Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

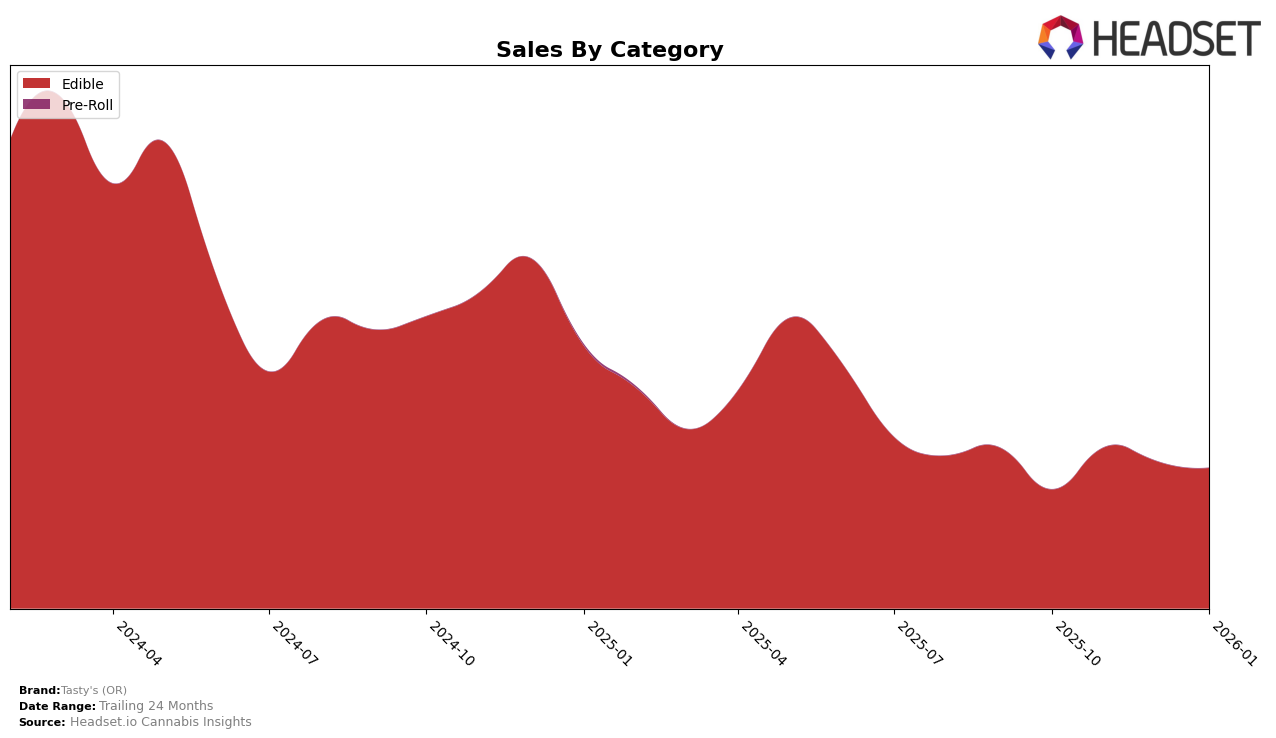

Tasty's (OR) has shown a notable performance in the Oregon market, particularly in the Edible category. Over the past few months, the brand has consistently improved its ranking, moving from 32nd in October 2025 to 26th by January 2026. This upward trend indicates a strengthening position in the competitive edible market, although it is important to note that the brand has not yet broken into the top 25. The steady increase in sales from October to November 2025 suggests that Tasty's (OR) is gaining traction among consumers, but the slight dip in December and January might indicate seasonal fluctuations or increased competition.

Despite not being in the top 30 in some months, the brand's ability to re-enter and maintain its position in the rankings is commendable. This resilience could be attributed to strategic marketing efforts or product innovation that resonates with consumers in Oregon. However, the absence of Tasty's (OR) from the top 30 in other states or provinces suggests that its influence is currently limited to Oregon. This could be viewed as a potential area for growth, as expanding its reach beyond Oregon might provide new opportunities for market penetration and increased brand visibility.

Competitive Landscape

In the competitive landscape of the Oregon edible cannabis market, Tasty's (OR) has shown a resilient performance with notable fluctuations in its ranking over the months. Starting from a rank of 32 in October 2025, Tasty's (OR) improved to 26 in November, experienced a slight dip to 28 in December, and rebounded back to 26 in January 2026. This upward trend in the latter months suggests a strengthening market presence. In comparison, Sour Bhotz consistently outperformed Tasty's (OR), maintaining a higher rank despite a decline from 19 to 25 over the same period. Fire Dept. Cannabis also remained ahead, though it showed a downward trend from 21 to 24. Meanwhile, She Don't Know and Crop Circle Co hovered around similar ranks, with Crop Circle Co not making the top 20 in any of these months. These dynamics highlight Tasty's (OR)'s potential for growth amidst a competitive field, with opportunities to capitalize on the declining trends of some competitors.

Notable Products

In January 2026, Tasty's (OR) top-performing product was Sour Peach Greenlit High Dose Gummy 10-Pack (100mg) in the Edible category, which climbed to the number one rank with impressive sales of 712 units. The Sativa Pineapple Gummy (100mg) also performed strongly, advancing to the second position with a notable increase from December. Grape Gummy (100mg), which had been the leader in November and December, slipped to third place in January. Sour Apple Greenlight Gummy (100mg) maintained a consistent presence, ranking fourth, while THC/CBG 1:1 Green Apple Gummy (100mg CBD, 100mg CBG) rounded out the top five. This shift in rankings highlights a dynamic change in consumer preferences, with Sour Peach Greenlit Gummy making a significant leap from its fifth position in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.