Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

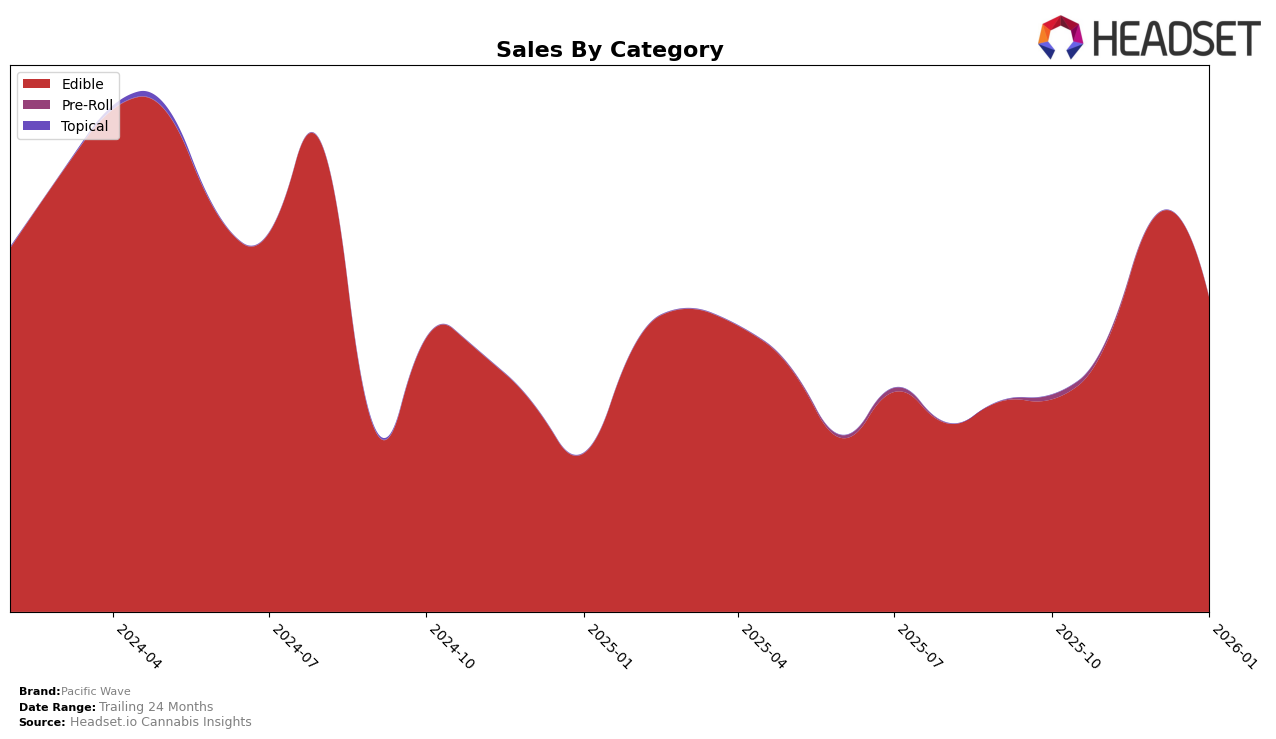

Pacific Wave has demonstrated a notable upward trajectory in the Edible category within the state of Oregon. In October 2025, the brand was ranked 28th, but by December 2025, it had climbed to 22nd place, maintaining this position into January 2026. This consistent improvement suggests a strengthening presence in the market, possibly driven by strategic product offerings or effective consumer engagement. The brand's sales figures reflect this positive trend, with a significant increase from October to December, before experiencing a slight dip in January. This performance indicates that while Pacific Wave is gaining traction, the market remains competitive, requiring sustained efforts to maintain and improve their ranking.

Interestingly, Pacific Wave's absence from the top 30 brands in any other states or categories highlights a potential area for growth and expansion. While their progress in Oregon's Edible category is commendable, the lack of representation in other markets suggests untapped opportunities. This could be seen as a challenge or a strategic focus, depending on the brand's long-term goals. For Pacific Wave, exploring new markets or expanding their product categories might be essential steps to capture a larger share of the cannabis industry. The brand's current trajectory in Oregon could serve as a model for replication in other regions, where similar market dynamics might offer fertile ground for growth.

Competitive Landscape

In the competitive landscape of the Oregon edibles market, Pacific Wave has demonstrated a notable upward trajectory in brand ranking from October 2025 to January 2026. Starting at rank 28 in October, Pacific Wave climbed to rank 22 by December and maintained this position into January 2026. This improvement is significant when compared to competitors like Mr. Moxey's, which saw a decline from rank 17 to 20 over the same period, and Fire Dept. Cannabis, which experienced a downward trend from rank 21 to 24. Additionally, Crown B Alchemy showed fluctuating ranks, ending slightly ahead of Pacific Wave at rank 21 in January. Meanwhile, Chompd Edibles remained relatively stable, with a slight improvement from rank 26 to 23. Pacific Wave's consistent rank improvement is indicative of a positive sales trajectory, contrasting with the more volatile or declining trends observed in some of its competitors.

Notable Products

In January 2026, Pacific Wave's top-performing product was Strawberry Giggly Gummy (50mg) in the Edible category, maintaining its number one rank from December 2025 with sales of 669 units. Blue Raspberry Galactic Gummies 10-Pack (100mg) climbed to the second position, showing a notable increase from its third-place rank in November 2025. Caramel Apple Taffy 10-Pack (100mg) also secured the second rank, improving from fourth in December 2025. Pineapple Giggly Gummies 10-Pack (10mg) entered the rankings in January 2026, debuting in the second position. Sour Watermelon Giggly Gummies 10-Pack (100mg) appeared in the third spot, marking its first appearance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.