Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

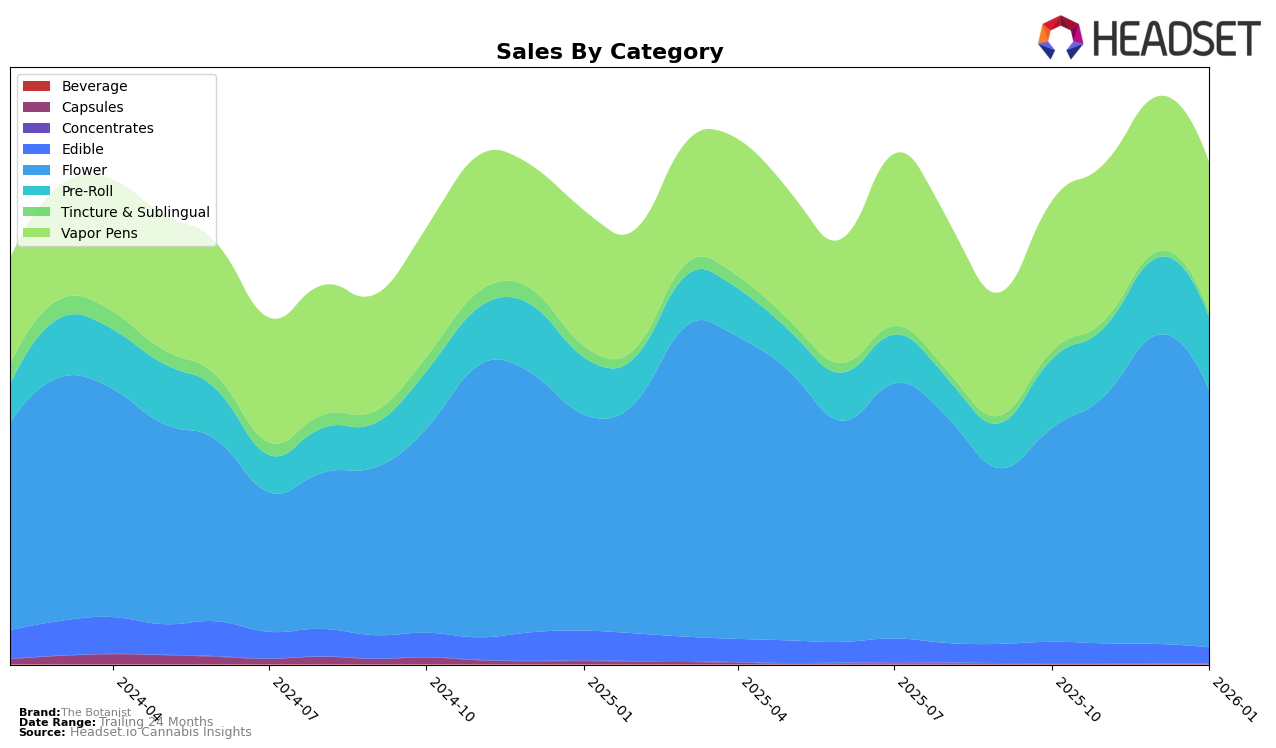

The Botanist has shown varied performance across different states and product categories. In Illinois, the brand's ranking in the flower category fluctuated, maintaining a position within the top 30, although it dropped from 20th in December 2025 to 27th by January 2026. Their performance in vapor pens also saw a decline, moving from 14th in October and November 2025 to 18th by January 2026, indicating a potential challenge in maintaining market share in this category. Contrastingly, in Massachusetts, The Botanist did not rank in the top 30 for pre-rolls beyond October 2025, which could suggest a need to reassess their strategy in this segment.

