Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

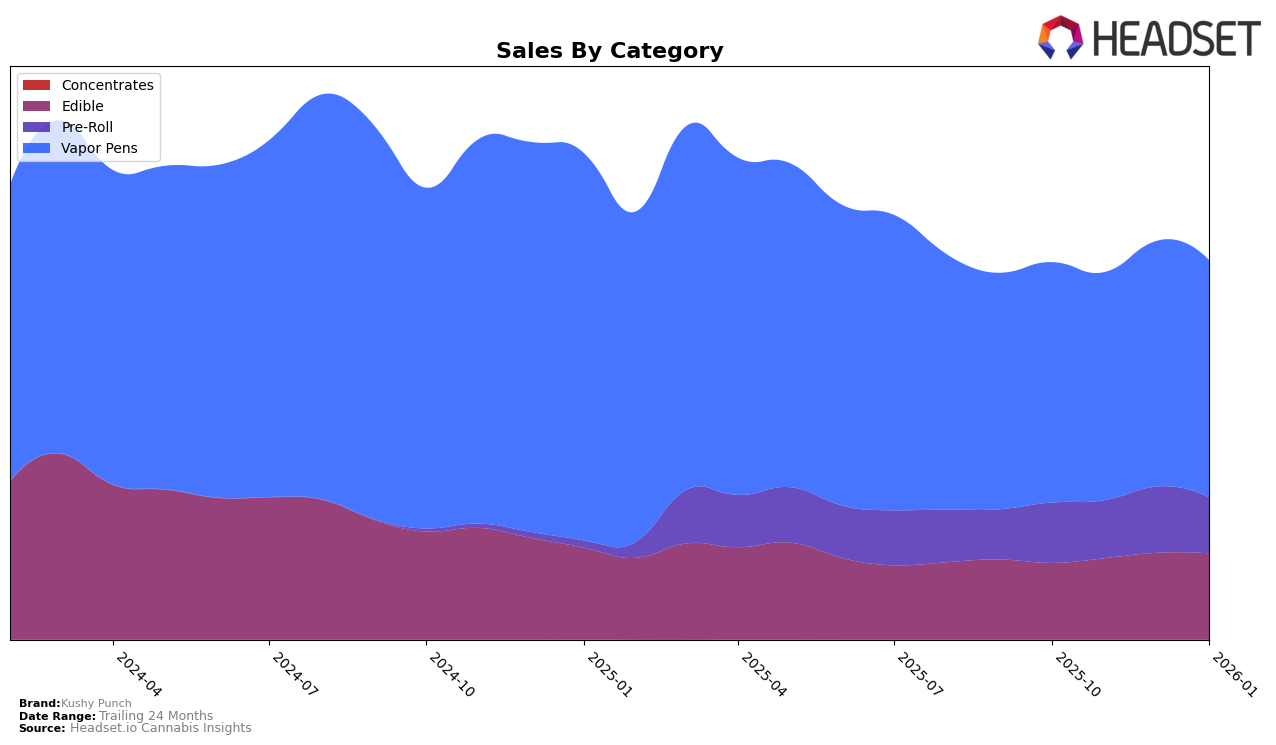

Kushy Punch has demonstrated varying levels of performance across different states and product categories, with notable movements in rankings within the edible and vapor pen segments. In Arizona, the brand made a significant entry into the top 30 edible brands by December 2025, ranking 25th and moving up to 23rd by January 2026. This upward trajectory highlights a positive trend in consumer acceptance and market penetration. In California, Kushy Punch maintained a consistent presence at the edge of the top 30 for edibles throughout the observed months, indicating steady performance in a highly competitive market. However, in the vapor pens category, they were not in the top 30, suggesting room for growth or stronger competition in that segment. Meanwhile, in Illinois, the brand's presence in the vapor pens category saw a decline from 33rd to 42nd place, reflecting potential challenges in maintaining market share.

The performance of Kushy Punch in the Missouri market stands out, particularly in the vapor pens category, where they climbed from 11th to an impressive 8th place by January 2026. This suggests a strong foothold and increasing consumer preference for their products in the state. In the pre-roll category, the brand maintained a steady ranking, moving slightly from 14th to 17th, indicating stable demand. In Michigan, Kushy Punch's entry into the pre-roll category at 90th place shows potential for growth, although they are not yet a major player. The brand's performance in New York is noteworthy in the edibles category, where they improved their ranking from 24th to 21st, driven by a significant increase in sales. However, their late entry into the vapor pens market in New York, ranking 55th, suggests they are still establishing their presence in this category. These movements across different states and categories highlight Kushy Punch's varying strategies and market dynamics.

Competitive Landscape

In the Missouri vapor pens category, Kushy Punch has shown a steady improvement in its market position, climbing from 11th place in October 2025 to 8th place by January 2026. This upward trajectory in rank is indicative of a positive reception among consumers, despite facing stiff competition from brands like Rove, which maintained a higher rank throughout the same period, albeit with fluctuating sales. Notably, Sinse Cannabis consistently outperformed Kushy Punch in terms of sales, especially in December 2025, suggesting a strong brand presence. Meanwhile, Elevate and Indi Vapes experienced slight declines in their rankings, which may have contributed to Kushy Punch's improved standing. This competitive landscape highlights Kushy Punch's resilience and potential for continued growth in the Missouri market.

Notable Products

In January 2026, the top-performing product for Kushy Punch was the Sativa Lemonade Full Spectrum Fast Acting Gummies 10-Pack (100mg), reclaiming the number one rank with sales of 3579 units. The Hybrid Sour Apple Gummies 10-Pack (100mg) rose to second place, marking its first appearance in the rankings. Blue Raspberry Fast Acting Gummies 10-Pack (100mg) dropped to third place after leading in December 2025. Kushy Punch x Uppercut - Sativa Strawberry Kiwi Gummies 10-Pack (100mg) maintained a strong presence, ranking fourth, while Indica Peach Mango Gummies (100mg) consistently held the fifth position. Compared to previous months, the Sativa Lemonade regained its top spot from December, while Blue Raspberry experienced a slight decline in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.