Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

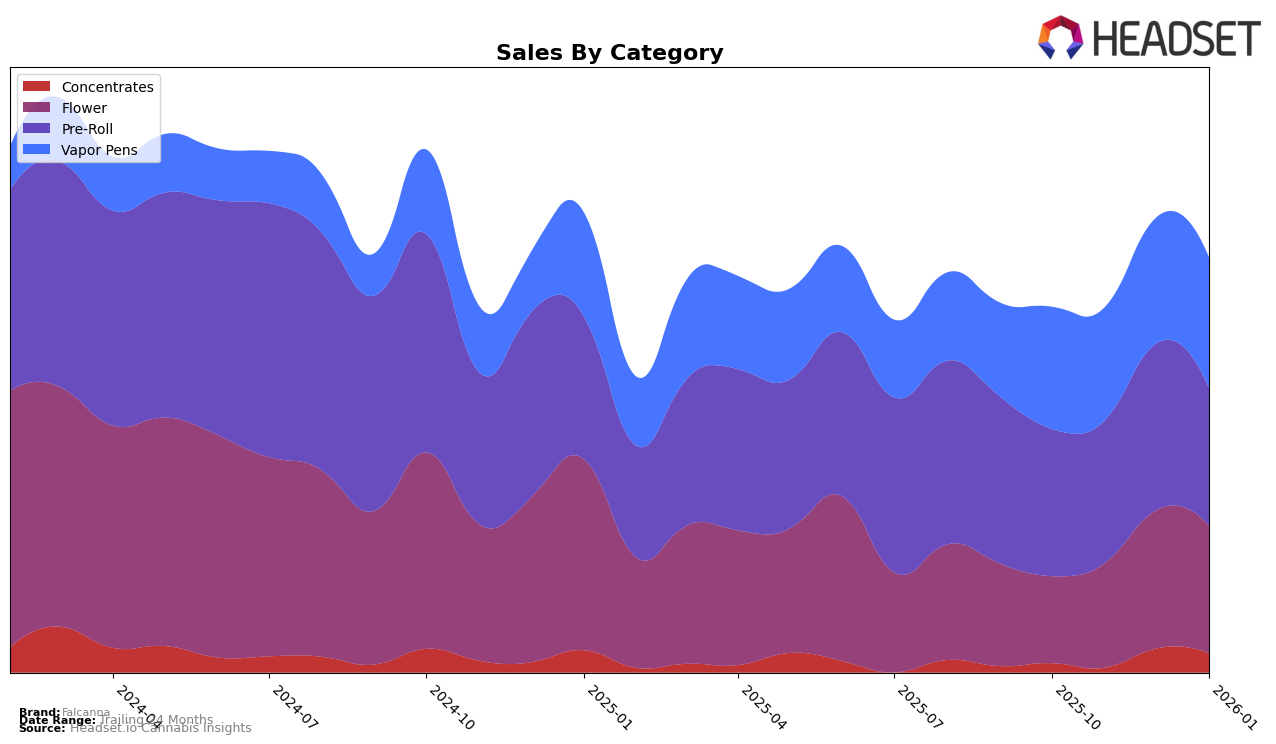

Falcanna has shown notable performance fluctuations across different product categories in Washington. In the Concentrates category, Falcanna managed to climb up the ranks from 39th in October 2025 to 32nd by December 2025, maintaining that position into January 2026. This upward trend reflects a positive reception in the market, especially as sales increased significantly in December. On the other hand, their Flower category performance also improved, rising from 60th place in October to 39th by January, indicating growing consumer interest and possibly effective marketing strategies or product improvements. However, it is important to note that Falcanna did not break into the top 30 in these categories, which suggests there is still room for growth.

In the Pre-Roll category, Falcanna consistently held the 21st position from October 2025 to January 2026, reflecting a stable demand for their products in this segment. This consistency could be seen as a positive sign of brand loyalty among consumers. Meanwhile, their performance in the Vapor Pens category saw minor fluctuations, with rankings moving from 34th in October to 36th in November, and then back to 34th by January. Despite these changes, the sales figures indicate a steady consumer base. Overall, while Falcanna is making strides in some areas, the absence from top 30 rankings in certain categories suggests that there are opportunities to further enhance their market presence in Washington.

Competitive Landscape

In the competitive landscape of Washington's Pre-Roll category, Falcanna has maintained a consistent rank of 21st from October 2025 through January 2026, indicating a stable position amidst fluctuating market dynamics. Despite not breaking into the top 20, Falcanna's sales figures suggest a competitive edge over brands like Fetti, which ranked lower at 25th in October 2025 and improved to 22nd by January 2026. However, Falcanna faces stiff competition from Shatter J's by Seattle Marijuana Company, which consistently outperformed Falcanna, peaking at 16th in December 2025. Meanwhile, Seattle's Private Reserve maintained a rank within the top 20, showing resilience despite a slight dip in November 2025. The data suggests that while Falcanna holds a steady position, there is an opportunity to leverage strategic marketing efforts to climb the ranks, especially as competitors like PICC Platform demonstrate significant upward mobility, moving from 52nd to 23rd within four months.

Notable Products

In January 2026, Candy Queen Pre-Roll 2-Pack (1.2g) regained its top position as the leading product for Falcanna, maintaining its rank from October and November 2025 and achieving sales of 1287. Deep Sea Live Resin HTE Ceramic Cartridge (1g) saw a significant rise, climbing to the second position from its previous fifth place in November 2025. Charlotte's Web Pre-Roll 12-Pack (7.2g) maintained a steady presence, ranking third, slightly improving from its fifth position in December 2025. Candy Queen Live Resin Cartridge (1g) entered the rankings for the first time in January, securing the fourth spot. Mac 1 Pre-Roll 2-Pack (1.2g) debuted in the rankings at fifth place, indicating a strong market entry.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.