Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

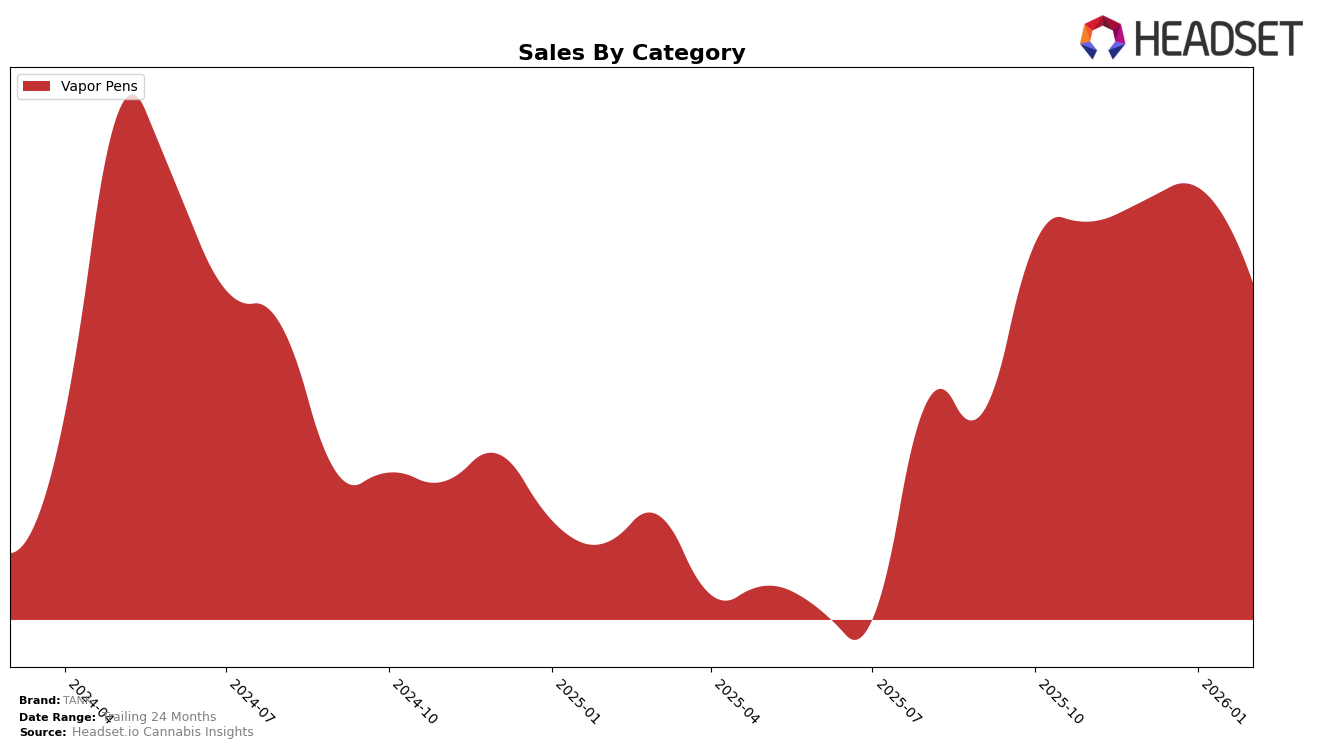

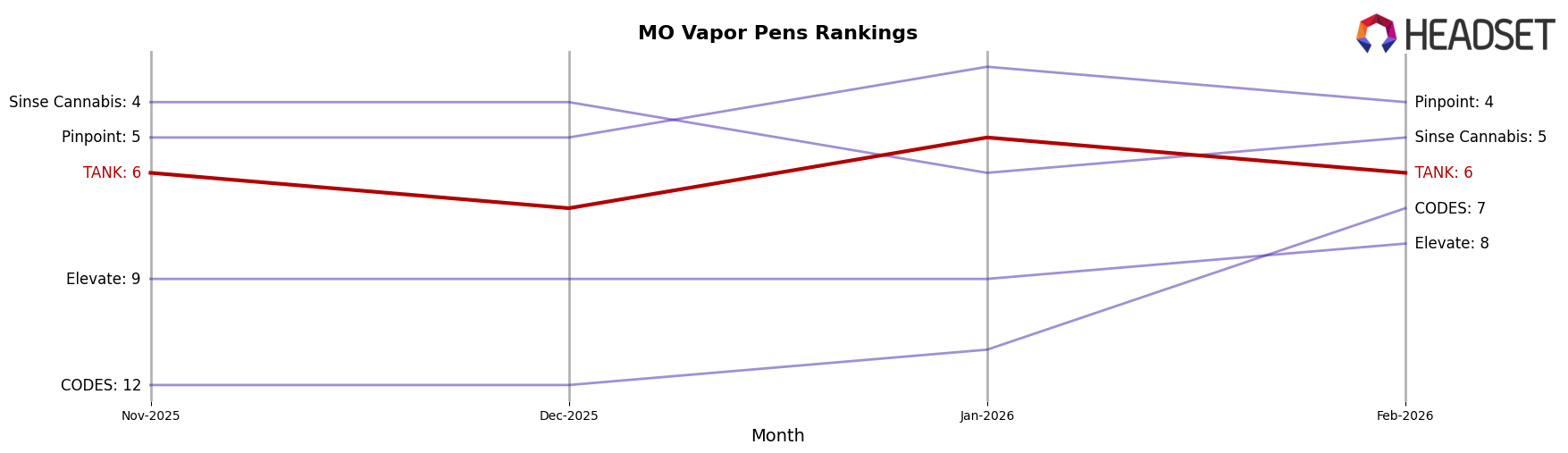

In the state of Missouri, TANK has demonstrated a consistent performance within the Vapor Pens category. Over the four-month period from November 2025 to February 2026, TANK maintained a presence in the top ranks, fluctuating between the 5th and 7th positions. Notably, TANK climbed to the 5th position in January 2026, indicating a positive reception or potentially effective strategic moves during that month. However, the subsequent drop to 6th place in February 2026, accompanied by a decrease in sales from January to February, suggests a need for analysis into potential market changes or competitive pressures that might have influenced this shift.

It is important to highlight that TANK's absence from the top 30 brands in other states or categories during this period could be seen as a limitation in their market penetration or brand reach. This could suggest a focus on consolidating their presence in Missouri rather than expanding into new markets or categories. Understanding the dynamics in Missouri's Vapor Pen market could provide insights into TANK's strategic priorities and potential areas for growth. This focused approach might also reflect a strategic decision to dominate a specific niche before scaling operations further afield.

Competitive Landscape

