Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

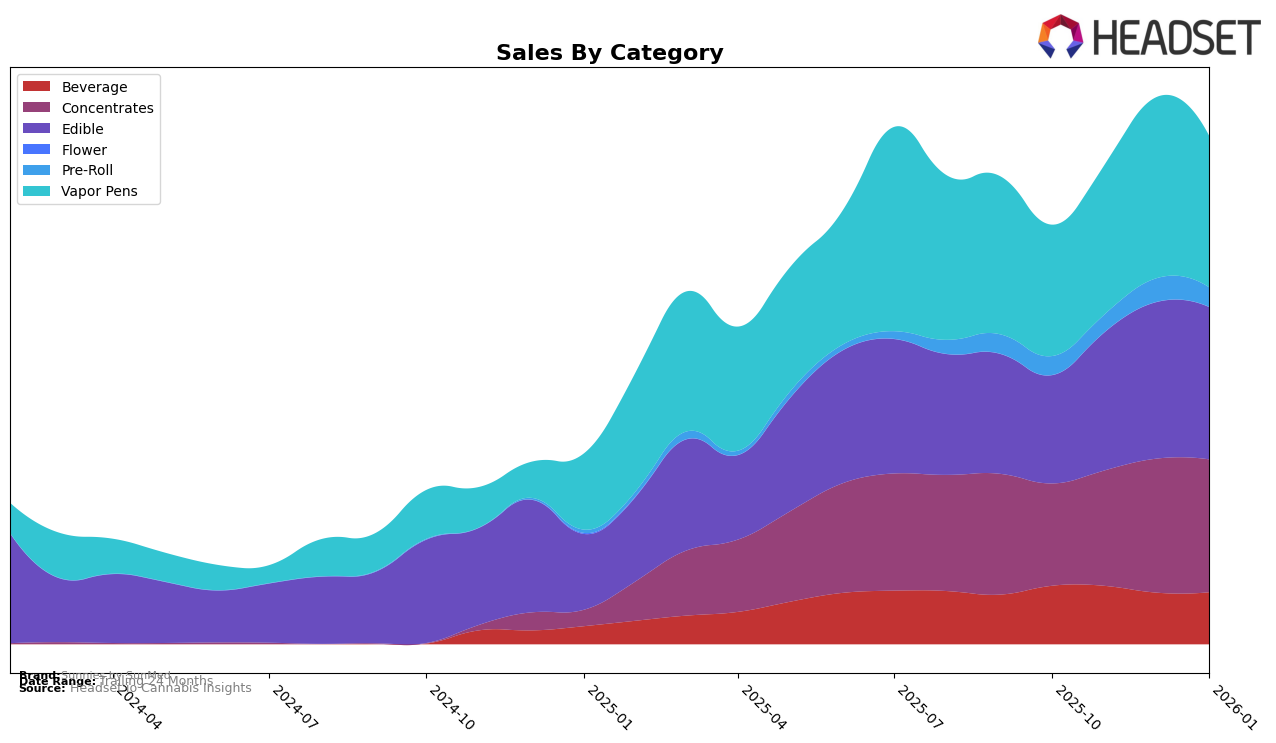

Sunnies by SunMed has shown a consistent presence in the Maryland market, particularly in the Beverage category. Over the past few months, they have maintained a steady rank of third place until January 2026, when they improved to second place. This indicates strong consumer loyalty and potentially effective marketing strategies in this category. In contrast, their presence in the Pre-Roll category is less prominent, as they did not make it into the top 30, reflecting either a strategic focus away from this category or perhaps a more competitive market environment. This could be an area for potential growth if they aim to expand their market share in Maryland.

In the Concentrates category, Sunnies by SunMed has shown promising upward movement, climbing from eighth to seventh place by November 2025 and maintaining that position through January 2026. This suggests a growing acceptance and demand for their products in this segment. Meanwhile, in the Edible category, they have experienced a slight fluctuation, moving from 16th to 13th and then back to 14th place. This volatility might indicate a competitive landscape or changing consumer preferences. Lastly, their performance in the Vapor Pens category saw an improvement from 21st to 15th place before settling back to 18th, which could suggest a need for strategic adjustments to maintain upward momentum in this popular segment.

Competitive Landscape

In the Maryland edible cannabis market, Sunnies by SunMed has experienced notable fluctuations in its competitive positioning over the past few months. Starting from October 2025, Sunnies by SunMed was ranked 16th, but showed a promising climb to 13th place by November and December, before slightly dropping to 14th in January 2026. This trajectory indicates a positive trend in sales performance, aligning with a general increase in sales figures over the same period. In comparison, Strane consistently held the 12th rank, maintaining a stable lead over Sunnies by SunMed, while Dixie Elixirs and Beboe have been close competitors, with Beboe showing a stronger upward movement, surpassing Sunnies by SunMed in January. Meanwhile, Evermore Cannabis Company has been trailing behind, indicating a less aggressive competitive threat. These dynamics suggest that while Sunnies by SunMed is gaining traction, it faces stiff competition from both established and emerging brands in the Maryland edible market.

Notable Products

In January 2026, Socials - Watermelon Infused Sparkling Water maintained its top position as the leading product for Sunnies by SunMed, with sales reaching 3,376 units. Following closely, Socials - Mango Infused Sparkling Water held steady at the second rank, showing consistent performance over the past months. Socials - Black Cherry Infused Sparkling Water remained in third place, experiencing a slight increase in sales compared to December 2025. Socials - Pineapple Infused Sparkling Water re-entered the rankings in fourth place, while Socials - Lemon Lime Infused Sparkling Water slipped from fourth to fifth place, indicating a decrease in popularity. Overall, the beverage category continues to dominate the sales landscape for Sunnies by SunMed.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.