Jan-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

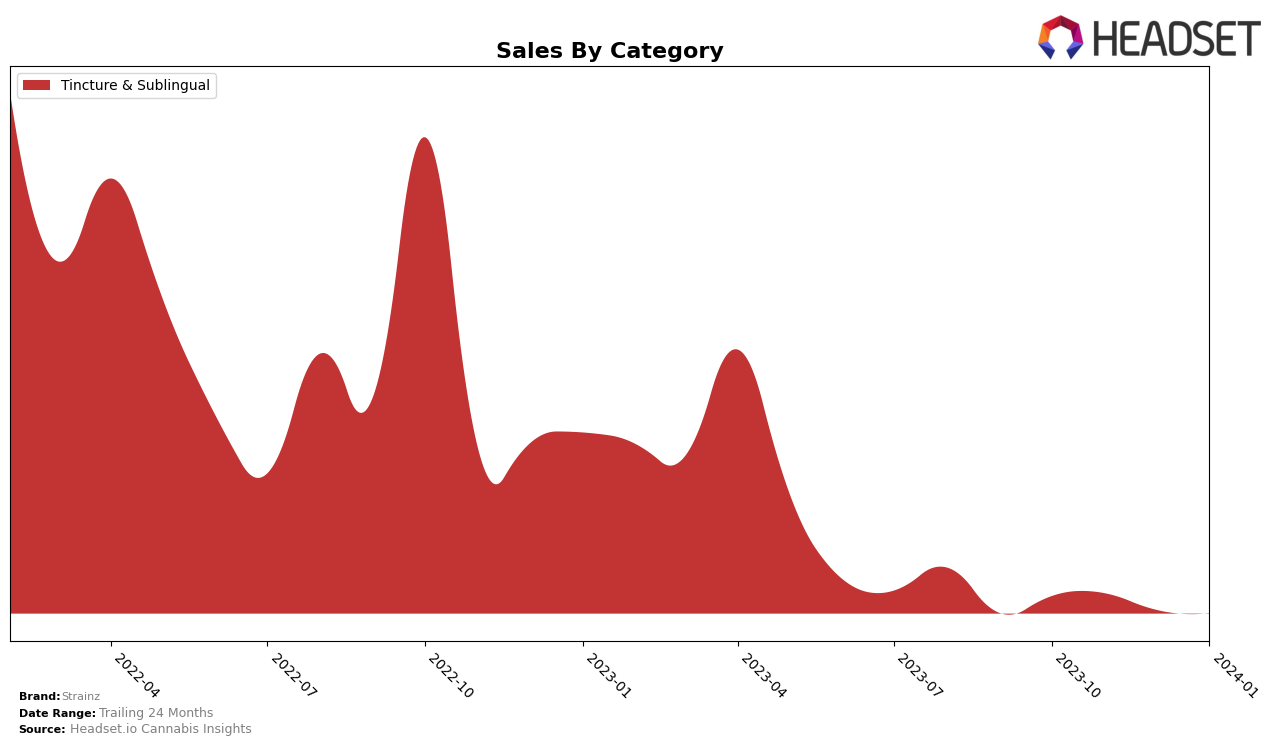

In the competitive cannabis market of Colorado, Strainz has shown a consistent presence in the Tincture & Sublingual category, albeit with slight fluctuations in its rankings over the last four months. Starting in October 2023, Strainz held the 12th position, maintaining it into November before experiencing a slight dip to the 15th spot in December. However, they managed a small recovery, moving up to the 13th position by January 2024. This movement indicates a resilient brand presence in Colorado's Tincture & Sublingual category, despite facing challenges that come with the highly competitive nature of the market. The sales figures, starting from 1773 units in October and seeing a peak in November at 1887 units before dipping in the following months, reflect a dynamic market response to Strainz's offerings in this category.

The slight decline in rankings from December 2023 to a slight recovery in January 2024 could suggest several market dynamics at play, including seasonal demand fluctuations or changes in consumer preferences within the Tincture & Sublingual category. Strainz's ability to maintain a top 20 position consistently across these months highlights its relevance and resilience in the Colorado market. However, the drop in sales from December to January, from 1232 units to 1102 units, could point towards a need for strategic adjustments to either marketing efforts or product offerings to capture a larger market share or to solidify its position within the top rankings. This performance trajectory offers valuable insights for market analysts and investors looking to understand the nuances of brand performance across different states and categories in the cannabis industry.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category within the Colorado market, Strainz has experienced a fluctuating trajectory in terms of its rank and sales from October 2023 through January 2024. Initially holding the 12th position in both October and November, Strainz saw a slight dip to the 15th rank in December, before climbing back up to the 13th position by January 2024. This fluctuation is notable against the backdrop of its competitors, such as marQaha, which consistently maintained a higher rank (9th) through the same period, and Ripple (formerly Stillwater Brands), which also held a consistently higher position, moving from 10th to 11th rank. On the other end, Lucky Turtle and Dixie Elixirs generally ranked lower than Strainz, with Lucky Turtle moving from the 15th to the 16th position and Dixie Elixirs experiencing a slight improvement from 18th to 14th. The sales trends for Strainz show a decline from October to January, which is critical for understanding its market position relative to these competitors, whose sales also saw various degrees of fluctuation.

Notable Products

In January 2024, Strainz's top-performing product was the CBD/THC 20:1 Restore Plus Natural/Unflavored Tincture (2000mg CBD, 100mg THC), maintaining its number one rank consistently from October 2023 through January 2024, with January sales reaching 15 units. Following closely, the CBD:THC 20:1 Restore Tincture (500mg CBD, 25mg THC) secured the second position in January 2024, showing a slight improvement from its previous ranks of third in October and November 2023 and second in December 2023. Notably, the CBD/THC 1:1 Balance Tincture (100mg CBD, 100mg THC), which was a top contender in previous months, dropped off the ranking in January 2024. The CBD/THC 1:5 Elevate Mint Natural Tincture (20mg CBD, 100mg THC) also disappeared from the January rankings, after holding second place in October and November 2023. These shifts highlight a consumer preference trend towards higher CBD to THC ratio products within the Strainz lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.