Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

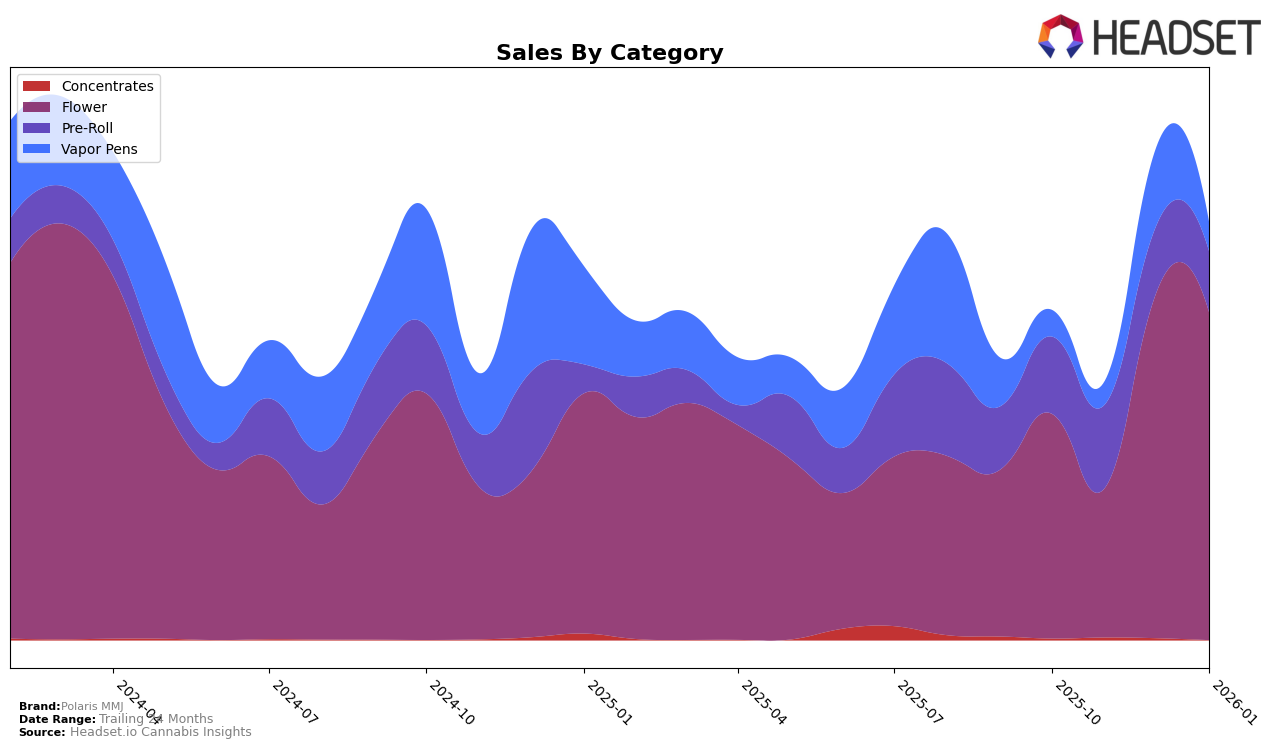

Polaris MMJ has shown varied performance across different product categories in Nevada. In the Flower category, Polaris MMJ demonstrated a significant improvement in its rankings, moving from 24th position in October 2025 to 14th in December 2025, before settling at 20th in January 2026. This upward trend was accompanied by a notable increase in sales, with a peak in December. Conversely, the brand's presence in the Vapor Pens category was less consistent, with rankings fluctuating from 42nd to 23rd and back to 43rd over the same period. This inconsistency in rankings highlights potential challenges in maintaining a stable market position within this category.

In the Pre-Roll category, Polaris MMJ experienced a decline in its rankings, dropping from 19th in October 2025 to 25th by January 2026. Despite this decline, the sales figures for November 2025 were relatively strong, indicating a temporary boost in consumer demand. However, the absence of Polaris MMJ from the top 30 brands in the Vapor Pens category during multiple months suggests a need for strategic adjustments to enhance competitiveness. This mixed performance across categories in Nevada underscores the complexities of navigating the cannabis market and the importance of adapting strategies to sustain growth and market presence.

Competitive Landscape

In the Nevada flower category, Polaris MMJ has experienced notable fluctuations in rank and sales over the past few months. While it achieved a peak rank of 14 in December 2025, it saw a decline to 20 by January 2026. This volatility contrasts with competitors like Deep Roots Harvest, which maintained a consistent presence in the top 20, and THC Design, which improved its rank significantly from 39 in October to 22 in January. Despite these challenges, Polaris MMJ's sales saw a substantial increase in December, indicating potential for growth. However, brands like Hustler's Ambition and Green Life Productions have maintained steadier sales figures, suggesting that Polaris MMJ may need to strategize to stabilize its market position and capitalize on its sales potential.

Notable Products

In January 2026, the top-performing product for Polaris MMJ was Head Cheese (3.5g) in the Flower category, regaining its first-place rank from October 2025 with sales reaching 3769. Head Cheese Popcorn (14g) maintained a strong presence, ranking second after topping the list in December 2025. New York City Diesel Pre-Roll (1g) made a notable entry into the rankings, securing third place. Ice Cream Cake Pre-Roll (1g) slightly dropped to fourth place from its previous third-place position in December 2025. Head Cheese Pre-Roll (1g) experienced a decline, moving from the top spot in November 2025 to fifth place in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.