Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

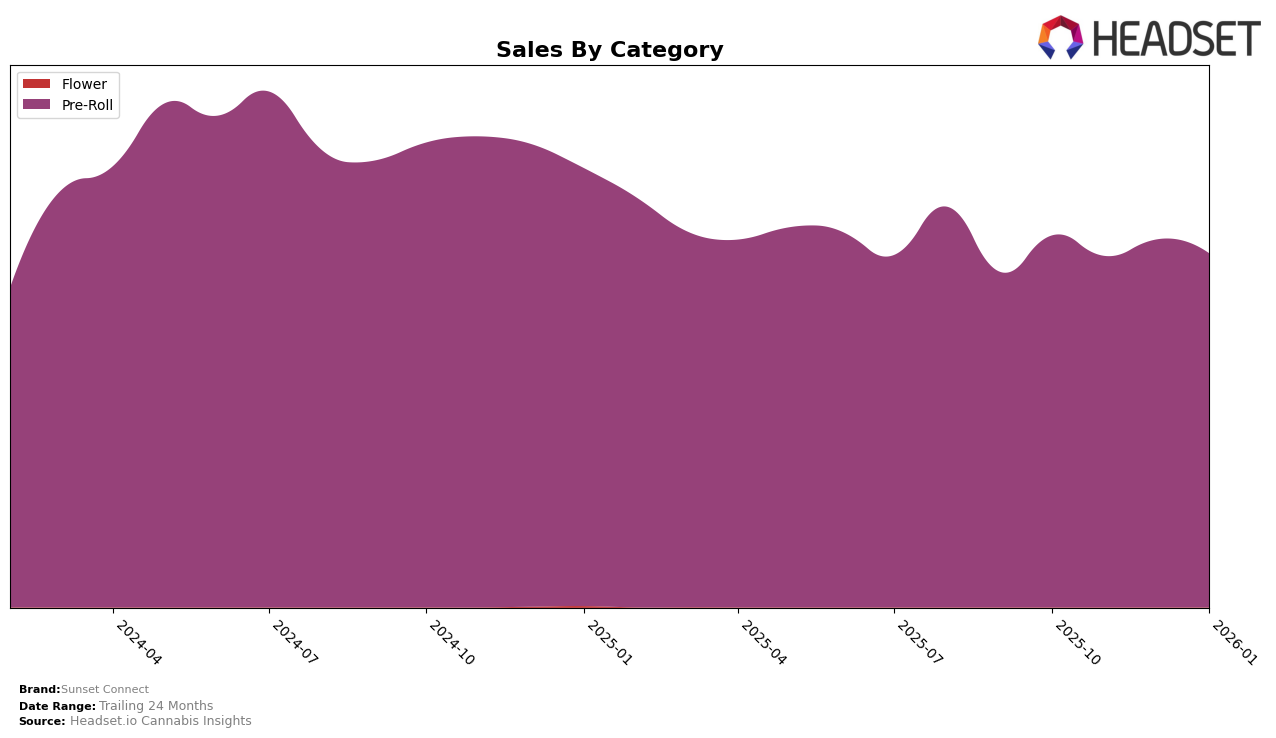

Sunset Connect's performance in the Pre-Roll category within California has shown some fluctuations over the past few months. The brand started in October 2025 ranked at 22nd, but experienced a slight dip to 26th in November. However, they managed to recover slightly by December, climbing back to 24th, where they maintained their position through January 2026. This indicates some resilience in their market strategy, though the initial drop could suggest competition or market dynamics that affected their standing. The consistency in their rank from December to January might be a sign of stabilization or successful adjustments in their operations or marketing strategies.

It's worth noting that Sunset Connect's sales figures reflect a similar pattern to their rankings, with a noticeable dip in November followed by a rebound in December. Despite the fluctuations, the fact that they remained within the top 30 in California's Pre-Roll category is a positive sign, suggesting that the brand has a solid foothold in this competitive market. However, the absence of a top 30 ranking in other states or categories could imply potential areas for growth or the need for strategic pivots to expand their market presence beyond California. This presents both a challenge and an opportunity for Sunset Connect to explore new markets or strengthen their existing ones.

Competitive Landscape

In the competitive landscape of the California Pre-Roll category, Sunset Connect has shown a consistent presence, although it remains outside the top 20 brands. Over the period from October 2025 to January 2026, Sunset Connect's rank fluctuated slightly, starting at 22nd, dipping to 26th in November, and stabilizing at 24th by January. This indicates a relatively stable market position despite the competitive pressures. Notably, Gelato consistently outperformed Sunset Connect, maintaining a rank within the top 23, which suggests a stronger market presence. Meanwhile, Selfies showed an upward trend, surpassing Sunset Connect by January with a rank of 23rd. Almora Farms and Fig Farms also posed competitive challenges, with Almora Farms briefly overtaking Sunset Connect in December before dropping to 26th in January. These dynamics highlight the need for Sunset Connect to strategize effectively to improve its rank and sales in this highly competitive market.

Notable Products

In January 2026, the top-performing product from Sunset Connect was the Sunset Popsicle Pre-Roll (1g), which secured the number one rank with sales of 9969 units. The Purple Rainbow Pre-Roll (1g) maintained its second-place position from December 2025, with a slight decrease in sales to 9900 units. Royal Grapes Pre-Roll (1g) climbed back into the rankings, achieving the third spot after not being ranked in December 2025, with sales of 9878 units. Willie Haze Pre-Roll (1g) improved its position, moving from fifth in December 2025 to fourth in January 2026. Sunset Jealousy Pre-Roll (1g) saw a drop from third to fifth, indicating a decrease in its sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.