Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

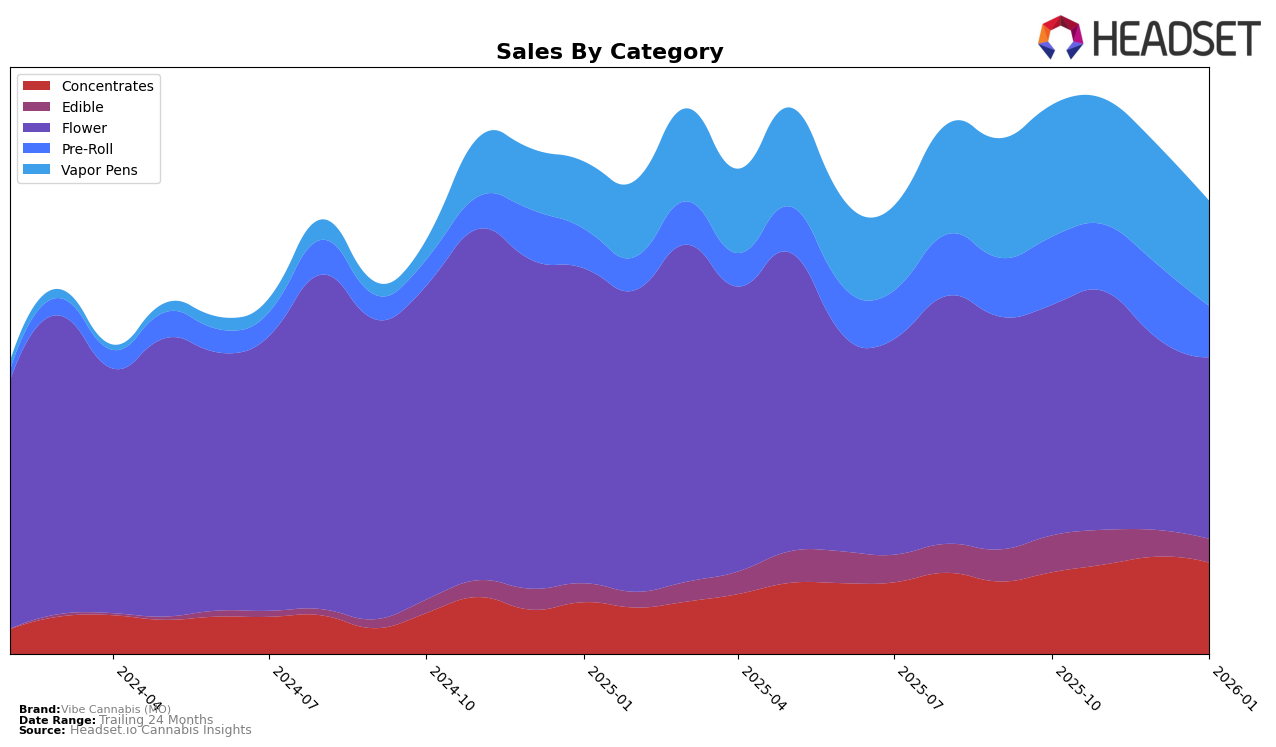

In the state of Missouri, Vibe Cannabis (MO) has shown a strong performance in the Concentrates category, consistently holding the top rank from October 2025 through January 2026. This consistent top ranking highlights their dominance and appeal in this particular product line. In contrast, the Edible category has seen a downward trend in rankings, slipping from 14th in October 2025 to 20th by January 2026. This decline in ranking suggests potential challenges in maintaining consumer interest or increasing competition in the Edible market. However, it's worth noting that despite this drop, Vibe Cannabis remains within the top 30 brands, which still signifies a significant presence in the market.

For Flower products, Vibe Cannabis (MO) experienced some fluctuations, with their rank moving from 8th to 10th between October 2025 and January 2026. This slight decline might indicate a need for strategic adjustments to regain higher positions. In the Pre-Roll category, the brand faced a more noticeable shift, dropping from 7th in November 2025 to 11th in January 2026. Such movements could reflect changing consumer preferences or increased competition. Meanwhile, Vapor Pens maintained a steady position, holding the 13th rank in both December 2025 and January 2026, suggesting a stable demand for their offerings in this category. These insights provide a glimpse into how Vibe Cannabis (MO) is navigating the competitive landscape across different product lines in Missouri.

Competitive Landscape

In the competitive landscape of the Missouri flower category, Vibe Cannabis (MO) has experienced notable fluctuations in its ranking over the past few months. Starting strong in October 2025 with a rank of 8, Vibe Cannabis (MO) improved to 7 in November, only to drop to 10 by December and maintain this position in January 2026. This decline in rank correlates with a decrease in sales from November to January, indicating potential challenges in maintaining market share. Meanwhile, Local Cannabis Co. consistently held a higher position, ranking 8 in December and January, suggesting a stable performance despite a slight sales dip. Daybreak Cannabis showed a positive trend, climbing from 12 in October to 9 by December and January, with sales increasing steadily, potentially posing a growing threat to Vibe Cannabis (MO). Additionally, Curio Wellness and Proper Cannabis have shown resilience with consistent rankings, indicating a competitive environment where Vibe Cannabis (MO) must strategize effectively to regain its upward momentum and capture more market share.

Notable Products

In January 2026, Vibe Cannabis (MO) saw Lemon Guava Haze (7g) leading the sales, securing the top rank with a notable sales figure of 2003 units. RKO (3.5g) followed as the second best-performing product, closely trailed by Green Apple Pre-Roll (1g) in third place. Rainbow Guava Budlets (7g) and Love At First Hit Bubble Hash Infused Pre-Roll (1g) claimed the fourth and fifth positions respectively. Compared to previous months, these products have newly emerged as top contenders, as their rankings were not recorded in the earlier months. The Flower category appears to dominate the top ranks, indicating a strong consumer preference for this product type in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.