Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

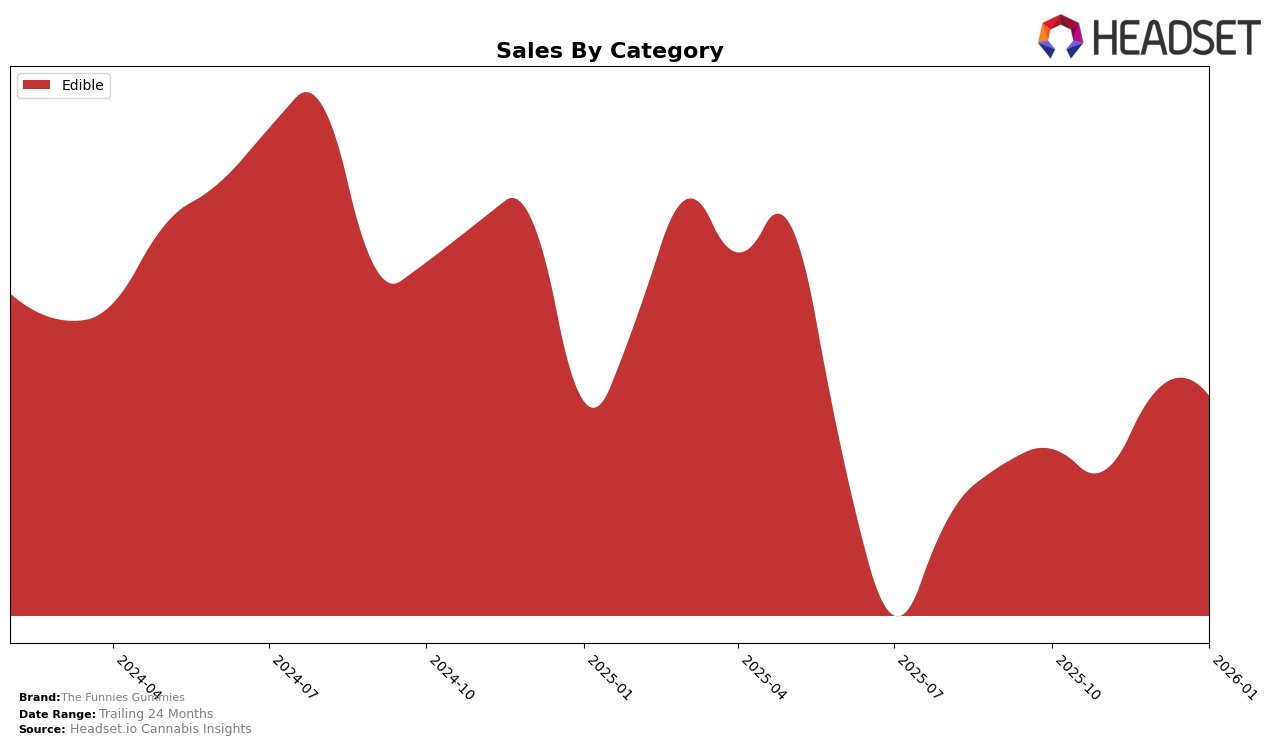

The Funnies Gummies have shown a notable performance in the Edible category within Illinois. Over the past few months, the brand has experienced a gradual upward movement in rankings, starting from the 10th position in October 2025 and climbing to 7th by January 2026. This positive trend reflects their growing popularity and suggests effective market strategies or product offerings that resonate well with consumers. Despite a slight dip in sales from October to November, the brand rebounded with increased sales figures in December and maintained a strong performance into January.

It's important to note that The Funnies Gummies did not appear in the top 30 rankings in any other state or category during this period, which could be seen as a limitation in their market reach or brand recognition outside of Illinois. This absence in other markets provides an interesting contrast to their success in Illinois and may highlight potential areas for growth or expansion. The brand's ability to maintain and improve its standing in Illinois could serve as a model for potential strategies in other regions. For more detailed insights and data on The Funnies Gummies, you can explore their profile on Headset.

Competitive Landscape

In the competitive landscape of the Illinois edible cannabis market, The Funnies Gummies has shown notable progress in its rankings over the last few months, indicating a positive trend in consumer preference and market penetration. Starting from the 10th position in October 2025, The Funnies Gummies climbed to the 7th position by January 2026. This upward movement is significant, especially when compared to competitors like Kanha / Sunderstorm and Wonder Wellness Co., both of which have maintained relatively stable positions, with Kanha / Sunderstorm experiencing a slight dip from 7th to 9th place. Meanwhile, Savvy has shown a strong performance, moving from 9th to 6th place, which suggests a competitive edge in sales growth. Despite these challenges, The Funnies Gummies' ability to improve its rank suggests effective marketing strategies and growing consumer loyalty, positioning it as a rising contender in the edible category within Illinois.

Notable Products

In January 2026, The Funnies Gummies' top-performing product was Super Funny - Pineapple Mango Mai Tai Gummies 2-Pack (100mg), maintaining its rank from November 2025 and achieving sales of 7787 units. Following closely was Super Funny - Purely Peach Gummies 2-Pack (100mg), which improved from third place in December 2025 to second in January. Super Funnies - Strawberry Daiquiri Gummies 2-Pack (100mg) consistently held the third position, showing a slight decline from its second-place rank in December 2025. Notably, Super Funnies - Sour Blue Raspberry Gummies 2-Pack (100mg) entered the rankings in January, securing fourth place. The Sour Blue Raspberry Gummies 20-Pack (100mg) dropped to fifth, a notable shift from its leading position in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.