Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

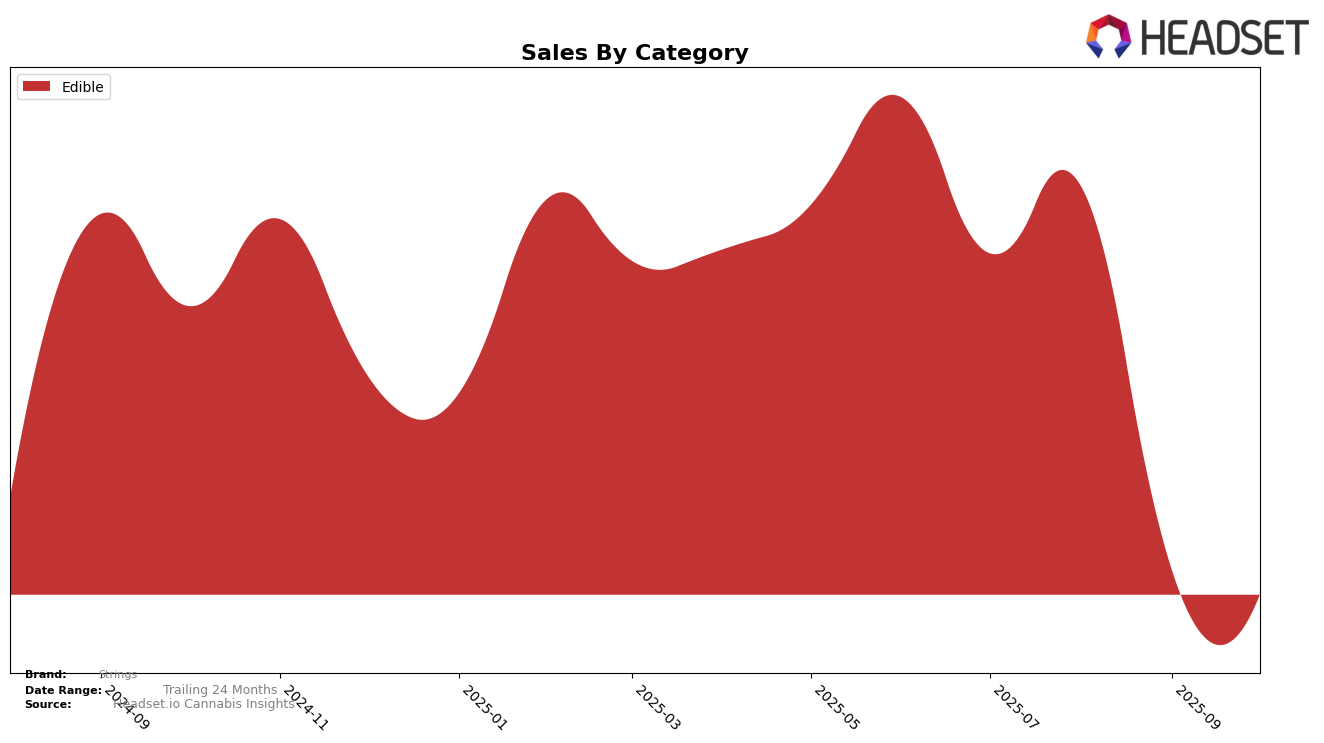

In the province of British Columbia, the cannabis brand Strings has demonstrated a steady presence in the Edibles category. From July to August 2025, Strings improved its ranking from 18th to 17th place, indicating a positive trend in consumer preference or market penetration. However, by September and October, the brand was no longer listed in the top 30, which could suggest a decline in market share or a competitive shift within the category. Despite this, the sales figures from July to August show an increase, with sales rising from 28,069 to 32,062, hinting at a brief period of growth before the brand's visibility diminished.

The absence of Strings from the top 30 rankings in September and October in British Columbia's Edibles category is notable. This decline might point to increasing competition or changes in consumer preferences that did not favor Strings. The initial upward movement from July to August could have been driven by specific marketing efforts or product launches, but sustaining such growth appears to have been challenging. It would be interesting to delve deeper into the strategies employed by Strings during this period to understand the factors contributing to their initial success and subsequent decline.

Competitive Landscape

In the competitive landscape of the Edible category in British Columbia, Strings has shown a notable upward trajectory in its market position. From July to August 2025, Strings improved its rank from 18th to 17th, demonstrating a positive trend in its market presence. This is particularly significant given that competitors like Vacay and San Rafael '71 have not maintained a consistent presence in the top 20 rankings, with San Rafael '71 not appearing in the rankings from August onwards and Vacay dropping out by October. This suggests that Strings is gaining a competitive edge, potentially capturing market share from these brands. The absence of these competitors in the rankings for later months could indicate a decline in their sales performance, contrasting with Strings' upward momentum. This trend positions Strings as a rising player in the British Columbia Edible market, highlighting its potential for continued growth and increased sales.

Notable Products

In October 2025, the top-performing product from Strings was the CBN/THC 1:1 Sour Blue Berries Gummies 4-Pack (10mg CBN, 10mg THC), which climbed to the number one spot despite a slight decrease in sales to 676 units. This product had consistently ranked second in the previous months. The CBG/THC 1:1 Kiwi Melon Apple Live Rosin Gummies 4-Pack (10mg CBG, 10mg THC) slipped to second place, after maintaining the top position from July to September 2025. Notably, the sales for the Kiwi Melon Apple Gummies decreased significantly to 327 units in October. This shift in rankings indicates a changing consumer preference or potential supply issues affecting the previously top-ranked product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.