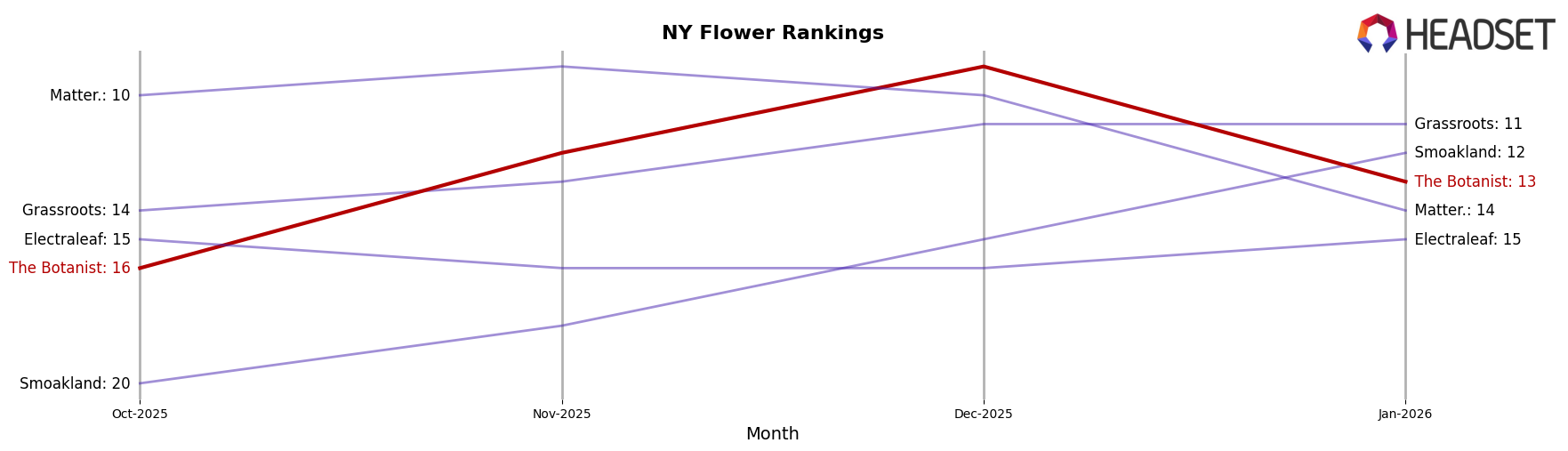

In New York, The Botanist's flower category saw a notable improvement, climbing from 16th in October 2025 to 9th in December, before settling at 13th in January 2026. This upward trend in New York's flower market highlights a strong regional performance. However, the vapor pen category saw The Botanist only entering the rankings in January 2026 at 43rd, indicating a late but potential entry in this segment. In Ohio, the pre-roll category showed a significant rise with a peak at 4th in December 2025, though it dropped to 10th by January 2026, suggesting volatility in consumer preferences or competitive pressures in the region. These movements across states and categories provide a snapshot of The Botanist's diverse market presence and the varying challenges and opportunities they face.

Competitive Landscape

In the competitive landscape of the New York flower category, The Botanist has shown a dynamic performance over the past few months. Starting from October 2025, The Botanist was ranked 16th, but it climbed to 9th by December 2025 before dropping to 13th in January 2026. This fluctuation in rank reflects a competitive market where brands like Grassroots and Matter. have maintained relatively stable positions, with Grassroots consistently holding the 11th spot from December to January and Matter. experiencing a slight drop from 10th to 14th. Meanwhile, Smoakland has shown a steady upward trend, moving from 20th to 12th, which may pose a future challenge for The Botanist. Despite these fluctuations, The Botanist's sales peaked in December 2025, indicating strong consumer demand during that period, although it faced a decline in January 2026. This competitive environment suggests that while The Botanist has the potential to rise in rank, it must strategize effectively to maintain its market position against consistently performing brands.

Notable Products

In January 2026, The Botanist's top-performing product was OG Chem Haze (3.5g) in the Flower category, which achieved the number one rank with sales of 3715. OG Chem Haze was not ranked in the previous months, indicating a significant surge in popularity. Grapple Pie (3.5g) maintained its strong performance, holding steady at the second rank, though its sales decreased from December 2025. Donny Burger Pre-Roll (1g) emerged as a new contender, securing the third rank, while Mint Sherbert (3.5g) dropped to fourth place after previously being unranked in December. Grapple Pie Pre-Roll (1g) held the fifth position, consistent with its ranking in December 2025, despite a decrease in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.