Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

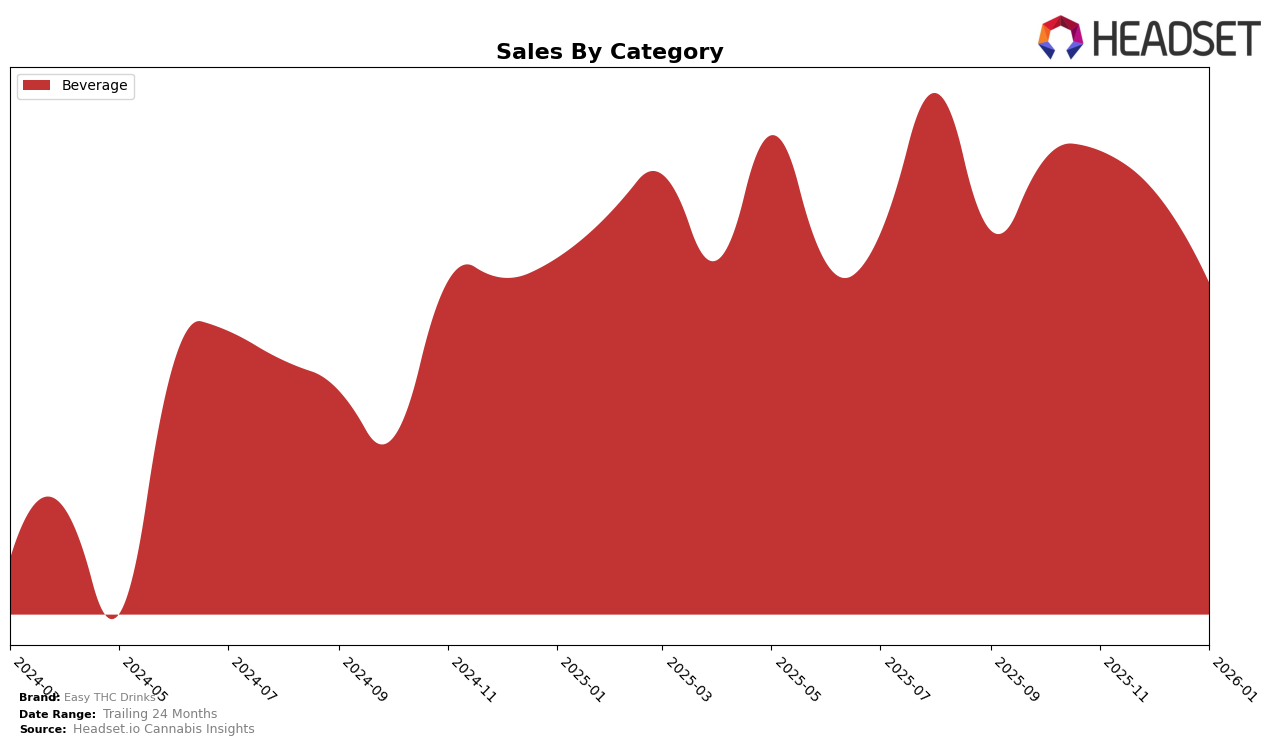

Easy THC Drinks has shown a consistent performance in the beverage category within Massachusetts, maintaining a steady ranking of 14th place from November 2025 through January 2026. This stability in ranking is noteworthy, especially considering the competitive nature of the cannabis beverage market. However, despite holding its position, the brand experienced a decline in sales from November to January, with January sales figures dipping to a notable low of 13,488. This suggests that while Easy THC Drinks has managed to sustain its rank, it faces challenges in boosting sales volume, which could be attributed to seasonal trends or increased competition.

In examining the broader market, Easy THC Drinks' absence from the top 30 brands in other states indicates a potential area for growth and expansion. This lack of presence in other markets could be seen as a missed opportunity to capitalize on emerging trends in cannabis beverages. The brand's focus on maintaining its stronghold in Massachusetts might be a strategic decision, but it leaves room for speculation on how it could perform if it ventured into other states with burgeoning cannabis markets. Observing how the brand adjusts its strategy to either consolidate its position in Massachusetts or expand into new territories will be crucial in understanding its future trajectory in the cannabis beverage landscape.

Competitive Landscape

In the competitive Massachusetts beverage market, Easy THC Drinks has shown resilience despite facing stiff competition. Over the four-month period from October 2025 to January 2026, Easy THC Drinks maintained a steady rank of 14, indicating consistent performance amidst fluctuating sales figures. Notably, Nectar experienced a decline in rank from 7 to 12, suggesting a potential opportunity for Easy THC Drinks to capture market share if this trend continues. Meanwhile, Drink Loud consistently held the 13th position, slightly ahead of Easy THC Drinks, but with a noticeable drop in sales from November to January, which could indicate a vulnerability. Happy Valley (MA) and The Best Dirty Lemonade did not appear in the rankings after October, suggesting they fell out of the top 20, which may present further opportunities for Easy THC Drinks to improve its market position. Overall, while Easy THC Drinks has maintained its rank, the shifting dynamics among competitors highlight potential areas for strategic growth and increased market penetration.

Notable Products

In January 2026, Easy THC Drinks' top-performing product was Lime Bubbly Water (5mg THC, 12oz), maintaining its number one rank consistently since October 2025, with sales reaching 1233 units. Grapefruit Bubbly Water (5mg THC, 12oz) climbed to the second position, having fluctuated between second and third place in the preceding months. Lemon Bubbly Water (5mg THC, 12oz) secured the third spot, showing a slight decline from its previous second-place ranking in December 2025. The consistent top ranking of Lime Bubbly Water highlights its sustained popularity despite a gradual decrease in sales figures over the months. Meanwhile, the competition between Grapefruit and Lemon Bubbly Water suggests a close race in customer preference within the Beverage category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.