Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

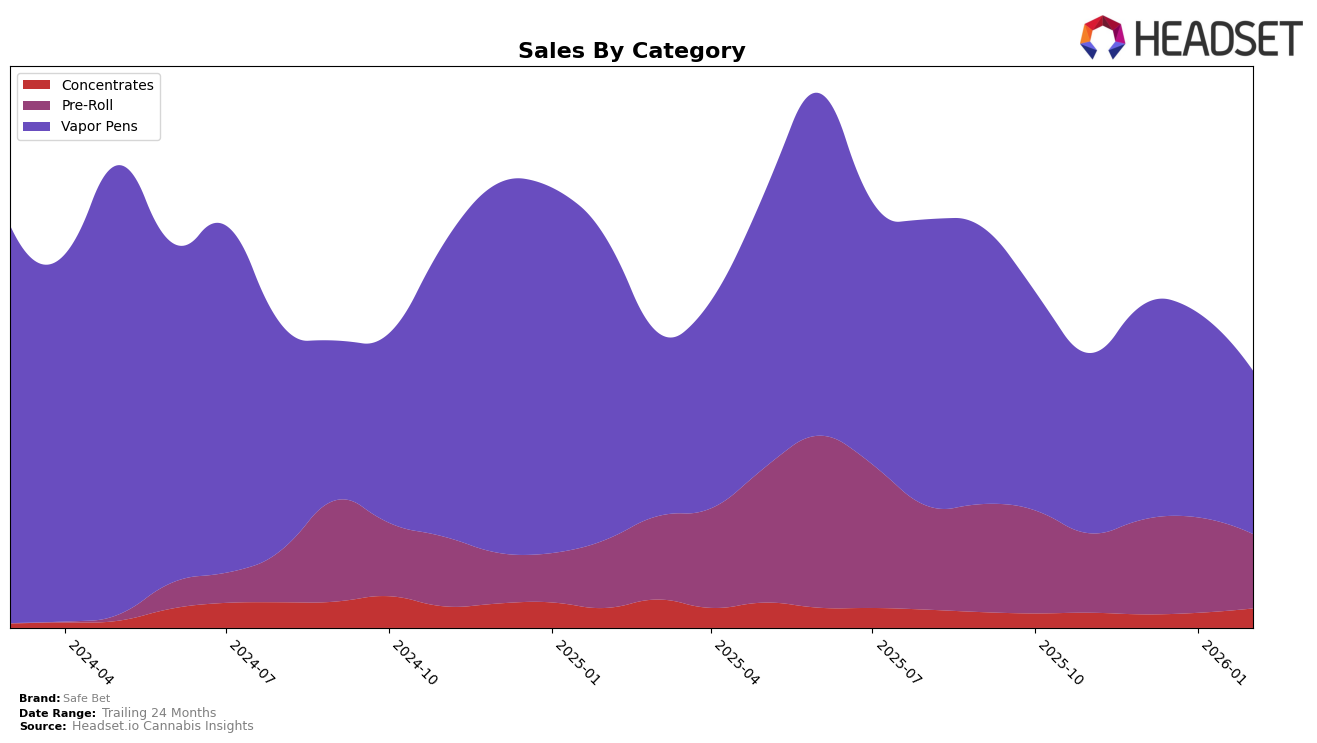

Safe Bet has shown a notable performance trajectory across different product categories in Missouri. In the Concentrates category, they have made a steady climb from a rank of 31 in November 2025 to 29 by February 2026, indicating a positive trend in consumer interest and sales. Their Pre-Roll category has maintained a consistent ranking at 24 from December 2025 through February 2026, suggesting a stable demand. However, it is the Vapor Pens category where Safe Bet has experienced some fluctuations, dropping from rank 20 in December 2025 to 22 in February 2026. Despite this slight decline, the category remains a strong performer for Safe Bet, showcasing their ability to maintain a competitive edge in a dynamic market.

When examining the sales data, Safe Bet's Concentrates have shown a significant increase in sales from January to February 2026, reflecting a growing consumer base. The Pre-Roll category, despite a consistent rank, experienced a dip in sales in February 2026, which may warrant further analysis to understand market dynamics. The Vapor Pens category, while experiencing a ranking decline, still shows a robust sales performance, indicating that Safe Bet's offerings in this category resonate well with consumers in Missouri. The absence of Safe Bet from the top 30 brands in some categories could be seen as an area for potential growth or a reflection of competitive pressures in those segments.

Competitive Landscape

In the competitive landscape of vapor pens in Missouri, Safe Bet has shown a dynamic shift in its market positioning. From November 2025 to February 2026, Safe Bet improved its rank from 24th to 22nd, indicating a positive trend in its market presence. This improvement is particularly notable when compared to Timeless, which experienced a decline from 17th to 23rd place, and Pinchy's, which dropped from 20th to 24th. Meanwhile, Flora Farms consistently maintained a competitive edge, slightly outperforming Safe Bet by securing the 21st position in February 2026. Interestingly, Clouds Vapes made a significant leap from 25th to 19th, surpassing Safe Bet in the latest rankings. Despite these competitive pressures, Safe Bet's sales trajectory shows resilience, with a notable increase in December 2025, although it faced a slight dip in February 2026. This evolving competitive environment underscores the importance for Safe Bet to strategize effectively to maintain and improve its market position.

Notable Products

In February 2026, the Green Crack Distillate Cartridge (1g) maintained its position as the top-performing product for Safe Bet, consistently holding the number one rank since November 2025 with sales of 1802 units. The Granddaddy Purple Distillate Cartridge (1g) remained steady at the second position, showing slight fluctuations over the previous months. The Bubblegum Distillate Cartridge (1g) climbed to third place, having entered the rankings in January 2026. The Blue Dream Distillate Cartridge (1g) secured the fourth position, marking its re-entry into the rankings after being absent in January. Notably, the Me Hoy Me Noy Pre-Roll (0.5g) appeared in the rankings for the first time, debuting at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.