Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

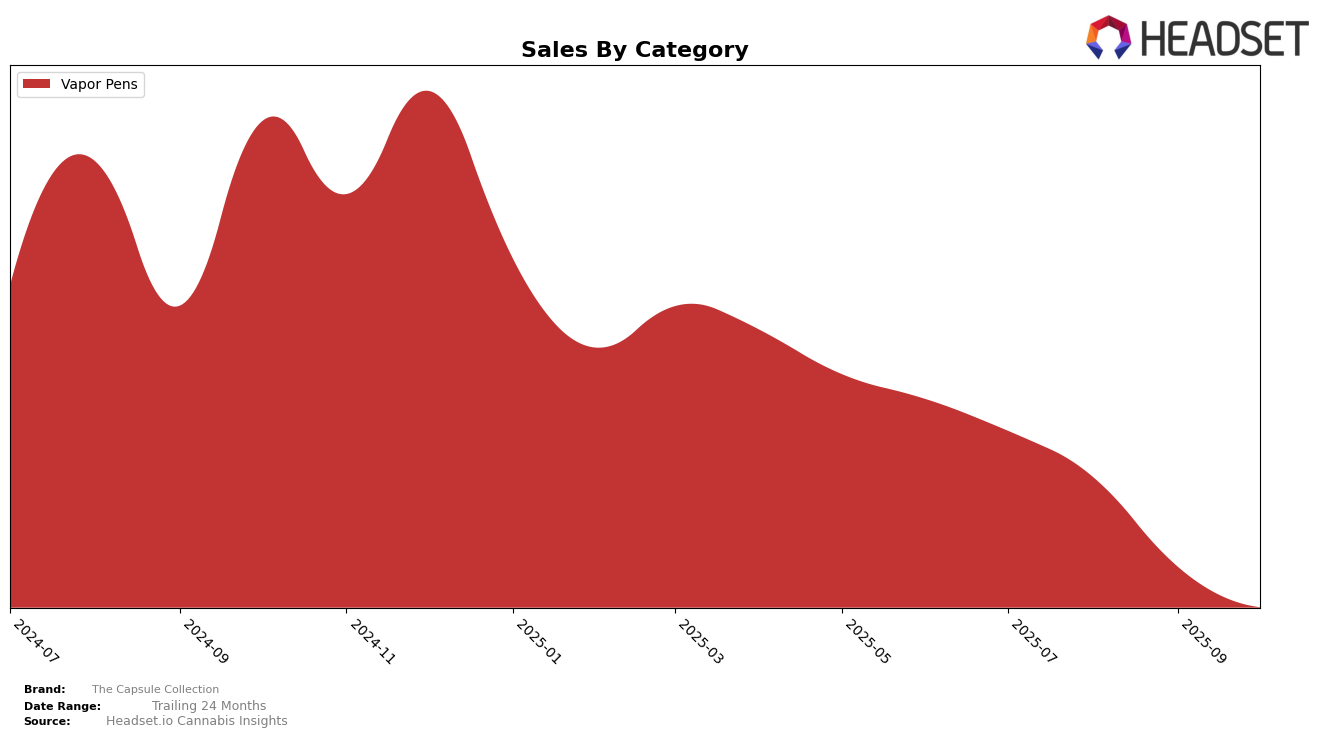

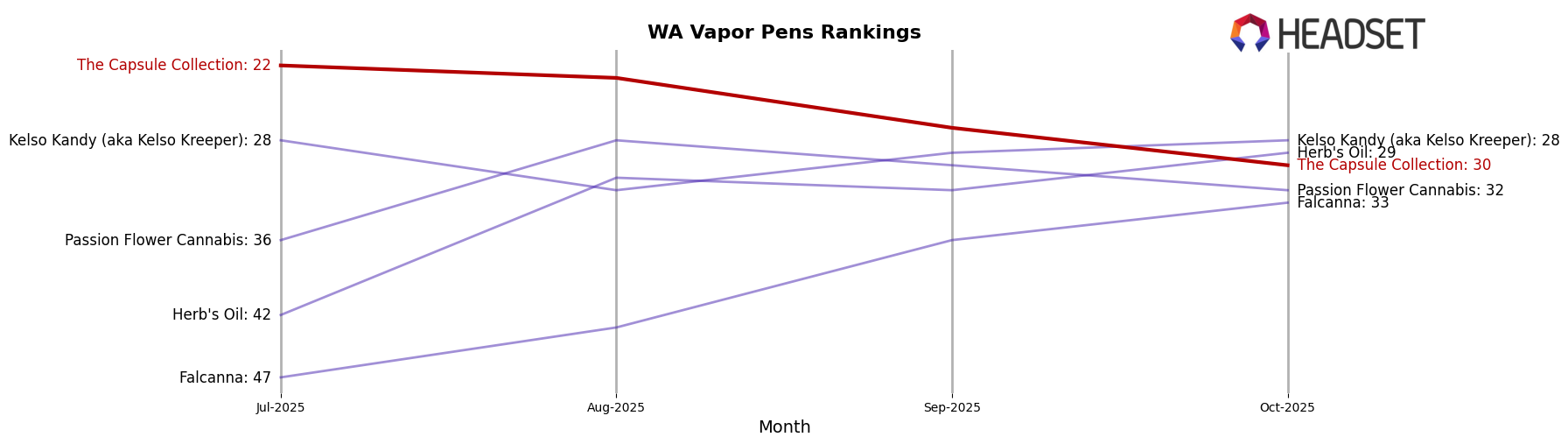

The Capsule Collection's performance in the Vapor Pens category in Washington has shown a gradual decline over the past few months. Starting in July 2025, the brand was ranked 22nd, but by October 2025, it had slipped to the 30th position. This downward trend coincides with a consistent decrease in sales figures, highlighting potential challenges in maintaining market share amidst increasing competition or shifting consumer preferences. The drop in ranking to the edge of the top 30 suggests that if the current trend continues, The Capsule Collection might soon find itself outside the top-performing brands in this category and state.

While specific details on other states and categories are not provided, the data from Washington could indicate broader trends affecting The Capsule Collection. The brand's presence in the top 30 for four consecutive months, despite declining sales, might still reflect a certain level of brand loyalty or recognition. However, the absence of ranking information for other states or categories could imply that the brand has not achieved a significant position elsewhere, which may be a point of concern or an opportunity for strategic growth. This situation presents a critical juncture for The Capsule Collection to reassess its market strategies to bolster its standing and possibly expand its reach beyond the current market.