In the competitive landscape of Vapor Pens in Missouri, TANK has experienced some fluctuations in its ranking, reflecting the dynamic nature of the market. Over the period from November 2025 to February 2026, TANK's rank shifted from 6th to 7th, then improved to 5th before settling back to 6th. This indicates a competitive pressure from brands like Pinpoint, which consistently maintained a higher rank, peaking at 3rd in January 2026. Meanwhile, Sinse Cannabis also posed a significant challenge, holding a top-five position throughout this period. Notably, CODES made a remarkable leap from 12th to 7th, suggesting an upward trend that could impact TANK's market share if sustained. Despite these challenges, TANK's sales remained relatively stable, though they saw a slight dip in February 2026, underscoring the importance of strategic positioning to maintain and improve its standing in this competitive market.

Notable Products

In February 2026, the top-performing product from TANK was the Blueberry Underground BDT Distillate Cartridge (1g) in the Vapor Pens category, maintaining its number one rank from January 2026 with sales of 5248 units. The Paradise Petrol BDT Distillate Cartridge (1g) also held steady at the second position, showing a notable increase in sales compared to previous months. Lemon Whip Kush Distillate Cartridge (1g) remained consistently in third place but experienced a decrease in sales figures. Strawberry Brew BDT Distillate Cartridge (1g) improved its rank to fourth place from fifth in January, despite a decline in sales. The newly ranked Lemon Whip Kush BDT Distillate Disposable (1g) entered the rankings at fifth place, indicating a growing interest in disposable options.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.