Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

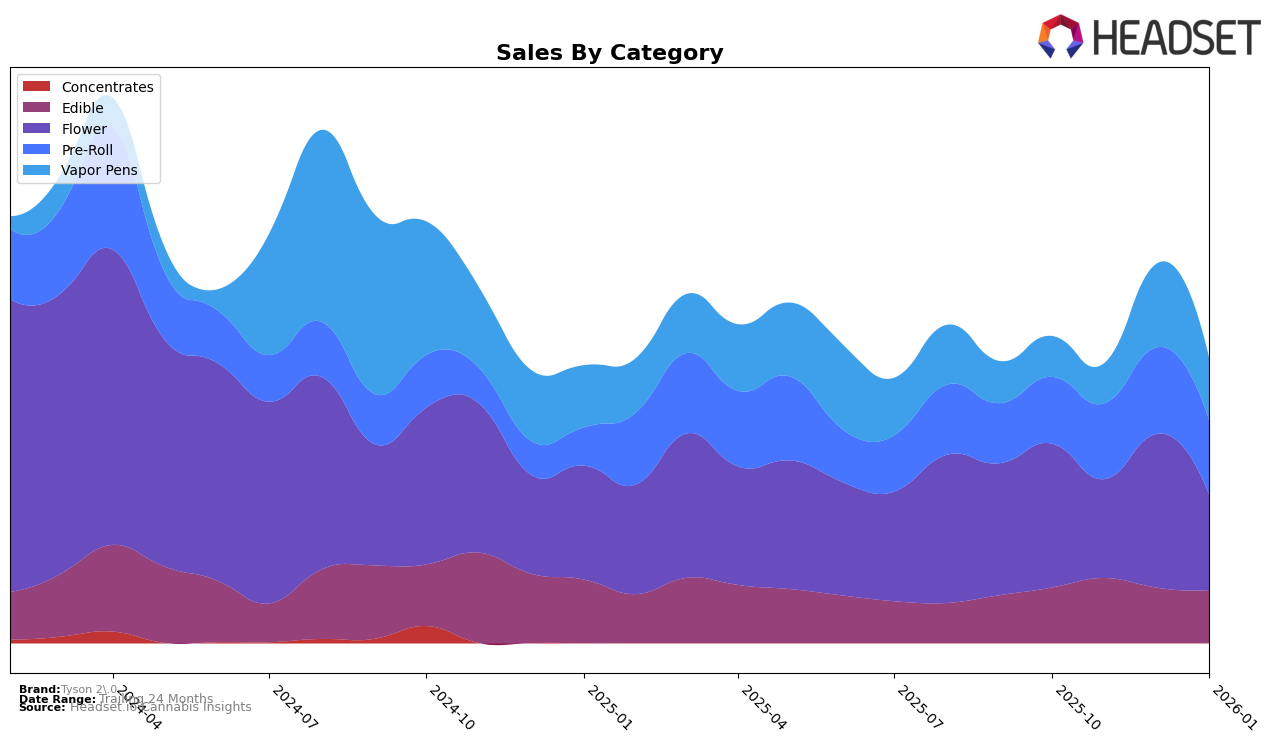

Tyson 2.0 has shown varied performance across different states and product categories, reflecting both opportunities and challenges. In Arizona, the brand's presence in the Flower, Pre-Roll, and Vapor Pens categories was not significant enough to break into the top 30 until January 2026, with rankings of 47, 46, and 41 respectively, indicating a downward trend in their market presence. In contrast, their performance in the Nevada market is relatively stronger, particularly in the Edibles category where they consistently ranked in the top 20, peaking at 12th place in October 2025. This suggests a strong foothold in the Nevada edibles market, despite a gradual decline in sales over the months.

In California, Tyson 2.0's presence in the Pre-Roll category has been modest, with rankings fluctuating around the 90th position, indicating room for growth in this competitive market. Meanwhile, in Ohio, the brand has seen a consistent ranking in the Edibles category, maintaining a position in the top 50, which reflects a stable consumer base. Notably, the brand's Vapor Pens in Illinois did not make it into the top 30, suggesting a need for strategic adjustments to improve market penetration. Additionally, in Washington, Tyson 2.0 only entered the rankings in November 2025 for Flower and Pre-Roll, indicating a late entry into the competitive landscape. This analysis highlights the varied market dynamics Tyson 2.0 faces across states and categories, offering insights into potential areas for strategic focus.