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, The Capsule Collection has experienced a notable decline in its market position from July to October 2025. Initially ranked 22nd in July, it fell to 30th by October, indicating a downward trend in its competitive standing. This decline in rank correlates with a decrease in sales over the same period, suggesting potential challenges in maintaining consumer interest or market share. In contrast, competitors like Falcanna and Herb's Oil have shown upward momentum, with Falcanna improving its rank from 47th to 33rd and Herb's Oil climbing from 42nd to 29th. These competitors have not only increased their sales but also improved their market positions, which could be drawing customers away from The Capsule Collection. The data suggests that The Capsule Collection may need to reassess its strategies to regain its competitive edge in this dynamic market.

Notable Products

In October 2025, The Capsule Collection's top-performing product was The Happy Pill - Mixed Berriez Distillate Disposable (1g), which climbed to first place in the Vapor Pens category, maintaining its strong position from previous months. The Happy Pill - Pineapple Maui Wowie Distillate Disposable (1g) made a notable entry into the rankings at second place with sales of 1062 units, despite not being ranked in August and September. Consistently holding third place, The Happy Pill - Watermelon OG Distillate Disposable (1g) showed a slight decline in sales figures. The Happy Pill- Blueberry Dream Flavored Distillate Disposable (1g) and The Happy Pill - The Dew Distillate Disposable (1g) maintained their positions at fourth and fifth, respectively, although both experienced a gradual decrease in sales over the months. This analysis highlights the stable dominance of The Happy Pill series in the Vapor Pens category for The Capsule Collection.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.