Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

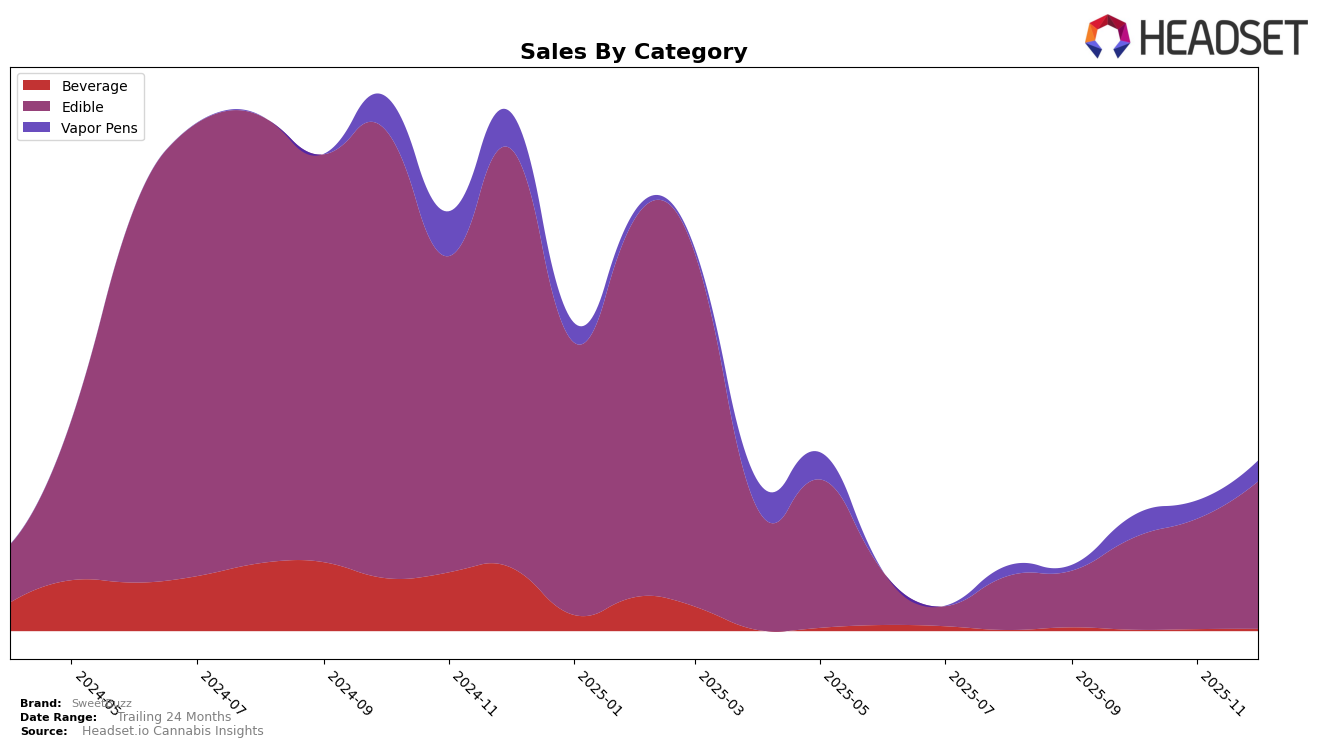

SweetBuzz has shown some interesting performance trends across different categories and states. In the state of Illinois, SweetBuzz has not been able to break into the top 30 brands in the Edible category from September to December 2025. Despite this, there is a positive trend in their sales figures, which increased from $10,492 in November to $14,064 in December. This growth indicates that while SweetBuzz might not yet be a leading brand in Illinois, there is a rising consumer interest in their products, which could eventually help them climb the rankings if the trend continues.

SweetBuzz's absence from the top 30 rankings in Illinois for the Edible category might be seen as a challenge, but it also highlights potential areas for improvement and growth. The steady increase in sales suggests that the brand is gaining traction with consumers, possibly due to product quality, unique offerings, or increased marketing efforts. As SweetBuzz continues to develop its presence in Illinois, monitoring these movements could provide insights into their market strategy and future potential. This trend could also be indicative of a broader pattern across other states and categories, although further data would be necessary to draw more comprehensive conclusions.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Illinois, SweetBuzz has shown a notable upward trajectory in its ranking, moving from being outside the top 20 in November 2025 to securing the 56th position by December 2025. This improvement in rank coincides with a significant increase in sales, suggesting a positive reception in the market. In contrast, Realeaf Botanicals maintained a relatively stable position, ranking 50th in December 2025, which is slightly higher than SweetBuzz, but with less dynamic sales growth. Meanwhile, Hedy experienced a decline in rank, dropping from 48th in November to 55th in December 2025, indicating potential challenges in maintaining market share. Kushy Punch, another competitor, was not in the top 20 during these months, highlighting a potential opportunity for SweetBuzz to capitalize on the shifting market dynamics and consumer preferences in Illinois.

Notable Products

In December 2025, SweetBuzz's top-performing product was Sweet Sparks Chocolate Candies 100-Pack, maintaining its first-place ranking from November and significantly increasing its sales to 357 units. Sweet Something - Peanut Butter Cups Chocolate 10-Pack consistently held the second position throughout the months leading up to December, showing a steady sales increase. Mint Chill Candy Cups 10-Pack emerged as a new entrant in the top three, debuting at third place. The THC/THCV 1:1 Orange Cream Spark'd Up Chocolatey Candies 100-Pack remained steady in fourth place, despite a slight decrease in sales. Cookie Got Creamed Fast Acting Chocolate 10-Pack dropped to fifth place from third in November, indicating a notable decline in popularity.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.