales figures, St Ides continues to outperform its competitors significantly. Uncle Arnie's, consistently ranked second, trails behind St Ides, indicating a substantial gap in market leadership. Similarly, Not Your Father's Root Beer, holding the third rank, further highlights the competitive edge St Ides maintains. The consistent ranking of these competitors suggests a stable market hierarchy, but the sales trends indicate potential opportunities for St Ides to further capitalize on its leading position by addressing any sales fluctuations and reinforcing its brand presence.

Notable Products

In February 2026, St Ides' top-performing product was Wild Raspberry Iced High Tea, maintaining its consistent position as the number one ranked product for four consecutive months, with sales reaching 77,792 units. Georgia Peach High Tea held its steady second rank, showing a slight decrease in sales compared to previous months. Maui Mango Infused High Tea remained in third place, with sales figures slightly increasing from January. High Punch High Tea climbed to the fourth rank, swapping places with Lychee Pear High Tea, which moved down to fifth. This reshuffling within the ranks indicates a dynamic competition among the lower-ranked products, despite the top three holding their positions firmly.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.