Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

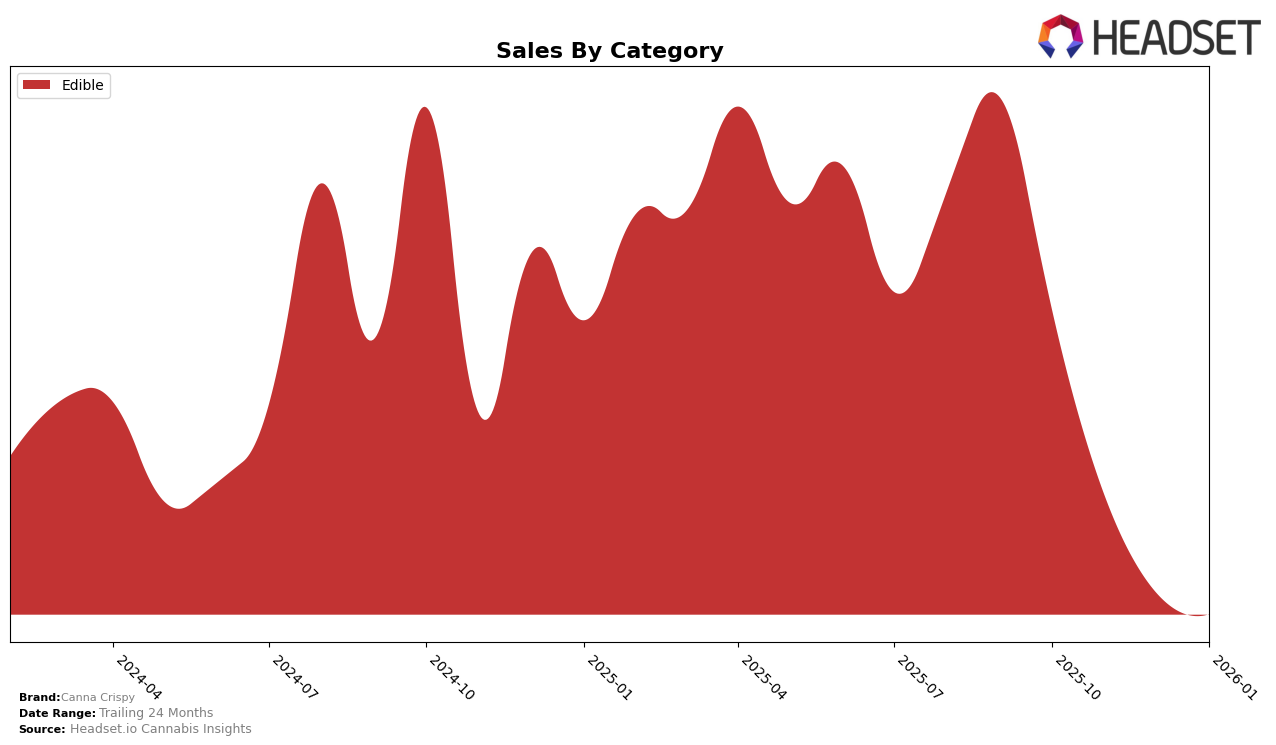

Canna Crispy's performance in the Edible category within Oregon shows a steady presence, albeit with a slight decline in rankings over the observed months. Starting at the 24th position in October 2025, the brand slipped to the 29th spot by January 2026. This downward trend indicates a need for strategic adjustments to regain a stronger foothold in the market. The brand's sales figures also reflect this trend, with a consistent decrease from October to January, hinting at potential challenges in maintaining consumer interest or facing increased competition.

Interestingly, Canna Crispy's presence across other states or provinces is not reflected in the top 30 rankings, suggesting either a focused regional strategy or a struggle to penetrate other markets effectively. This limitation could be seen as a missed opportunity for growth and diversification. The absence from top rankings outside of Oregon highlights the importance of expanding market reach and exploring new territories to bolster overall brand performance. Understanding the dynamics in other states and adapting to local consumer preferences might be crucial for Canna Crispy's future success.

Competitive Landscape

In the competitive landscape of the Oregon edible market, Canna Crispy has experienced notable fluctuations in rank and sales over the past few months. Starting from October 2025, Canna Crispy held the 24th position, but by January 2026, it had slipped to 29th. This decline in rank coincides with a downward trend in sales, from a peak in October to a lower point in January. In contrast, beaucoup showed a strong performance, maintaining a higher rank than Canna Crispy throughout the period, despite a dip in January. Meanwhile, She Don't Know consistently outperformed Canna Crispy, holding a steady rank around the mid-20s, suggesting a more stable market presence. Crop Circle Co and Concrete Jungle also displayed competitive dynamics, with Crop Circle Co recovering its rank by January after a dip in November. These insights highlight the competitive pressures Canna Crispy faces, emphasizing the need for strategic adjustments to regain its market position.

Notable Products

In January 2026, the top-performing product for Canna Crispy was Sativa Fruity Crispy Treat (100mg), maintaining its number one rank with a notable sales figure of 1374 units, up from 944 units in December 2025. Indica Peanut Butter Chocolate Crispy Treats (100mg) held steady at the second position, although its sales decreased slightly to 693 units from 719 in December. Indica Chocolate Crispy Treat (100mg) re-entered the rankings at third place with 254 units sold, while Hybrid Original Crispy Treat (100mg) slipped to fourth place from its previous third-place position. A new entry, Hybrid Strawberry Crispy Treats (100mg), debuted at fifth place with 217 units sold, indicating a growing interest in this flavor. Overall, Sativa Fruity Crispy Treat's continued dominance highlights its popularity among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.