Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

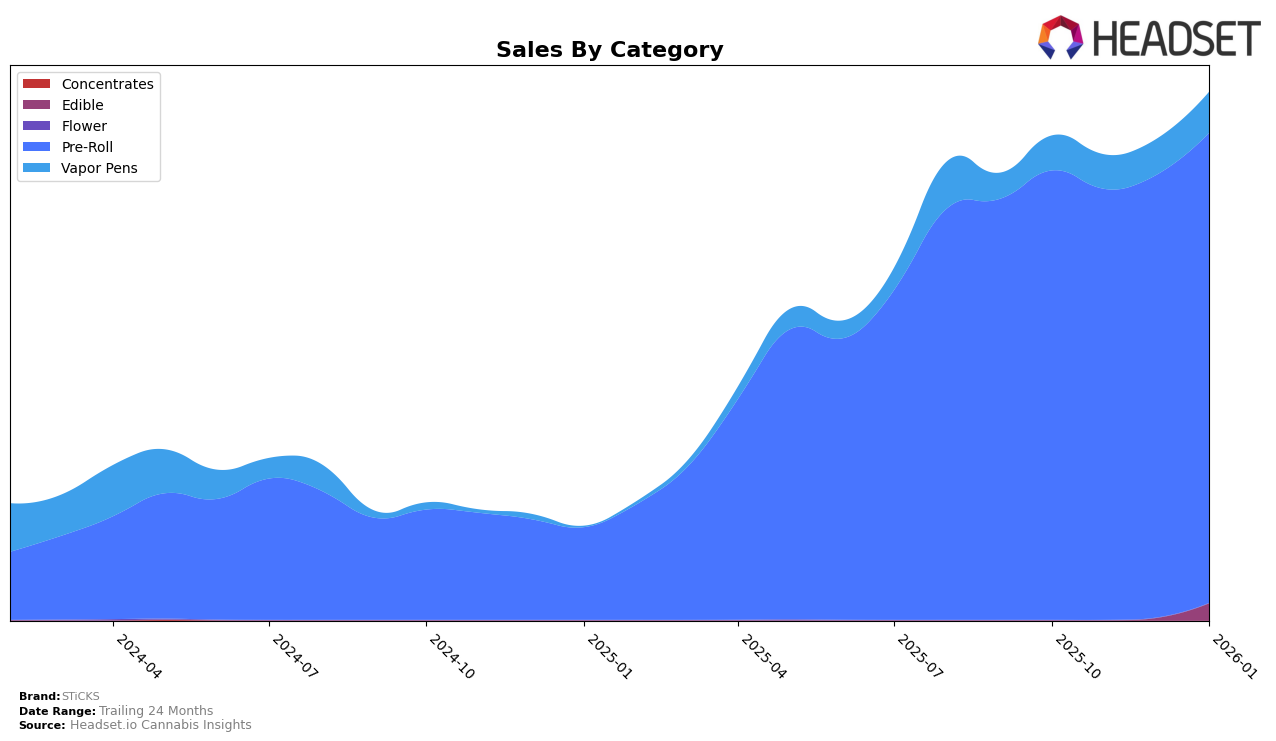

In the state of Oregon, STiCKS has shown a strong performance in the Pre-Roll category, consistently maintaining the number one rank from October 2025 through January 2026. This consistency indicates a dominant position in this segment, with sales figures reflecting a steady increase, reaching over $1 million in January 2026. However, in the Edible category, STiCKS only appeared in the rankings in January 2026, securing the 20th spot, which suggests a recent entry or resurgence in this category. This could be seen as a positive development, indicating potential growth opportunities in the Edible market for STiCKS.

On the other hand, the Vapor Pens category presents a different scenario. STiCKS did not make it into the top 30 rankings for October, November, or December 2025, but managed to climb to the 34th position by January 2026. This upward movement, although modest, could signal an improvement or shift in strategy within this category. Despite not being in the top rankings initially, the brand's ability to enter the top 40 by January suggests a potential area for growth if the trend continues. Monitoring these movements could provide insights into the brand's strategic focus and market adaptation in Oregon.

Competitive Landscape

In the Oregon pre-roll category, STiCKS consistently held the top rank from October 2025 through January 2026, demonstrating its strong market presence and consumer preference. Despite fluctuations in sales, STiCKS maintained its leading position, indicating a robust brand loyalty and effective market strategies. Competitors like Hellavated and Portland Heights consistently ranked second and third, respectively, throughout the same period. Notably, Hellavated showed stable sales figures, while Portland Heights experienced a decline in sales, which could suggest potential vulnerabilities that STiCKS might capitalize on to further solidify its market dominance. This consistent ranking and sales performance highlight STiCKS' effective positioning and potential for continued leadership in the Oregon pre-roll market.

Notable Products

In January 2026, Blue Magoo Infused Pre-Roll (1g) reclaimed its top position in the STiCKS lineup, achieving the highest sales figure of 34,809. MT. Hood Magic Infused Pre-Roll (1g) made a significant leap to the second spot, improving from its previous fourth position in December 2025. Valley Purps Infused Pre-Roll (1g) maintained a steady third place, showing consistent performance over the last two months. Oregon Strawberries Infused Pre-Roll (1g) experienced a drop from first in December 2025 to fourth in January 2026. A new entry, PDX Diesel Infused Pre-Roll (1g), debuted at fifth place, marking its presence in the rankings for the first time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.