Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

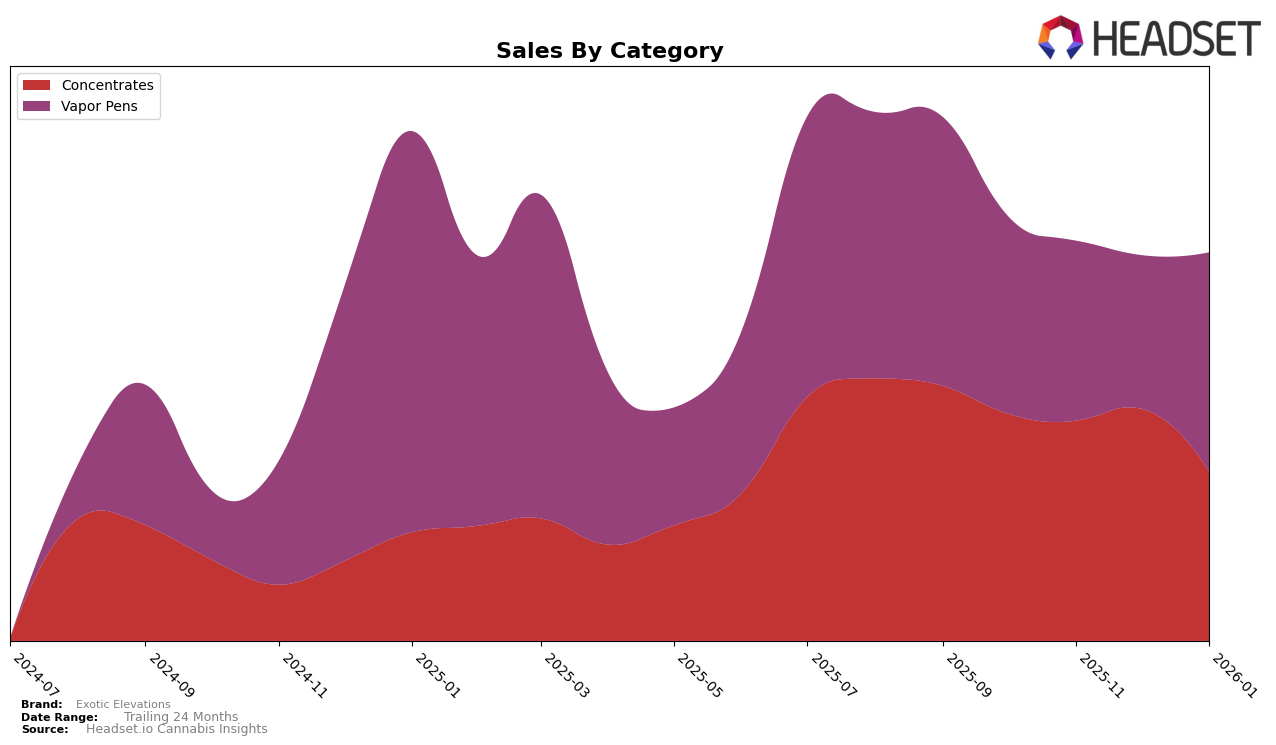

Exotic Elevations has shown varied performance across different product categories and states. In the Maryland market, the brand's performance in the Concentrates category has been relatively stable, with a slight improvement in rank from 16th in October 2025 to 13th in December 2025. However, January 2026 saw a drop to 17th, indicating some fluctuations in market dynamics or consumer preferences. This movement suggests that while Exotic Elevations is a recognized player, there may be competitive pressures or shifts in consumer demand affecting their standing.

In the Vapor Pens category within Maryland, Exotic Elevations did not consistently rank within the top 30, as evidenced by their absence from the top 30 in October 2025 and December 2025. This inconsistency highlights potential challenges in maintaining a strong presence in this category. However, the brand did see a resurgence in January 2026, moving up to 32nd place, which could indicate strategic adjustments or product innovations that resonated with consumers. This dynamic landscape suggests that while Exotic Elevations faces challenges, there are opportunities for growth and repositioning in the Vapor Pens category.

Competitive Landscape

In the Maryland vapor pens category, Exotic Elevations has experienced notable fluctuations in its competitive positioning over recent months. Despite a dip in December 2025, where it fell out of the top 35, the brand rebounded in January 2026 to rank 32nd, indicating a positive recovery trajectory. This improvement is crucial as it competes with brands like Beboe, which consistently improved its rank from 39th in October 2025 to 31st by January 2026, and Flower by Edie Parker, which saw a decline but maintained a higher rank than Exotic Elevations. Meanwhile, Nature's Heritage experienced a downward trend, dropping to 36th, which could present an opportunity for Exotic Elevations to surpass it if current trends continue. However, Cheetah remains a strong competitor, despite a significant drop in January 2026, maintaining a higher sales volume than Exotic Elevations. These dynamics suggest that while Exotic Elevations is on an upward trend, strategic efforts are necessary to capitalize on the weaknesses of competitors and enhance its market position.

Notable Products

In January 2026, Exotic Elevations saw Forbidden Gumdrop Live Liquid Diamonds Cartridge (1g) take the lead as the top-performing product, achieving the number one rank with sales of 346 units. Following closely, Purple Strawpaya Live Liquid Diamonds Cartridge (1g) secured the second position, while Peach Puddintain Live Liquid Diamonds Cartridge (0.5g) moved down from second place in December 2025 to third. Chemi-Cola Live Liquid Diamonds Cartridge (0.5g) debuted at rank four, and Banana Gushers Live Liquid Diamonds Cartridge (0.5g) completed the top five. Notably, Peach Puddintain's shift from second to third indicates a slight decline in its sales momentum compared to the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.