Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

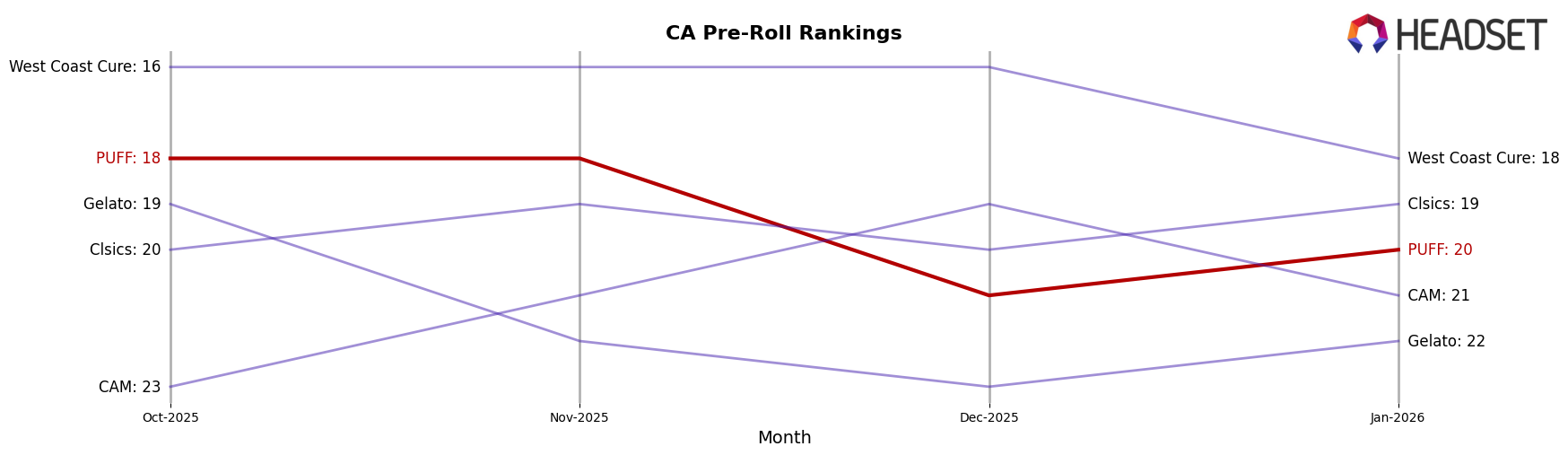

In the pre-roll category, PUFF has shown a consistent presence in the California market, maintaining a ranking within the top 30 brands. Despite a slight dip in December 2025, where their rank fell to 21st, they recovered slightly in January 2026 to secure the 20th position. This indicates a resilient performance in a competitive market. In contrast, their performance in New York reveals a gradual decline from 13th in October 2025 to 16th by January 2026, suggesting challenges in maintaining their earlier momentum.

