Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

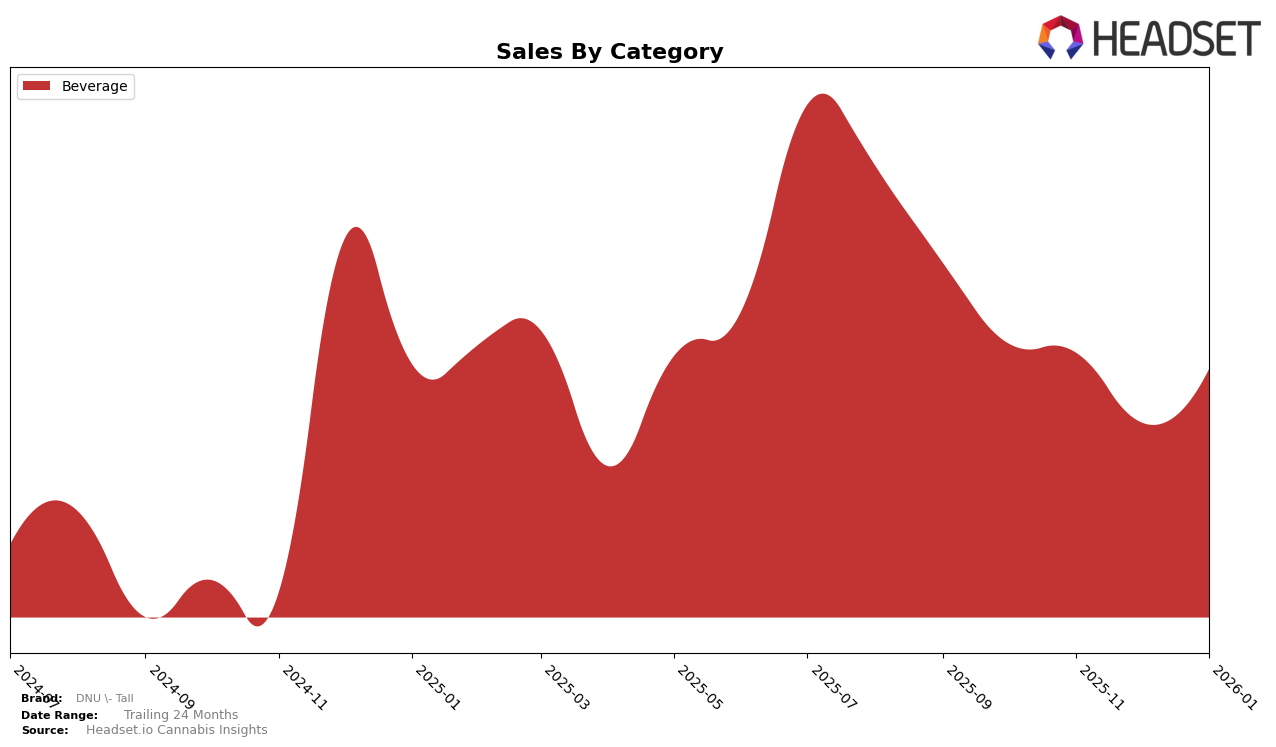

DNU - Tall has maintained a consistent rank in the Beverage category in Maryland over the past few months, consistently holding the 6th position from October 2025 through January 2026. This stability in ranking suggests a steady demand and consumer preference for their products within the state. Despite slight fluctuations in monthly sales figures, the brand's ability to retain its position indicates a strong foothold in the Maryland beverage market. However, it's worth noting that they did not break into the top 5, which might be an area of focus for future growth initiatives.

While DNU - Tall's performance in Maryland is noteworthy, the absence of rankings in other states or provinces suggests that the brand's influence may be limited geographically. This could be seen as a potential area for market expansion or a strategic decision to focus on a particular region. The lack of presence in the top 30 in other markets might highlight opportunities for growth or, conversely, point to challenges in scaling operations beyond their current stronghold. Understanding the dynamics in other states or provinces could provide insights into potential market entry strategies or reveal competitive landscapes that are currently barriers to entry.

Competitive Landscape

In the Maryland beverage category, DNU - Tall consistently maintained its position at rank 6 from October 2025 to January 2026. Despite stable rankings, its sales figures showed a slight decline over this period, suggesting potential challenges in market penetration or consumer retention. In contrast, Tall, a direct competitor, held a steady rank at 5, with sales figures notably higher than DNU - Tall, indicating a stronger market presence and possibly more effective sales strategies. Meanwhile, Dixie Elixirs consistently ranked at 4, maintaining a significant lead in sales over both DNU - Tall and Tall. These insights suggest that while DNU - Tall remains a stable player in the market, there is room for growth and improvement in sales strategies to climb the ranks and compete more effectively with leading brands.

Notable Products

In January 2026, the top-performing product for DNU - Tall was Dragon Fruit Seltzer 10mg THC 12oz, maintaining its number one rank from previous months with sales of 2987 units. Yuzu Blood Orange Seltzer 5mg THC 12oz also held steady in the second position, with a slight increase in sales to 1418 units. Both products are in the Beverage category and have consistently performed well since October 2025. Notably, there has been a stable trend in the rankings for these top products, indicating strong consumer preference and consistent demand. This stability in rank and sales figures suggests a loyal customer base and effective market positioning for the brand's seltzer offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.