Competitive Landscape

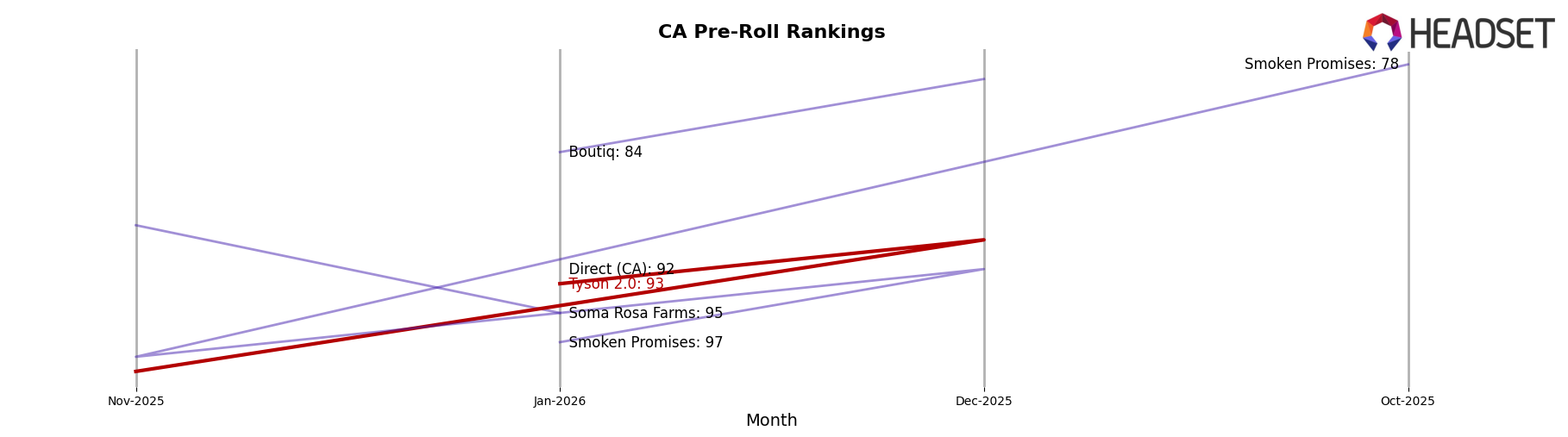

In the competitive landscape of the California pre-roll category, Tyson 2.0 has shown a dynamic shift in its market position from October 2025 to January 2026. Initially absent from the top 20 in October, Tyson 2.0 entered the rankings at 99th in November, improved to 90th in December, but slipped slightly to 93rd in January. This fluctuating rank indicates a competitive struggle, particularly against brands like Smoken Promises, which consistently maintained a presence in the top 100, albeit with its own fluctuations, and Boutiq, which entered the rankings at 79th in December and held a strong position at 84th in January. Despite these challenges, Tyson 2.0's sales showed a promising increase from November to December, suggesting potential for growth if it can stabilize its ranking. The brand's journey reflects the highly competitive nature of the California pre-roll market, where strategic adjustments could enhance its standing against established competitors.

Notable Products

In January 2026, Tyson 2.0's top-performing product was Haymaker Haze Pre-Roll (1g) in the Pre-Roll category, securing the number one rank with notable sales of 2161 units. Challenger - The Soap Pre-Roll (1g) followed as the second best-selling product, marking its debut in the rankings. Round 12 Diamond Infused Pre-Roll (1g) experienced a slight drop from the second position in December 2025 to third in January 2026. Mike Bite - Watermelon Gummies 10-Pack (100mg) in the Edible category ranked fourth, showing a decline from its previous second position in November 2025. Knockout OG Diamond Infused Pre-Roll 5-Pack (2.5g) rounded out the top five, a new entry in the rankings for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.