Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

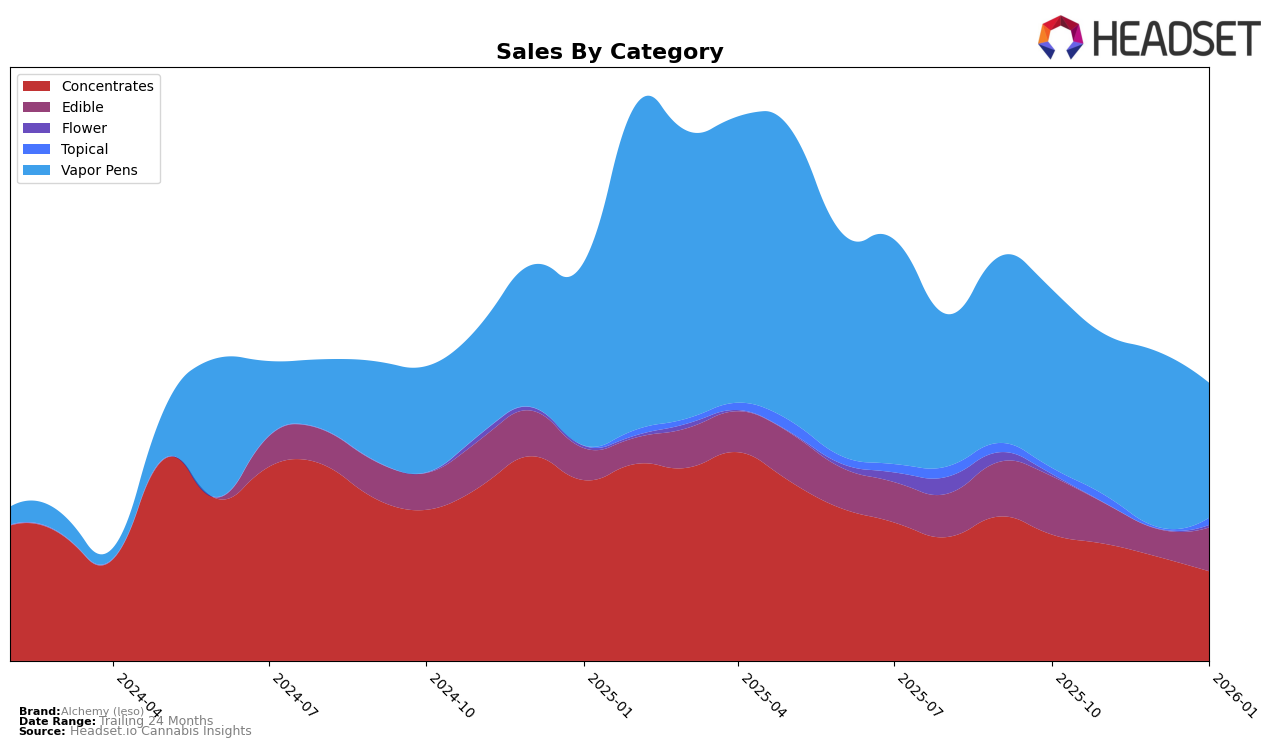

In the state of Illinois, Alchemy (Ieso) has shown a varied performance across different cannabis product categories. In the Concentrates category, the brand has experienced a gradual decline in rankings from 6th place in October 2025 to 11th place by January 2026, indicating a need to potentially reassess their strategy in this segment. On the other hand, their Vapor Pens have maintained a relatively stable presence within the top 30, fluctuating slightly but ending at 29th place in January 2026. This suggests that while there is some consistency in their performance, there may be room for improvement to climb higher in the rankings.

Alchemy (Ieso) faced challenges in the Edible category, where it failed to maintain a top 30 position in November and December 2025, only to recover slightly to 33rd place in January 2026. This highlights a volatile market presence that could benefit from targeted marketing or product innovation. Interestingly, in the Topical category, the brand was absent from the rankings in October and December 2025 but managed to secure 4th and 5th positions in November 2025 and January 2026, respectively. This sporadic success could indicate untapped potential in the Topical segment that might be worth exploring further. Overall, while Alchemy (Ieso) demonstrates strengths in certain categories, there are opportunities for growth and stabilization across their product lines in Illinois.

