Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

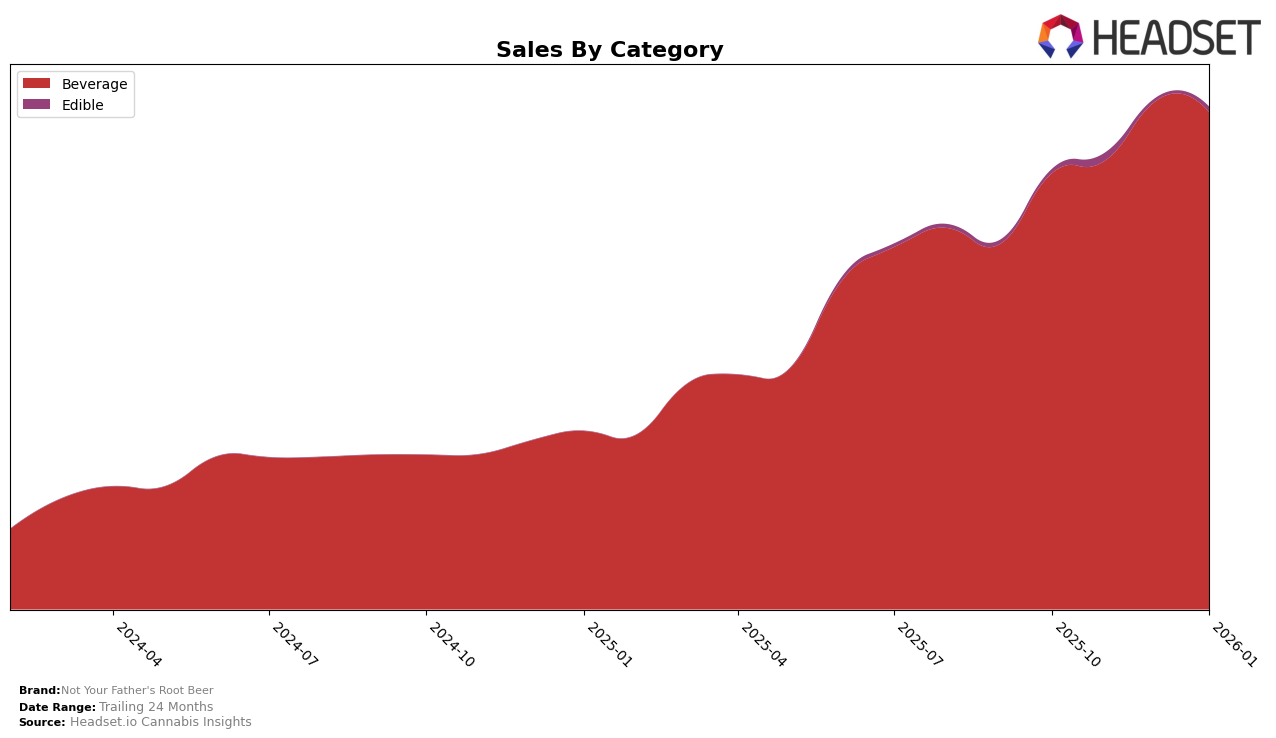

Not Your Father's Root Beer has shown a consistent performance in the Beverage category across different states, with notable success in California. In California, the brand has maintained a steady rank of third place from October 2025 through January 2026. This stability in ranking suggests a strong foothold in the market and indicates a loyal customer base or effective marketing strategies. The brand's sales in California saw an upward trend from October to December 2025, peaking in December before a slight dip in January 2026. This pattern could imply seasonal influences or promotional efforts that impacted sales positively during the holiday season.

However, the absence of Not Your Father's Root Beer from the top 30 in other states and provinces may highlight areas for potential growth or challenges in penetrating those markets. The lack of ranking in these regions could be seen as a setback or an opportunity for the brand to expand its reach and increase its market share. Understanding the factors that contribute to its success in California could be key to replicating that success in other areas. The data suggests that while the brand is performing well in its stronghold, there is room for improvement and exploration in other jurisdictions.

Competitive Landscape

In the competitive landscape of cannabis beverages in California, Not Your Father's Root Beer consistently holds the third rank from October 2025 through January 2026. Despite maintaining its position, it faces stiff competition from leading brands like St Ides and Uncle Arnie's, which have secured the first and second ranks, respectively, throughout the same period. Not Your Father's Root Beer's sales figures, while robust, are significantly lower than those of St Ides, which consistently dominates the market. However, the brand shows resilience by outperforming Pabst Labs and CANN Social Tonics, which rank fourth and fifth. The brand's stable ranking suggests a strong customer base, but the sales gap with the top two brands indicates potential for growth through strategic marketing and product differentiation.

Notable Products

In January 2026, Not Your Father's Root Beer maintained its top position in product sales with Root Beer Soda (100mg THC, 16oz) leading the rankings, achieving sales of 28,815 units. This product has consistently held the number one rank since October 2025. The Alpine Splash Live Resin Soda (100mg THC, 16oz) followed in second place, showing a slight dip in sales from December but maintaining its rank. Cherry Cola Live Resin Soda (100mg THC, 16oz) and CBD/THC 1:4 Orange Cream Soda (25mg CBD, 100mg THC, 16oz) continued to hold third and fourth positions respectively, with sales figures showing minor fluctuations over the months. The CBG/THC 1:5 Fruit Punch Soda (20mg CBG, 100mg THC) remained in fifth place, but it is noteworthy that its sales increased significantly in January 2026 compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.