Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

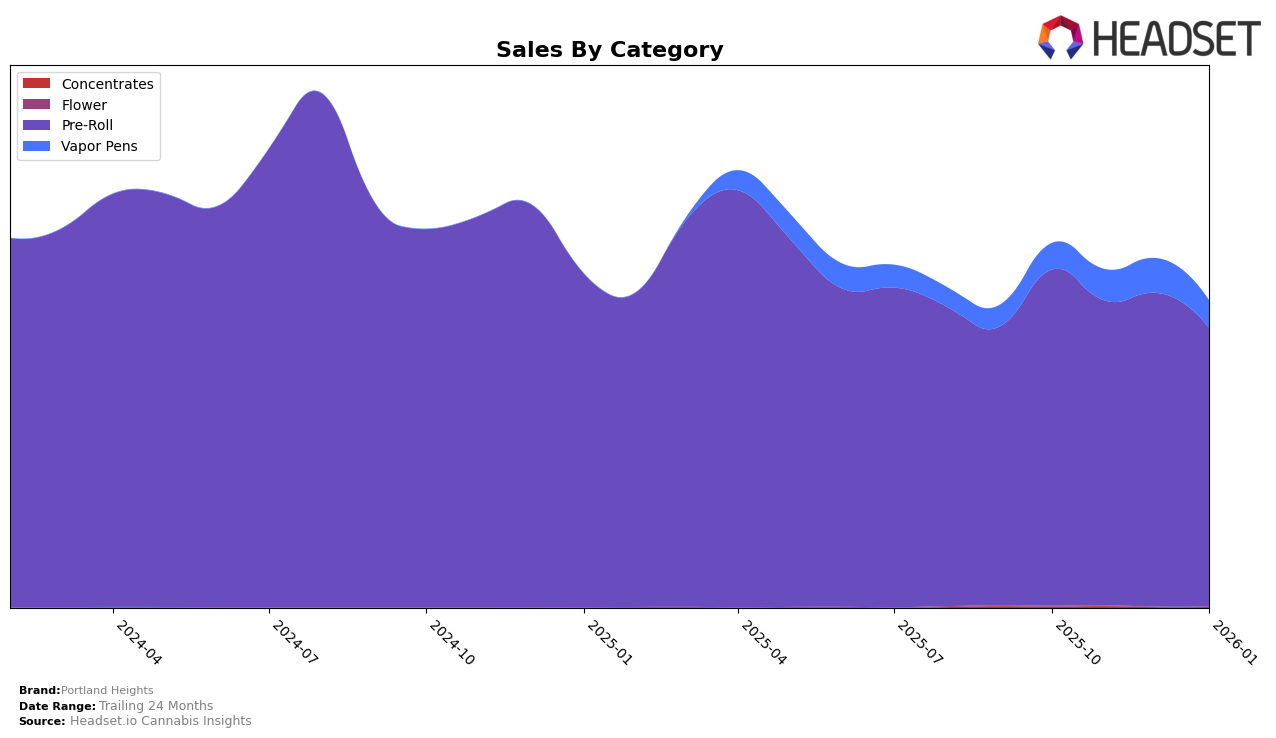

Portland Heights has shown consistent performance in the Pre-Roll category in Oregon, maintaining a steady rank of 3rd place from October 2025 through January 2026. This stability indicates a strong foothold in the market, despite a gradual decline in sales from $652,524 in October to $540,588 in January. Such consistency in ranking suggests that Portland Heights has a loyal consumer base in this category, which could be attributed to product quality or effective branding strategies. However, the drop in sales might warrant a closer look into market dynamics or seasonal factors that could be affecting consumer purchasing behavior.

In contrast, Portland Heights' performance in the Vapor Pens category in Oregon has been less stable, with rankings fluctuating between 46th and 53rd place from October 2025 to January 2026. Despite this volatility, there was a noticeable increase in sales from $51,081 in October to $66,787 in December, before dropping to $52,499 in January. This suggests that while Portland Heights is not a leading player in the Vapor Pens category, it has experienced periods of growth, which could be indicative of successful marketing campaigns or favorable consumer trends during specific months. The absence of a top 30 ranking in this category highlights potential areas for improvement to gain a more prominent market position.

Competitive Landscape

In the competitive landscape of Oregon's Pre-Roll category, Portland Heights consistently held the third rank from October 2025 through January 2026. Despite this steady ranking, the brand experienced a downward trend in sales, particularly noticeable in January 2026. This decline in sales could be attributed to the persistent dominance of STiCKS and Hellavated, which maintained the first and second ranks respectively throughout the same period. Notably, STiCKS not only led in rank but also showed an upward trajectory in sales, peaking in January 2026. Meanwhile, Benson Arbor and Kaprikorn remained stable in the fourth and fifth positions, with Kaprikorn showing a slight improvement in sales in the latter months. The competitive pressure from these brands, particularly the top two, suggests that Portland Heights may need to innovate or adjust its strategies to regain sales momentum and potentially improve its market position.

Notable Products

In January 2026, Portland Heights' top-performing product was the Super Cookies Moonrock Infused Blunt (2g) in the Pre-Roll category, maintaining its leading position from December 2025 with sales of 1,037 units. The Alien Gelato Moonrock Infused Pre-Roll (1g) entered the rankings at second place, signaling a strong market entry. The Ghost Moonrock Infused Blunt (2g) debuted in third place, demonstrating a competitive presence in the Pre-Roll market. Meanwhile, the Sweets- Grape Obama Moonrocks Infused Blunt (2g) saw a slight drop from third to fourth place compared to the previous month. Lastly, the Animal Jelly Moonrock Infused Blunt (2g) secured the fifth position, rounding out the top performers for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.