Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

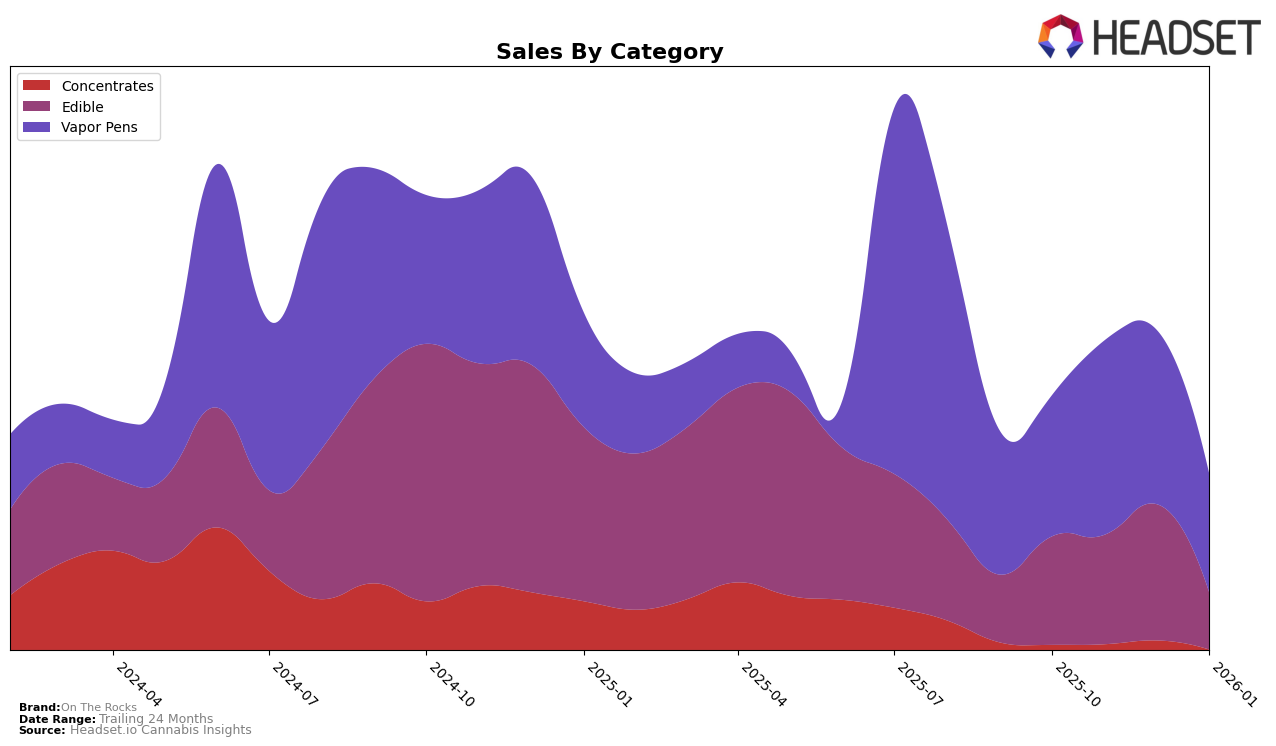

On The Rocks has shown varied performance across different states and product categories over recent months. In the Connecticut market, the brand has maintained a relatively stable presence in the Edible category, with rankings fluctuating slightly between 10th and 13th place from October 2025 to January 2026. Despite a notable dip in sales for January 2026, where they fell to $41,080, the brand's performance in this category has largely been consistent. In contrast, On The Rocks' position in the Vapor Pens category in Connecticut has seen a slight downward trend, sliding from 15th to 19th over the same period, which could suggest increasing competition or a shift in consumer preference.

In Illinois, On The Rocks did not make it into the top 30 brands for Vapor Pens in the last two months of the observed period, indicating a challenging market environment or potential strategic shifts. Meanwhile, in New Jersey, the brand has managed to climb into the top 75 for Vapor Pens, peaking at rank 70 in December 2025 before slightly dropping to 71 in January 2026. This upward movement in New Jersey could reflect successful marketing efforts or product reception in that state, contrasting with the brand's absence from Illinois' top rankings. Such regional differences highlight the complexities of market dynamics and consumer preferences that On The Rocks must navigate.

Competitive Landscape

In the Connecticut vapor pens category, On The Rocks has experienced a slight decline in rank from October 2025 to January 2026, moving from 15th to 19th place. This shift is notable when compared to competitors like Earl Baker, which maintained a relatively stable position, peaking at 14th in November 2025 before dropping to 18th by January 2026. Meanwhile, All:Hours demonstrated a more volatile trajectory, achieving 11th place in both October and December 2025 but falling to 17th by January 2026. The sales trends indicate that while On The Rocks saw a decrease in sales over this period, All:Hours managed to significantly outperform in sales, particularly in December 2025. Additionally, Lucky Break consistently remained at the bottom of the top 20, suggesting a less competitive threat. These dynamics highlight the competitive pressures On The Rocks faces in maintaining its market position amidst fluctuating sales and rankings.

Notable Products

In January 2026, On The Rocks maintained its top position with the Hybrid Peach Mango Live Rosin Gummies 10-Pack (100mg) leading the sales, despite a notable reduction to 689 units sold. The Sour Apricot Apple Live Rosin Gummies 10-Pack (100mg) climbed to the second rank, improving from its consistent third position in the previous months. The Hybrid Peach Mango Flavored Live Rosin Gummies 20-Pack (100mg) slipped to third place as its sales dropped significantly from December. The new entry, Moon Boots Live Rosin Disposable (1g), debuted strongly at fourth place in the Vapor Pens category. Scout Breath Live Rosin Disposable (1g) rounded out the top five, marking its first appearance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.