Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

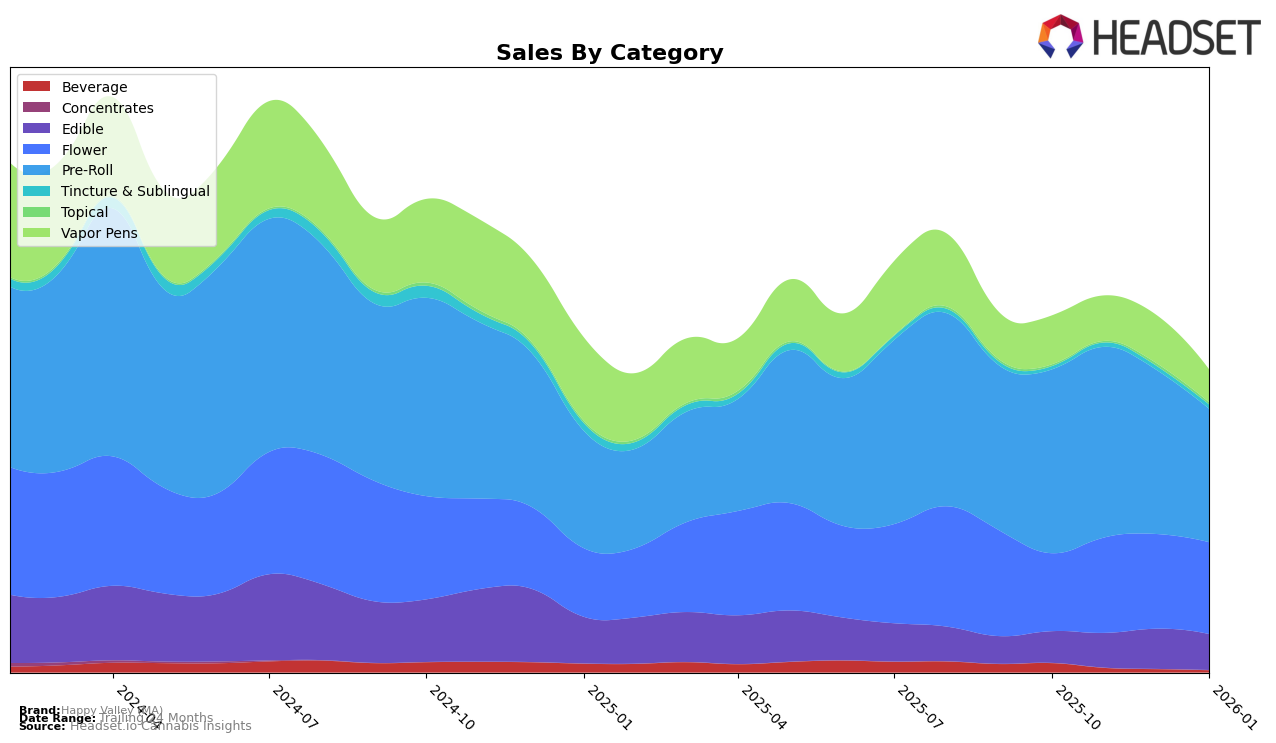

Happy Valley (MA) has demonstrated varying performance across different product categories in Massachusetts. In the beverage category, the brand made a notable appearance in October 2025 with a rank of 14, but it did not maintain a top 30 position in the subsequent months, indicating a potential shift in consumer preferences or competitive pressures. In contrast, the edible category shows a more stable trajectory, with Happy Valley (MA) consistently ranking between 21 and 23 from October 2025 to January 2026. This consistency in edibles suggests a steady consumer base and possibly successful product offerings in this category.

The flower and pre-roll categories present an interesting dynamic for Happy Valley (MA). While the brand did not break into the top 30 in the flower category, with rankings hovering around the low 40s, there was a positive movement from October to January, indicating a gradual improvement. On the other hand, the pre-roll category has been a strong performer, with Happy Valley (MA) achieving a high rank of 7 in October 2025, although it experienced a decline to 11 by January 2026. This drop in pre-roll rankings might be an area to watch, as it could suggest increased competition or changes in consumer demand. Meanwhile, in the vapor pens category, the brand has seen a downward trend in rankings, dropping from 37 in October to 44 in January, which might raise concerns about its competitive positioning in this segment.

