Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

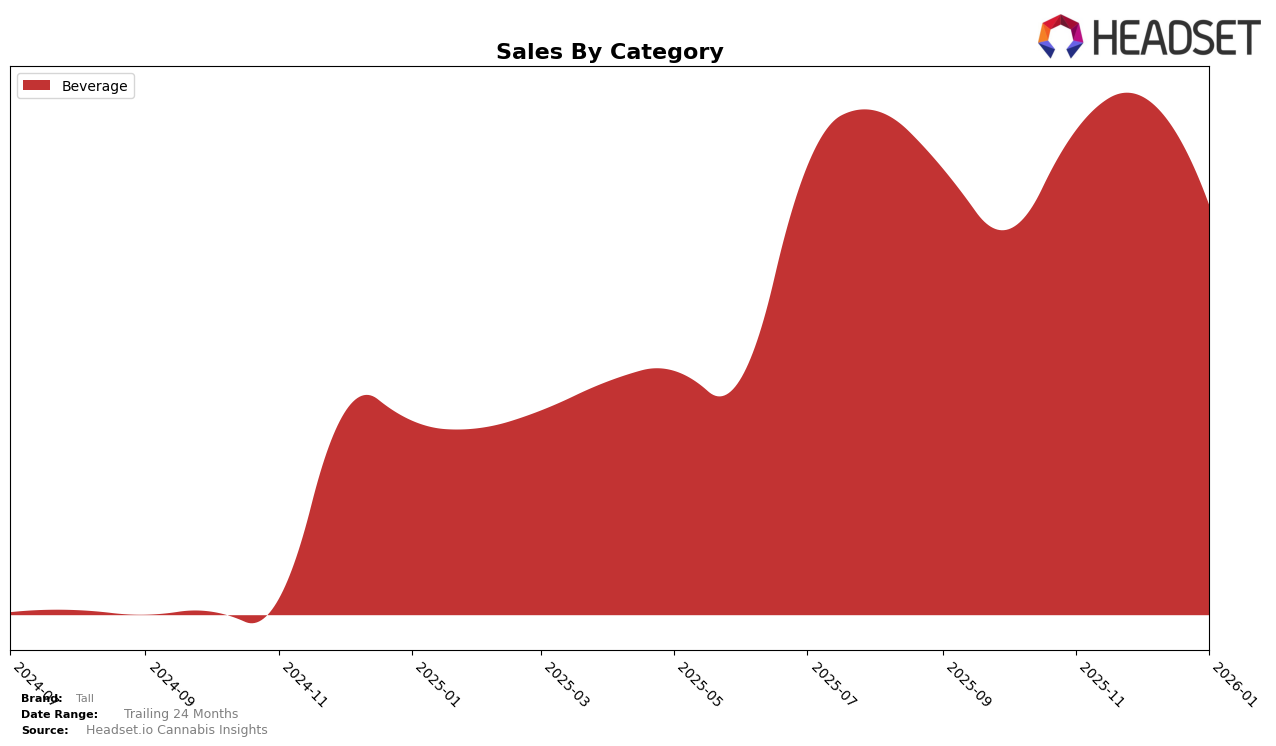

The cannabis brand Tall has demonstrated consistent performance in the Beverage category within the state of Maryland. Over the span from October 2025 to January 2026, Tall maintained a steady rank of 5th place, indicating a stable presence in the market. This consistency suggests a reliable consumer base and effective market strategies that keep them competitive. Notably, the brand experienced a peak in sales during November and December, which could be attributed to seasonal demand or successful promotional activities. However, a slight dip in sales was observed in January, which may warrant further analysis to understand post-holiday market dynamics.

While Tall's performance in Maryland's Beverage category is commendable, the absence of rankings in other states and categories suggests areas for potential growth or challenges in expanding their market reach. The fact that Tall did not make it into the top 30 brands in other states or categories could be seen as a limitation, but it also highlights opportunities for strategic expansion. Understanding the competitive landscape and consumer preferences in these untapped regions could provide valuable insights for Tall to enhance its brand presence and diversify its product offerings. This analysis underscores the importance of geographic and categorical diversification for sustained growth in the cannabis industry.

