Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

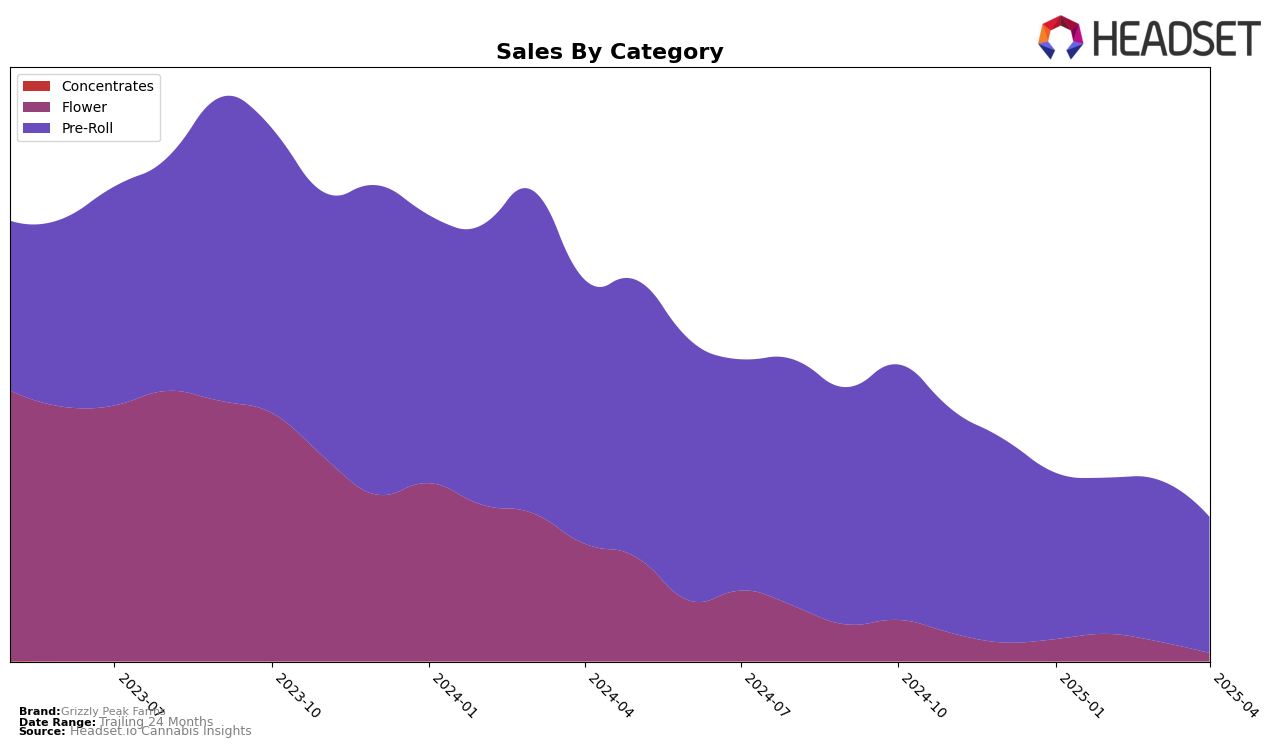

Grizzly Peak Farms has shown varying performance across different categories and states, with notable movements in their rankings. In the California market, their presence in the Pre-Roll category saw a decline from January to April 2025. The brand started the year in the 19th position, maintaining this rank in February, but slipped to 20th in March and further to 24th by April. This downward trend indicates a challenge in maintaining their competitive edge in one of the most dynamic cannabis markets. The drop in rankings corresponds with a decrease in sales from January to April, highlighting potential areas for strategic improvement.

Interestingly, Grizzly Peak Farms did not appear in the top 30 brands for other states and categories during this period, which could be seen as a missed opportunity for market expansion or an indication of strong competition. The absence of rankings in additional states suggests that the brand may need to explore new strategies to enhance its market presence and diversify its category offerings. Focusing on strengthening their position in California while exploring untapped markets could be key to future growth and stability. Such strategic moves would help Grizzly Peak Farms leverage their existing strengths and address areas where they currently lack visibility.

Competitive Landscape

In the competitive landscape of California's Pre-Roll category, Grizzly Peak Farms has experienced notable fluctuations in its ranking over the first four months of 2025. Starting the year at 19th place, the brand maintained its position in February but saw a slight dip to 20th in March and a more significant drop to 24th in April. This downward trend in rank coincides with a decrease in sales, suggesting potential challenges in maintaining market share. In contrast, competitors like PUFF and Sunset Connect have shown more stability, with PUFF improving its rank from 21st in January to 17th in February, although it later slipped out of the top 20 in March and April. Meanwhile, Sunset Connect maintained a relatively stable position, only dropping out of the top 20 in March. These dynamics highlight the competitive pressures Grizzly Peak Farms faces, emphasizing the need for strategic adjustments to regain and sustain a stronger market position.

Notable Products

In April 2025, the top-performing product from Grizzly Peak Farms was the Greatful Dave Pre-Roll (1g), which secured the first rank with sales figures reaching 14,273 units. This product climbed back to the top after being ranked second in February and March. The Big Steve Diamond Infused Pre-Roll (1g) followed closely in second place, having previously held the top spot for two consecutive months. The Sativa Bone Diamond Infused Pre-Roll (1g) consistently maintained its third position throughout the first four months of 2025. Other products like the Indica Bone Diamond Infused Pre-Roll (1g) and Grizzly Bone Pre-Roll (1g) held steady in their fourth and fifth ranks, respectively, showing no change in their standings from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.