Competitive Landscape

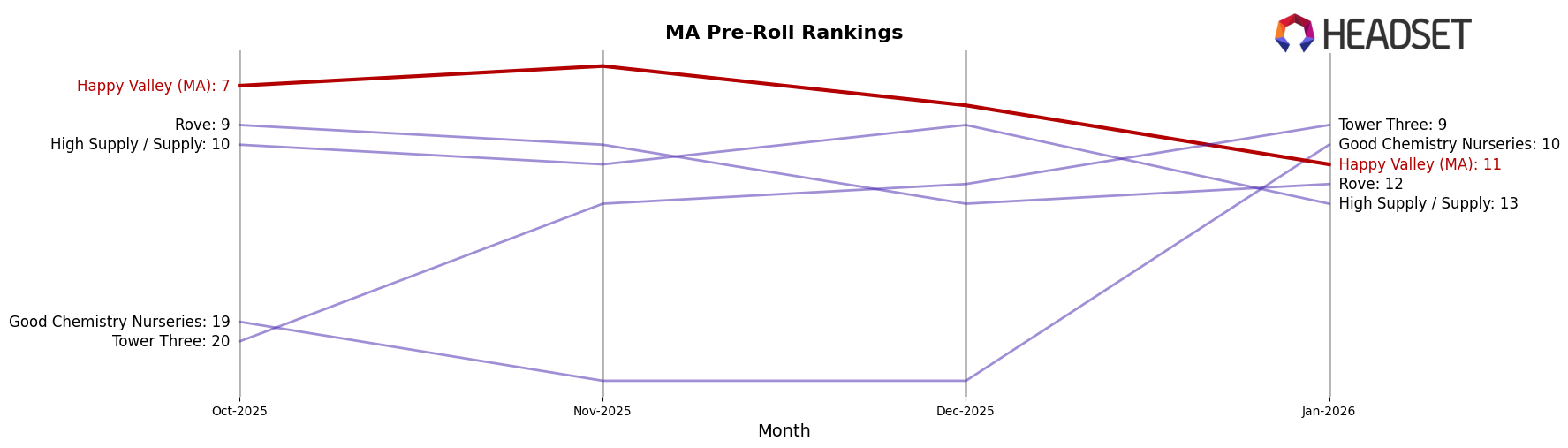

In the competitive landscape of the Pre-Roll category in Massachusetts, Happy Valley (MA) has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 7th in October 2025, Happy Valley (MA) climbed to 6th place in November, indicating a strong market presence. However, by December, it slipped to 8th and further to 11th in January 2026. This decline in rank suggests increasing competition from brands like Rove and High Supply / Supply, which maintained relatively stable positions. Notably, Tower Three showed a significant upward trend, moving from 20th to 9th position, potentially drawing market share away from Happy Valley (MA). Meanwhile, Good Chemistry Nurseries made a remarkable leap from 19th to 10th place in January 2026, further intensifying the competitive pressure. These shifts highlight the dynamic nature of the market and underscore the need for Happy Valley (MA) to strategize effectively to regain its competitive edge.

Notable Products

In January 2026, Happy Valley (MA) saw Super Lemon Haze Pre-Roll (1g) maintain its top position as the leading product, continuing its streak from previous months despite a drop in sales to 4608. Banana Jealousy Pre-Roll (1g) climbed back to the second spot after slipping to fifth in December, showing a resurgence in popularity. Super Lemon Haze (3.5g) consistently held the third rank, indicating steady demand in the Flower category. White Wedding Pre-Roll (1g) emerged in the rankings, securing the fourth position after being absent in December. New to the list, Dirty Taxi Pre-Roll (1g) entered at fifth place, suggesting a positive reception from consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.