Competitive Landscape

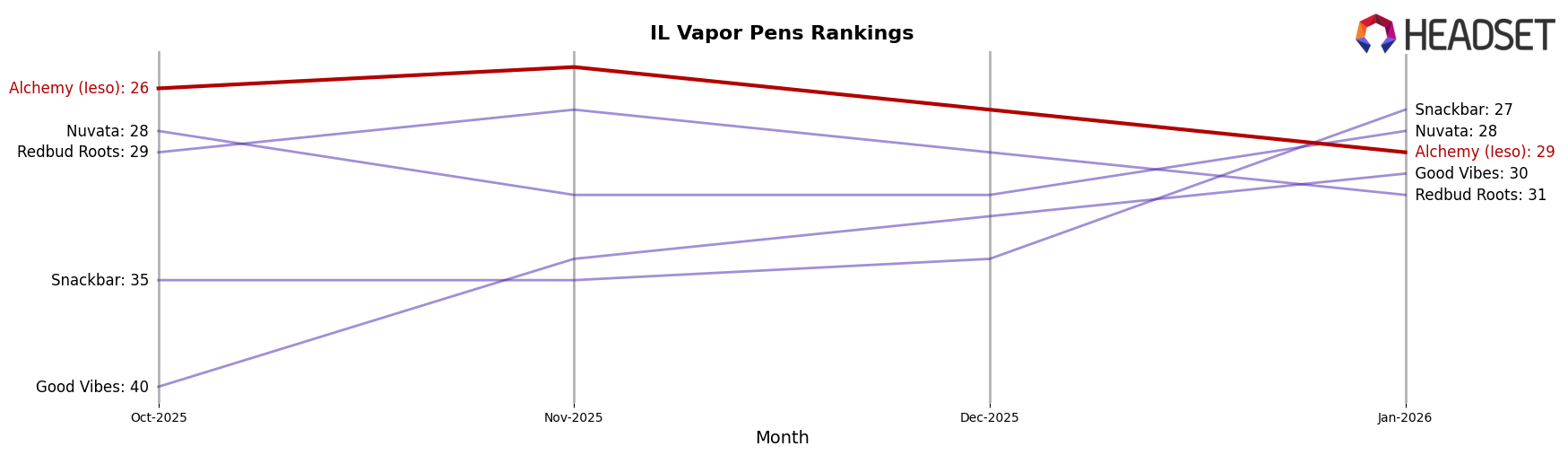

In the competitive landscape of vapor pens in Illinois, Alchemy (Ieso) has experienced some fluctuations in its market position from October 2025 to January 2026. Despite starting strong with a rank of 26th in October, Alchemy (Ieso) saw a slight decline, dropping to 29th by January. This shift is notable as it reflects a broader trend of decreasing sales, with January's figures significantly lower than those in October. Competitors such as Nuvata and Redbud Roots have also experienced rank fluctuations, but Snackbar made a notable leap from 35th to 27th, indicating a potential rise in consumer preference. Meanwhile, Good Vibes showed consistent improvement, climbing from 40th to 30th, suggesting a growing market presence. These dynamics highlight the competitive pressures Alchemy (Ieso) faces, underscoring the need for strategic adjustments to regain its footing in the Illinois vapor pen market.

Notable Products

In January 2026, the top-performing product for Alchemy (Ieso) was the CBD/THC 8:1 Dragonfruit Gummies 20-Pack, which climbed to the number one spot in the Edible category with sales of 1183 units. Following closely, the Sleep Potion - CBN/THC 5:1 Black Raspberry Gummies 20-Pack debuted strongly at second place. The CBC/THC 1:1 Fruit Punch Gummies 20-Pack secured the third position, showing a consistent presence in the rankings. The CBD/CBG/THC 3:2:1 Cranberry Lime Gummies 20-Pack slipped to fourth place, while the Coma Distillate Cartridge (1g) dropped to fifth in the Vapor Pens category after ranking second in November 2025. These shifts indicate a dynamic market with significant changes in consumer preferences for Alchemy (Ieso) products over the past few months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.