Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

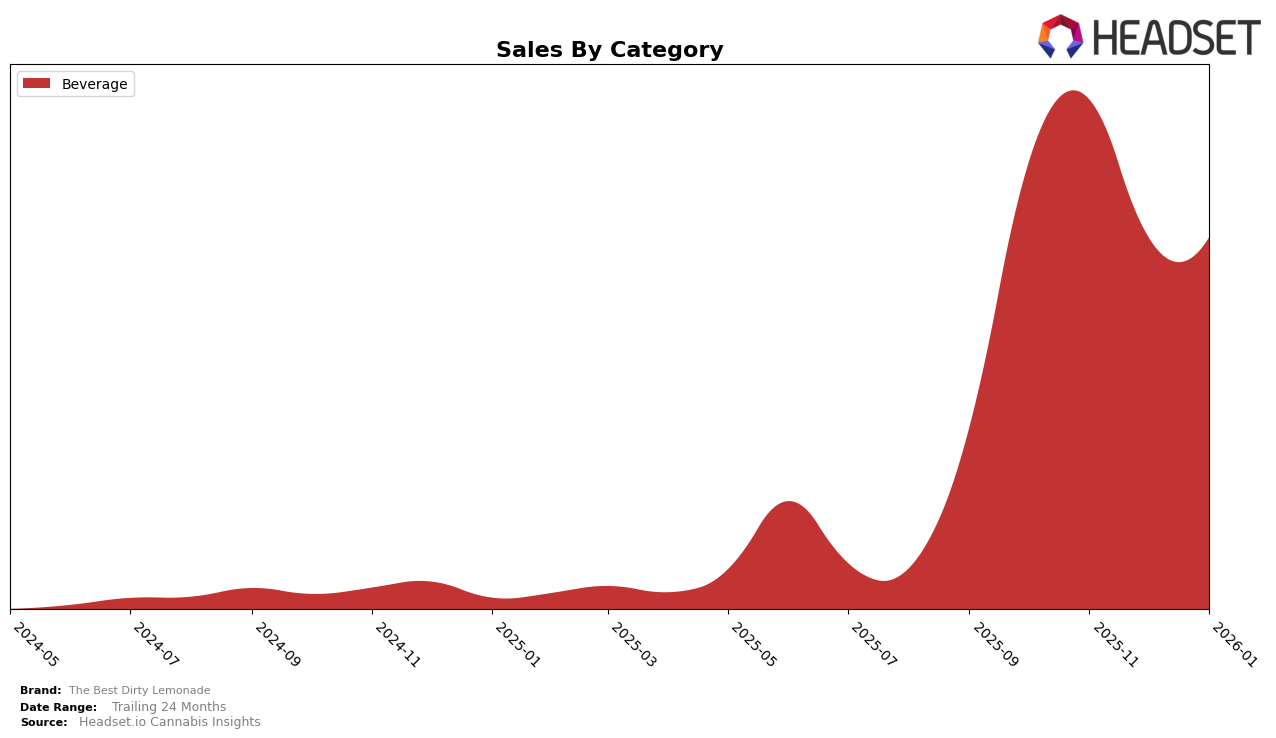

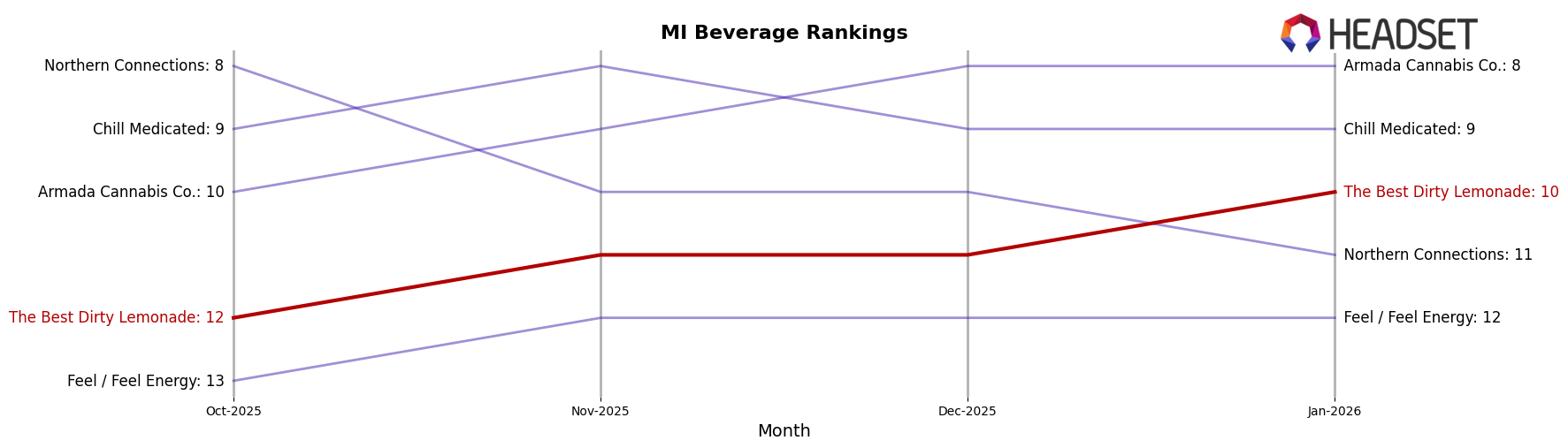

The Best Dirty Lemonade has shown varied performance across different states and categories, with notable movements in the beverage category. In Massachusetts, the brand appeared in the rankings during October 2025, securing the 16th position, but did not maintain a spot in the top 30 in the subsequent months. This indicates a potential decline in popularity or increased competition within the state. On the other hand, in Michigan, The Best Dirty Lemonade demonstrated a consistent presence in the rankings, improving slightly from 12th in October 2025 to 10th by January 2026. This upward trend in Michigan suggests a positive reception and potentially growing market share in the region.

Focusing on sales trends, Michigan has been a stronghold for The Best Dirty Lemonade, with sales peaking in November 2025 at 44,718 units before stabilizing in the following months. This indicates a robust demand and effective market penetration strategies in the state. In contrast, the absence of ranking data for Massachusetts beyond October 2025 suggests challenges in maintaining a competitive edge or consumer interest. This disparity between the two states highlights the importance of understanding regional market dynamics and consumer preferences to sustain brand growth. Such insights are crucial for strategic decision-making and optimizing marketing efforts across different territories.

Competitive Landscape

