Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

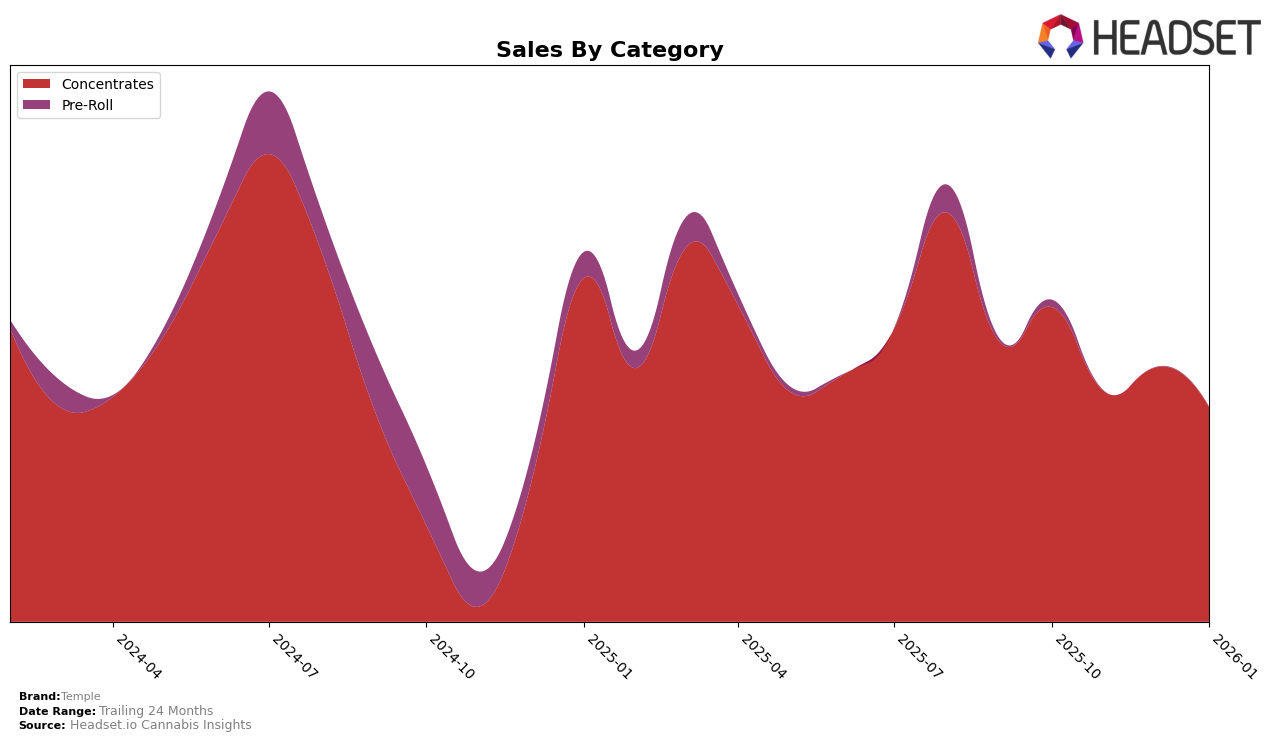

Temple's performance in the Concentrates category in Maryland shows a gradual decline in rank over the last few months. Starting from 20th place in October 2025, the brand slipped to 22nd in November, and further down to 24th by December, maintaining the same position in January 2026. This consistent drop in ranking, despite a slight rebound in sales during December, indicates potential challenges in maintaining market competitiveness. The absence of Temple in the top 30 brands beyond January suggests that they may need to reassess their strategies to regain a stronger foothold in the Maryland market.

The sales trend for Temple in Maryland's Concentrates category also reflects a fluctuating pattern. October 2025 saw relatively higher sales, which then decreased significantly in November. Although there was a recovery in December, sales again dipped in January 2026. This volatility could be attributed to various factors such as market dynamics or consumer preferences. The brand's ability to sustain its position within the top 30 despite these fluctuations indicates some level of resilience, but the downward trend in rank should be a point of concern for future performance.

Competitive Landscape

In the Maryland concentrates market, Temple has shown a consistent presence, maintaining its rank between 20th and 24th from October 2025 to January 2026. Despite a slight decline in sales from November to January, Temple's rank remained stable, indicating a resilient market position amidst fluctuating sales figures. Notably, Phas3 demonstrated a strong upward trajectory, climbing from 28th in October to 20th by January, surpassing Temple in both rank and sales by the end of the period. Meanwhile, Kings & Queens also improved its rank, moving from 24th to 22nd, with a notable sales increase in December. Avexia, despite a drop in sales, maintained a rank close to Temple, suggesting a competitive landscape where small shifts in sales can impact rankings. These dynamics highlight the importance for Temple to strategize effectively to enhance its market share and potentially regain a higher ranking in the coming months.

Notable Products

In January 2026, the top-performing product for Temple was Jacks Juice Nepalese Hash Ball 1g in the Concentrates category, which climbed to the number one rank with sales of 245 units. Papa Don Temple Ball Hash 1g, previously holding the top spot in December 2025, fell to second place. Smiley Face Temple Hash Ball 1g maintained its position at rank three, showing consistent performance since its introduction. Jacks Juice Temple Ball Hash 1g debuted at fourth place, while Mango Mindset Temple Ball Hash 1g followed closely in fifth. The rankings reflect a dynamic shift in product popularity, with Jacks Juice Nepalese Hash Ball 1g making a significant leap from second to first place since December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.