Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

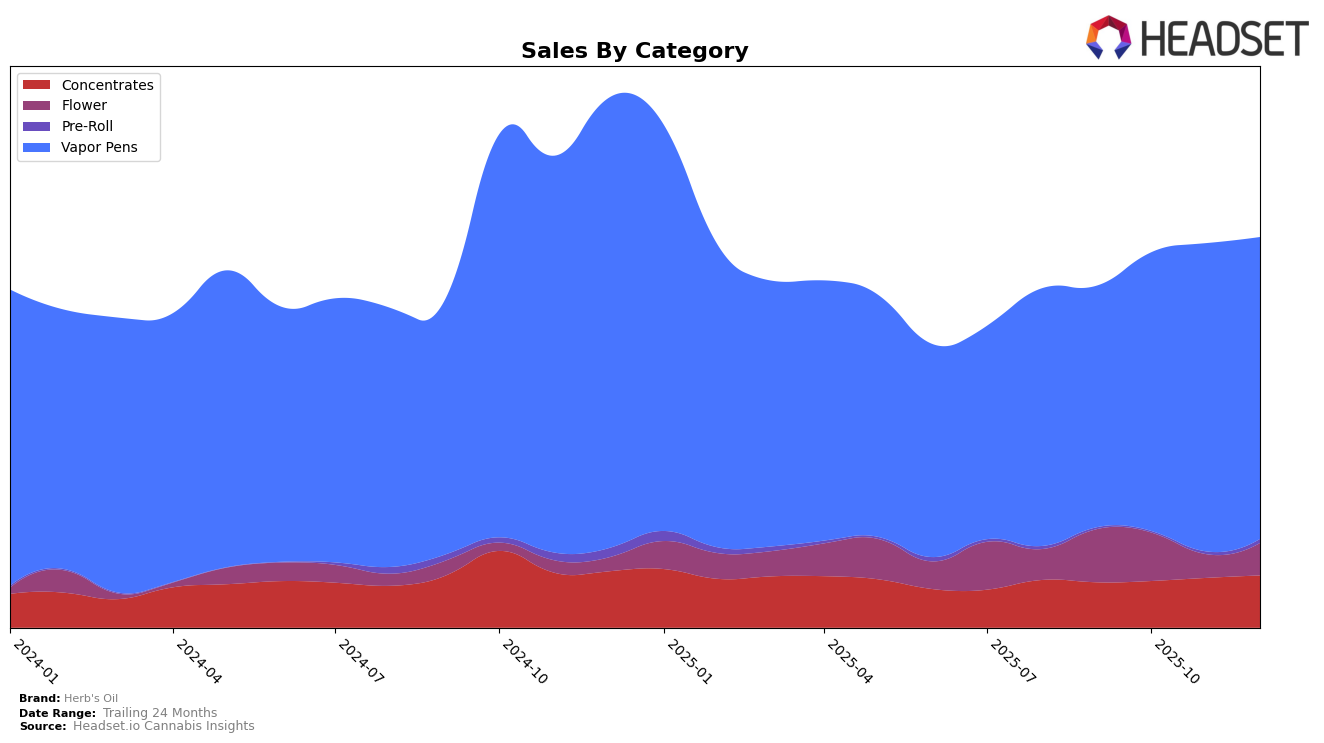

Herb's Oil has demonstrated a mixed performance across various categories and states. In Washington, the brand's presence in the Concentrates category has seen some fluctuations. Although not in the top 30, the brand improved its ranking from 68th in October 2025 to 59th by November and maintained that position in December. This upward trend in ranking indicates a growing acceptance or demand for their products within this category, despite not breaking into the top tier. On the other hand, their Vapor Pens category performance in Washington has been more stable, consistently staying within the top 30. The brand moved up slightly from 32nd in September to 28th in November, before settling at 30th in December, suggesting a steady consumer base in this segment.

While the Vapor Pens category shows a stable ranking, the sales figures reveal more about Herb's Oil's market dynamics. Notably, the sales for Vapor Pens peaked in November 2025, with a slight dip in December, which might suggest seasonal trends or competitive pressures during the holiday season. The Concentrates category, although not in the top 30, shows a consistent upward trend in sales from September to December, indicating a potential for future growth if the brand continues to capitalize on this momentum. This data highlights the importance of monitoring both rankings and sales to fully understand a brand's market position and potential areas for strategic focus.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Herb's Oil has demonstrated a consistent presence, maintaining a relatively stable rank from September to December 2025. Despite a slight dip in December, Herb's Oil has shown resilience, ranking 30th, which is a commendable position given the competitive environment. Notably, Honey Tree Extracts has consistently outperformed Herb's Oil, maintaining a higher rank throughout the months, indicating a strong market presence. Meanwhile, Canna Organix and Mama J's have shown fluctuating ranks, with Mama J's making a significant leap to 34th in December from being unranked in previous months. This suggests a dynamic market where Herb's Oil must continue to innovate and adapt to maintain and improve its position. Additionally, Treehaus Cannabis experienced a notable rise in December, surpassing Herb's Oil by moving to the 29th position, indicating increased competition in the lower ranks. These insights highlight the importance for Herb's Oil to focus on strategic marketing and product differentiation to enhance its competitive edge in the Washington vapor pen market.

Notable Products

In December 2025, Northern Lights Distillate Cartridge (1g) maintained its top position as the leading product from Herb's Oil, continuing its dominance from the previous months with a notable sales figure of 1064 units. Blackberry Kush Distillate Cartridge (1g) held steady at the second position, showing consistent performance since November. AK-47 Distillate Cartridge (1g) saw a slight improvement, moving up to third place from fourth in November. Maui Waui PHO Cartridge (1g) made its debut in the rankings at fourth place, indicating a strong market entry. Gummy Bear Distillate Cartridge (1g) rounded out the top five, climbing from an unranked position in previous months to fifth place in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.