Competitive Landscape

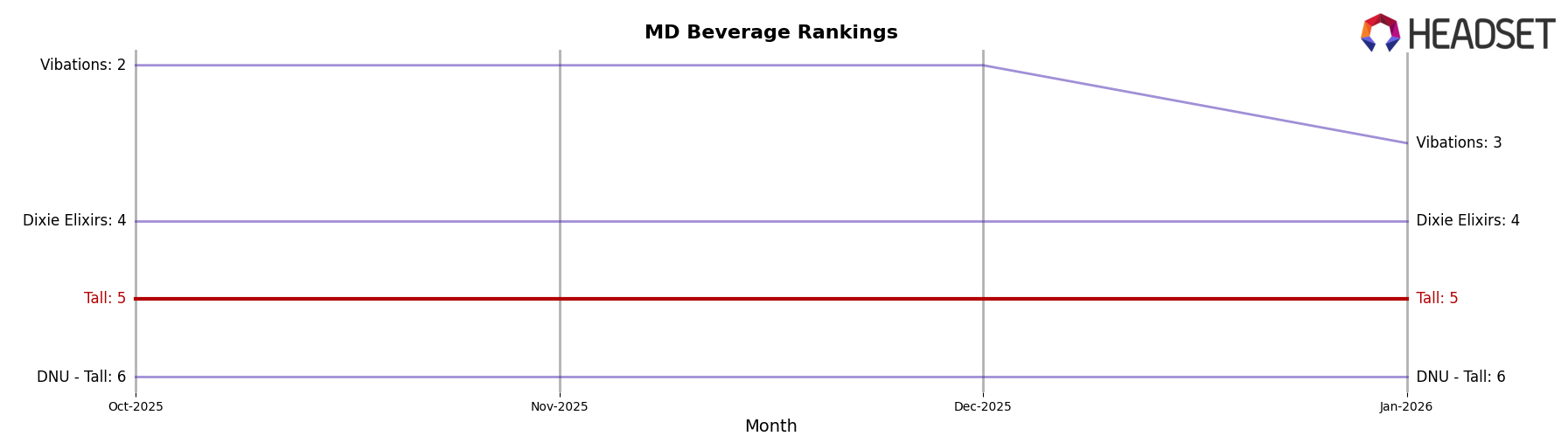

In the Maryland beverage category, Tall consistently held the 5th rank from October 2025 to January 2026, indicating a stable position amidst a competitive landscape. Despite maintaining its rank, Tall's sales saw fluctuations, with a notable peak in December 2025 before a decline in January 2026. This suggests a potential seasonal influence or promotional impact during the holiday period. In comparison, Vibations experienced a drop in rank from 2nd to 3rd in January 2026, accompanied by a significant sales decrease, which could signal an opportunity for Tall to capture market share if Vibations' downward trend continues. Meanwhile, Dixie Elixirs maintained a steady 4th rank, with sales showing resilience despite a dip in November 2025. These dynamics highlight Tall's need to strategize around competitive pressures and capitalize on any emerging weaknesses in its competitors' performance.

Notable Products

In January 2026, Tall's top-performing product was the Juicy Peach Seltzer (10mg THC, 12oz) in the Beverage category, maintaining its first-place rank consistently from October 2025 with sales of 2904 units. The CBD/THC 1:1 Fuji Apple Pear Seltzer (10mg CBD, 10mg THC, 12oz) held the second spot, showing a notable increase from its December position, with sales improving to 2818 units. The Hibiscus Cherry Lime Seltzer (10mg THC, 12oz) ranked third, experiencing a drop from its second-place position in December. Dark Berry Elevated Seltzer (5mg THC, 12oz, 355ml) maintained its fourth-place rank since October. The CBD/THC 1:1 - Fuji Apple Pear Seltzer (10mg CBD, 10mg THC, 12oz) entered the top five in December and retained its position in January, despite lower sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.