Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

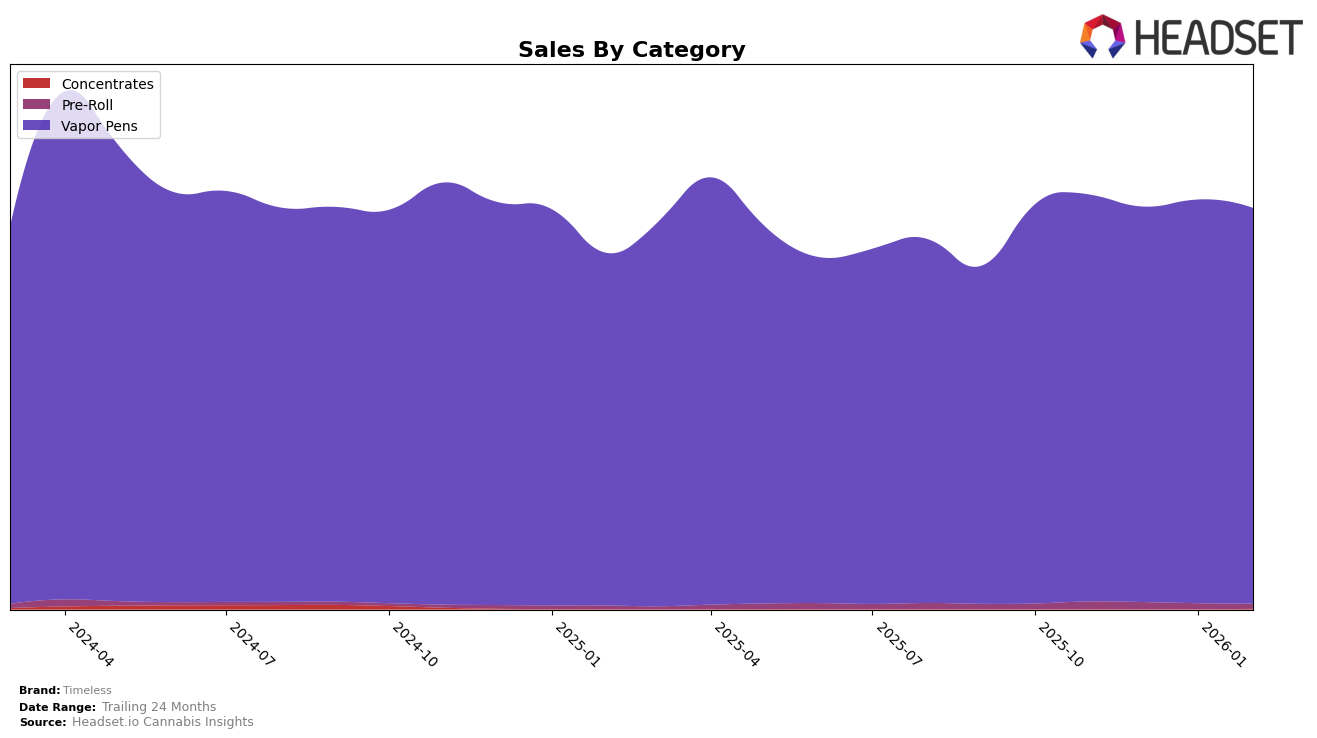

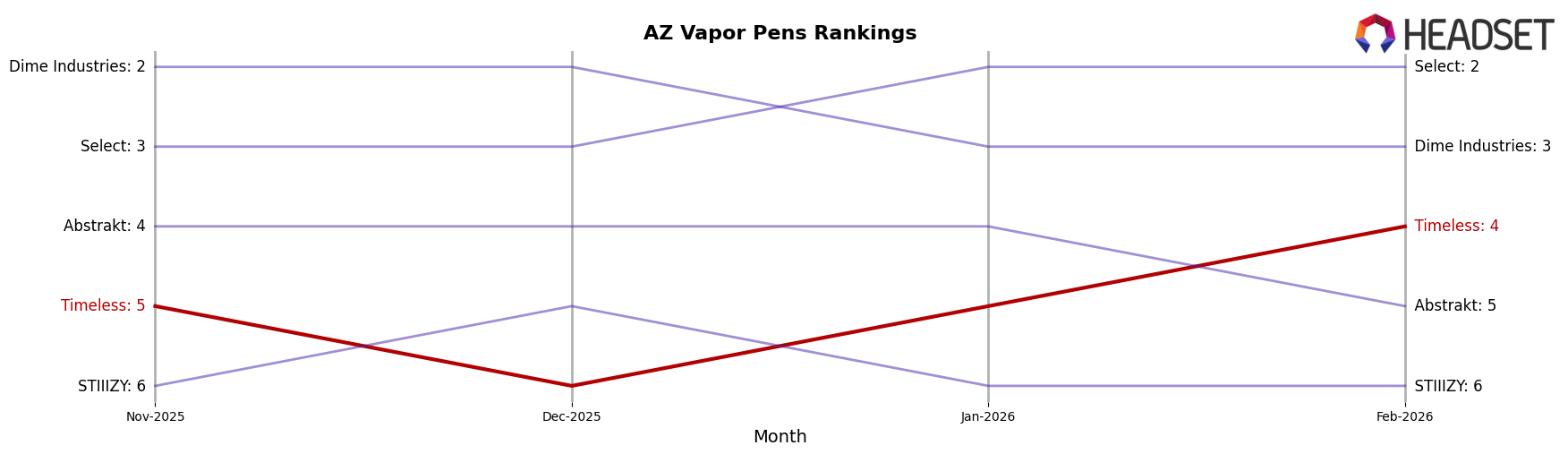

Timeless has demonstrated varied performance across different states, particularly in the category of Vapor Pens. In Arizona, the brand has shown a strong presence, consistently ranking in the top 6 over the past four months and climbing to 4th place by February 2026. This stability is reflected in their sales, which saw a notable increase from December 2025 to February 2026. Conversely, in California, Timeless has struggled to break into the top 30, with rankings stagnating in the low 40s, suggesting a more competitive or challenging market environment. The brand's performance in Missouri has seen a downward trend, with rankings slipping from 17th to 23rd over the same period, indicating potential market saturation or increased competition.

In the Midwest, Illinois presented a positive trajectory for Timeless, moving from 38th to 26th place by February 2026, which might suggest a successful marketing strategy or increased consumer preference. Meanwhile, New Jersey has been a bright spot, with the brand climbing from 20th to 11th place, reflecting a substantial improvement in market positioning. However, in New York, Timeless has not managed to secure a top 30 position, indicating a need for strategic adjustments to capture market share. In Ohio, the brand's ranking has been relatively stable, fluctuating slightly but remaining around the 15th to 18th positions, suggesting a steady but unremarkable performance in this state.