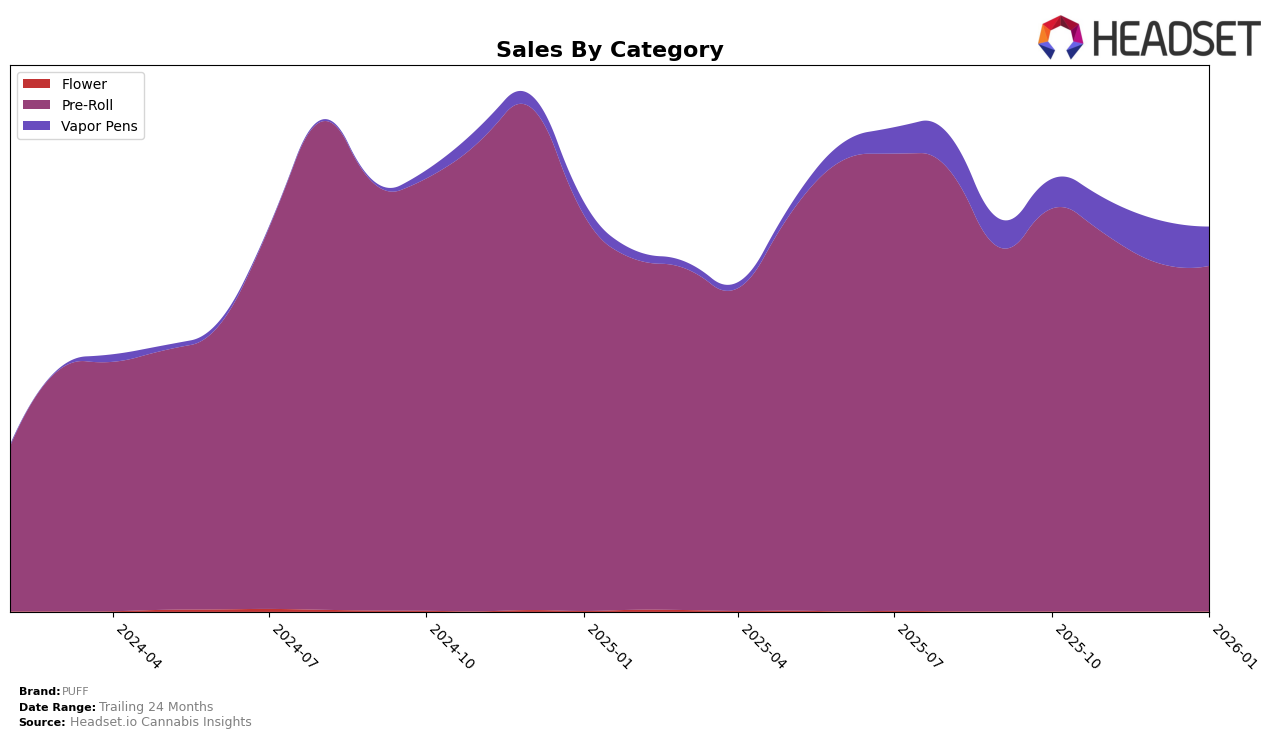

PUFF's venture into the vapor pens category in New York has not yet placed them in the top 30, indicating either a nascent stage in this segment or stiff competition. However, there is a notable upward trend in their sales figures, which could signal potential for future growth if leveraged correctly. The absence of a top 30 ranking in vapor pens might be seen as a gap in their market strategy, but it also represents an opportunity for PUFF to innovate and capture more market share in this category.

Competitive Landscape

In the competitive landscape of the California pre-roll category, PUFF has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 18th in October and November 2025, PUFF's rank slipped to 21st in December before slightly recovering to 20th in January 2026. This movement reflects a dynamic market where competitors like West Coast Cure maintained a consistent 16th position until dropping to 18th in January, and Clsics showed a stable performance, hovering around the 19th and 20th spots. Meanwhile, CAM improved its ranking from 23rd in October to 19th in December, before settling at 21st in January. PUFF's sales trajectory mirrored its ranking volatility, with a noticeable dip in December, which could be attributed to intensified competition and market dynamics. As PUFF navigates this competitive environment, understanding these shifts can provide strategic insights for enhancing its market presence and sales performance.

Notable Products

In January 2026, the top-performing product for PUFF was Orange Tree Pre-Roll (1g) in the Pre-Roll category, which ascended to the number one rank with sales reaching 5,247 units. Banana OG Pre-Roll (1g) followed closely, climbing from the fourth position in December to second place in January. Limesicle Pre-Roll (1g) debuted in third place, demonstrating strong market entry. Lemon Cherry Gelato Pre-Roll (1g) secured the fourth position, while Grape Drink Pre-Roll (1g) experienced a drop from its consistent first-place ranking in the previous months to fifth place in January. This shift in rankings highlights significant changes in consumer preferences within the Pre-Roll category at PUFF.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.