Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

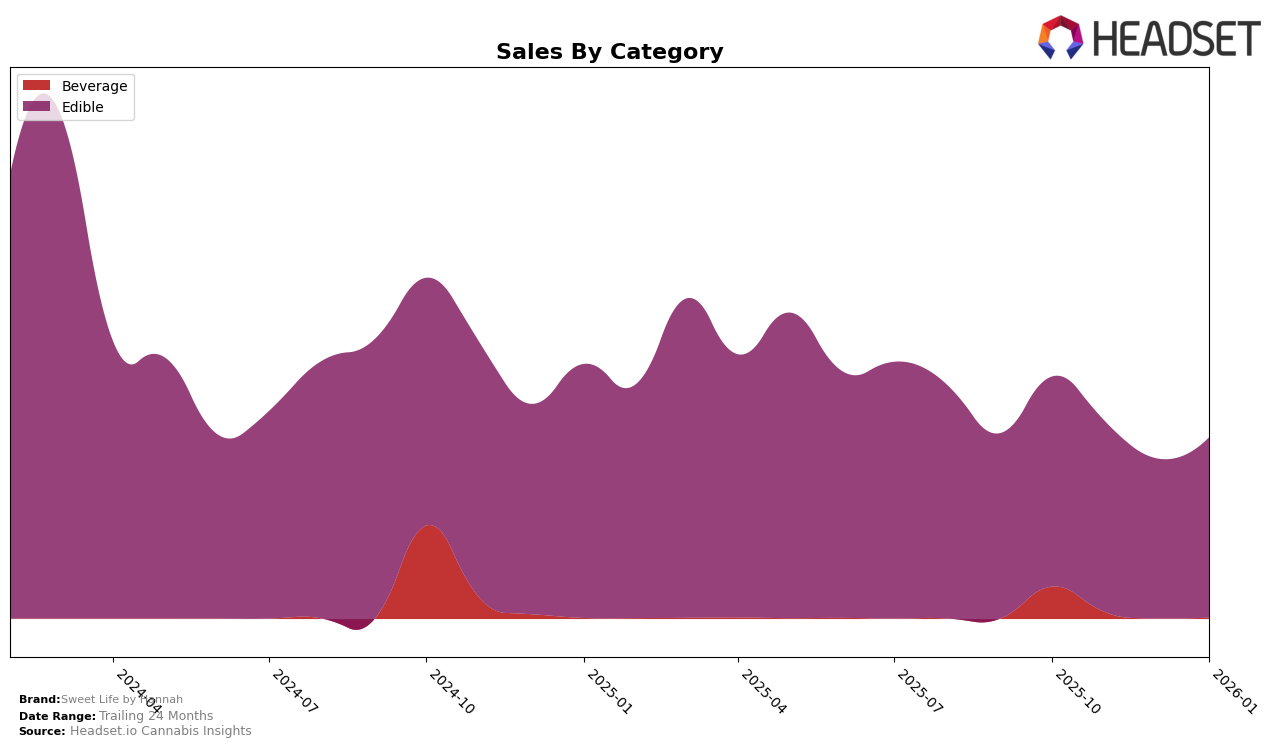

Sweet Life by Hannah has shown a consistent presence in the Illinois market within the Edible category, although it has not broken into the top 30 brands in recent months. Starting from October 2025 with a rank of 44th, the brand saw a slight decline in its rankings, moving to 46th in November and 48th in December, before slightly improving to 45th in January 2026. This fluctuation suggests that while the brand maintains a presence, it faces challenges in climbing higher within the competitive landscape of the Illinois Edible market.

Sales figures for Sweet Life by Hannah in Illinois reflect a downward trend from October to December 2025, before showing a modest recovery in January 2026. The brand's sales decreased from approximately $40,403 in October to $30,808 in December, indicating potential market pressures or seasonal factors affecting consumer demand. However, the increase to $34,701 in January suggests a possible rebound or strategic adjustments that may have positively impacted sales. Despite these efforts, the inability to secure a top 30 position highlights the competitive nature of the market and the need for Sweet Life by Hannah to enhance its strategies to gain a stronger foothold.

Competitive Landscape

In the competitive Illinois edible market, Sweet Life by Hannah has experienced fluctuations in its rank and sales over the past few months, indicating a dynamic competitive landscape. In October 2025, Sweet Life by Hannah was ranked 44th, but by December 2025, it had slipped to 48th before slightly recovering to 45th in January 2026. This volatility is contrasted by competitors such as BITS, which maintained a steady rank of 38th throughout the same period, and Revolution Cannabis, which showed a decline from 35th to 41st. Notably, Terra also experienced a drop in rank, from 43rd to 47th, suggesting a competitive pressure that affects multiple brands. While Sweet Life by Hannah's sales decreased from October to December 2025, there was a positive uptick in January 2026, indicating potential recovery or strategic adjustments. This competitive analysis highlights the importance for Sweet Life by Hannah to continuously innovate and adapt to maintain and improve its market position in the Illinois edible category.

Notable Products

In January 2026, the top-performing product from Sweet Life by Hannah was Marshmallow Treat (25mg) in the Edible category, maintaining its first-place ranking throughout the previous months with a notable sales figure of 4,233 units. Chocolate Chip Cookies (50mg), also an Edible, climbed to the second position from a consistent third place in previous months, showing a positive trend. Puppy Chow Cereal Mix (50mg) dropped to the third rank, indicating a significant decrease in sales performance compared to earlier months. Canna Chow (50mg) held its fourth position, although its sales figures have shown a declining trend. Nuera x Sweet Life By Hannah - Blood Shot Syrup (50mg) re-entered the rankings at fifth place after being unranked in December, though it experienced a sharp decline in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.