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, Timeless has demonstrated a notable resilience and upward momentum in recent months. While it started with a rank of 5th in November 2025, it experienced a slight dip to 6th in December, only to rebound to 5th in January and climb to 4th by February 2026. This upward trajectory suggests a positive reception among consumers, even as competitors like Select and Dime Industries consistently held higher ranks. Notably, Select maintained a strong position, moving from 3rd to 2nd, while Dime Industries showed a slight decline from 2nd to 3rd. Meanwhile, STIIIZY and Abstrakt experienced fluctuations, with Abstrakt dropping to 5th in February. This dynamic market environment highlights Timeless's ability to improve its standing amidst strong competition, indicating potential for further growth in sales and market share.

Notable Products

In February 2026, the top-performing product for Timeless was Rest - Blackberry Kush Distillate Cartridge (1g) in the Vapor Pens category, maintaining its number one rank from December 2025. Chill - Blue Dream Distillate Cartridge (1g) remained steady in the second position, showing consistent performance over the past few months. Energy - Maui Wowie Distillate Cartridge (1g) dropped to third place from the top rank it held in January 2026. Rest - Alien Technology Distillate Cartridge (1g) held its fourth position consistently from November 2025 through February 2026. Notably, Wet Dream Distillate Disposable (2g), which ranked fifth in February 2026, had no ranking or sales data before January 2026, indicating it is a newer product in the lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.