In the competitive landscape of the beverage category in Michigan, The Best Dirty Lemonade has shown a promising upward trend in rank over the past few months. Starting from the 12th position in October 2025, it climbed to the 10th position by January 2026, indicating a positive trajectory in market presence. This improvement in rank is notable when compared to competitors such as Northern Connections, which experienced a decline from 8th to 11th place during the same period. Meanwhile, Chill Medicated and Armada Cannabis Co. maintained relatively stable positions, with Chill Medicated consistently holding the 9th spot and Armada Cannabis Co. moving up from 10th to 8th. Despite having lower sales figures compared to these competitors, The Best Dirty Lemonade's ability to improve its rank suggests effective marketing strategies or growing consumer preference, setting it apart in a competitive market. This upward movement could be an indicator of potential growth in sales if the trend continues.

Notable Products

In January 2026, Blue Raspberry Lemonade (50mg THC, 12oz, 355ml) maintained its top position as the leading product for The Best Dirty Lemonade, with sales reaching 2547 units. Classic - Original Lemonade (50mg THC, 12oz, 355ml) climbed back to the second spot after slipping to third in the previous two months, showing a notable recovery in sales. Strawberry Lemonade (50mg THC, 12oz, 355ml) dropped to third place, continuing its downward trend from previous months. Strawberry Lemonade (5mg THC, 12oz, 355ml) remained consistently in fourth place, with a further decline in sales. Blue Raspberry Lemonade (5mg THC, 12oz, 355ml) held steady in fifth place, indicating stable but low sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.