Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

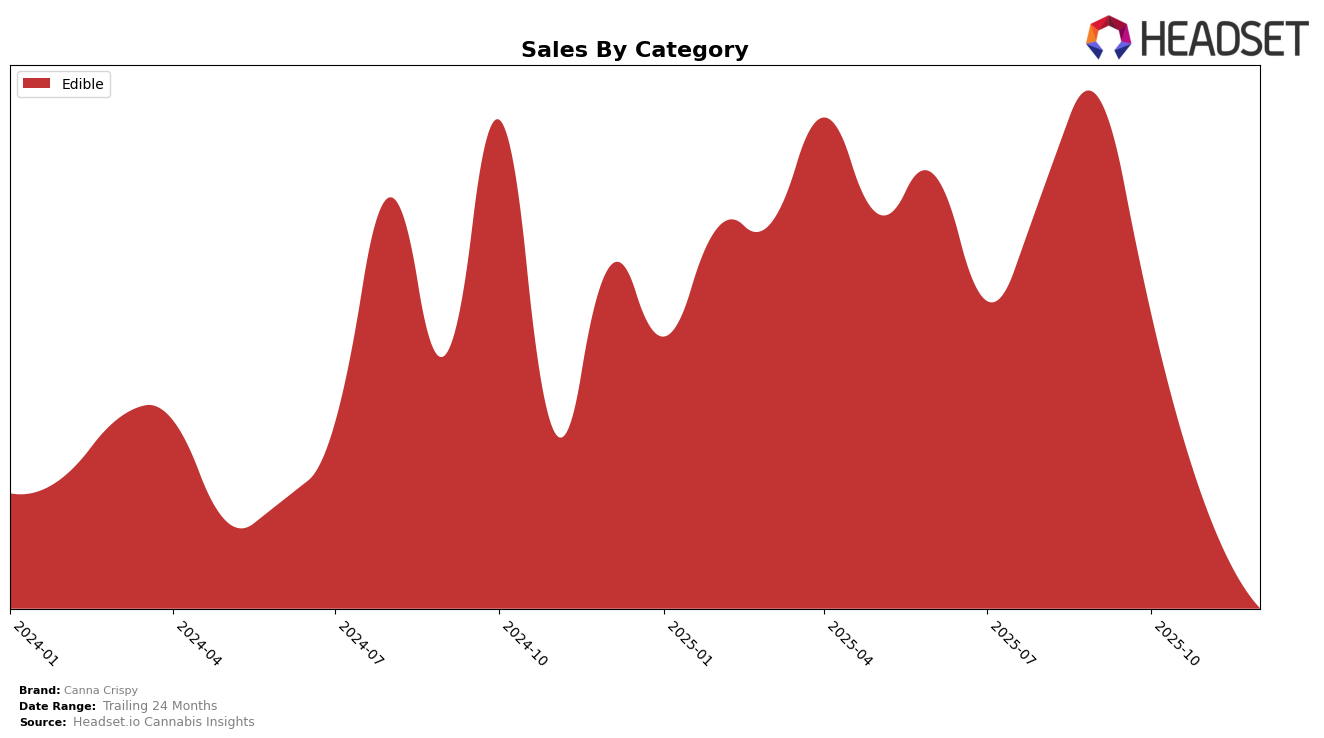

Canna Crispy has experienced a notable decline in its performance within the Edible category across the state of Oregon. In September 2025, Canna Crispy was ranked 22nd, but by December 2025, it had dropped to the 29th position. This downward trend indicates a consistent loss of market share over the months. The sales figures reflect this decline, with sales in December 2025 being significantly lower than in September 2025. This could suggest increased competition in the Edible category or a shift in consumer preferences that the brand has not been able to capitalize on.

Interestingly, Canna Crispy did not appear in the top 30 rankings for any other states or categories during this period. This absence from other markets highlights a potential area for growth or a need to reassess their market strategies outside of Oregon. The brand's focus on a single state may be limiting its overall market potential, especially if similar declines are occurring in other markets where they are present but not ranked. Exploring opportunities to expand into additional states or diversify their product offerings could be beneficial for future performance.

Competitive Landscape

In the competitive landscape of the Edible category in Oregon, Canna Crispy has experienced a noticeable decline in both rank and sales from September to December 2025. Initially ranked at 22nd in September, Canna Crispy's position fell to 29th by December, indicating a significant drop in market presence. This decline is mirrored in sales, which decreased steadily over the same period. In contrast, Crop Circle Co demonstrated resilience, recovering from a dip in November to regain its 27th position by December, with sales rebounding to levels comparable to October. Meanwhile, Concrete Jungle showed a slight improvement in rank, moving from 30th to 28th, although sales fluctuated. Tasty's (OR) also experienced volatility, with rank and sales both peaking in November before dropping again in December. The shifting dynamics among these competitors highlight the challenges Canna Crispy faces in maintaining its market share amidst fluctuating consumer preferences and competitive pressures.

Notable Products

In December 2025, the top-performing product for Canna Crispy was the Sativa Fruity Crispy Treat (100mg), maintaining its first-place ranking from previous months despite a sales figure of 880 units. The Indica Peanut Butter Chocolate Crispy Treats (100mg) remained consistently in second place, showing stable performance throughout the months. The Hybrid Original Crispy Treat (100mg) climbed to third place after not being ranked in November, showing a notable recovery. The new entrant, Hybrid Peanut Butter Chocolate Crispy Treats (100mg), debuted in fourth place, indicating a strong market entry. Lastly, the Hybrid Cookies and Cream Crispy Treats (100mg) held onto the fifth position, consistent with its previous appearance in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.