Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

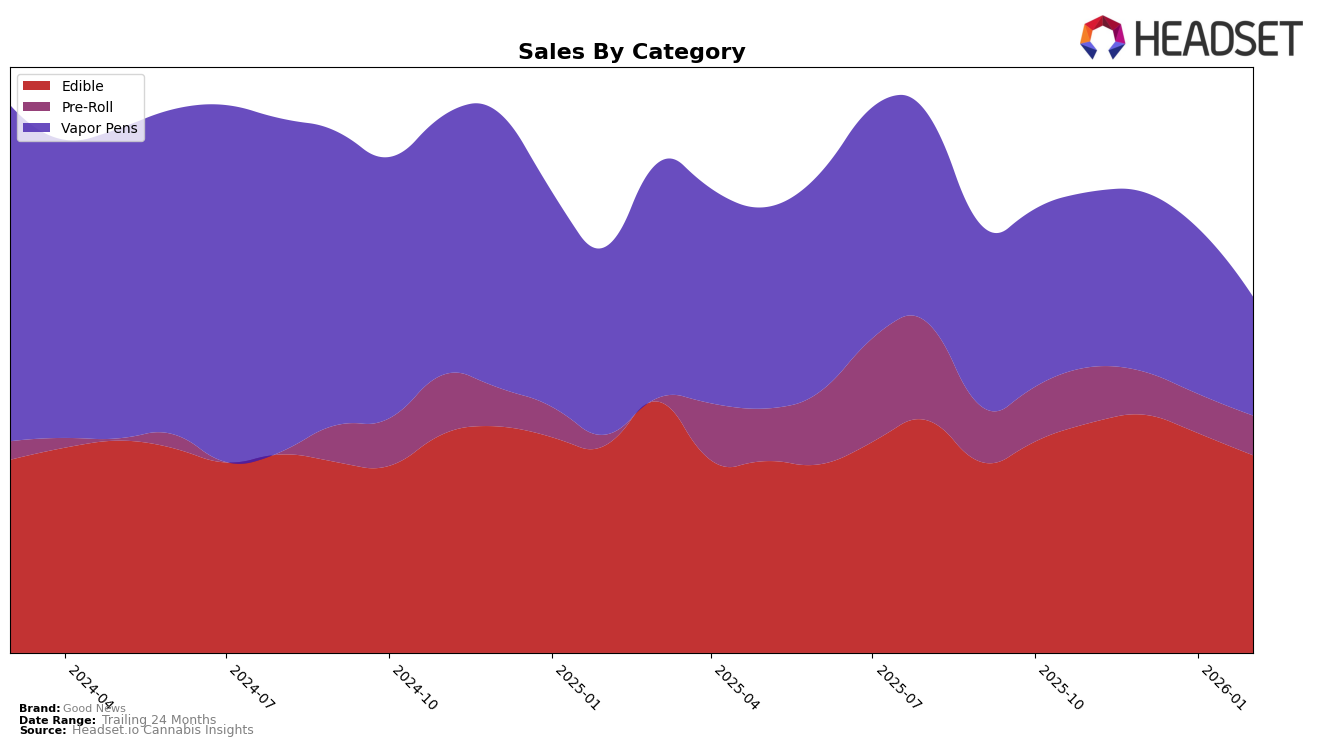

In the state of Illinois, Good News has shown varied performance across different product categories. The brand's Edible category maintained a relatively stable position, slipping slightly from 9th to 11th place from November 2025 to February 2026, despite a gradual decrease in sales. In contrast, the Vapor Pens category experienced a more pronounced decline, dropping from 21st to 24th place over the same period, indicating potential challenges in maintaining consumer interest or facing increased competition. The Pre-Roll category remained static at 18th place from December 2025 to February 2026, suggesting a consistent performance but also highlighting an opportunity for growth to break into higher rankings.

In Massachusetts, Good News faced challenges in the Pre-Roll category, where it did not rank in the top 30 in December 2025, indicating a significant gap in market presence during that month. However, by February 2026, the brand improved its position to 90th, suggesting some recovery. The Edible category showed stability by maintaining the 11th position from December 2025 to February 2026, while the Vapor Pens category saw a decline from 19th to 24th place, similar to the trend observed in Illinois. In Ohio, Good News remained consistent in the Edible category, holding the 13th position from January to February 2026, despite fluctuations in sales, which may reflect a loyal customer base or effective brand positioning in that market.

Competitive Landscape

In the competitive landscape of the Edible category in Illinois, Good News experienced a fluctuating rank over the observed months, starting at 9th in November 2025, dropping to 11th in December, further slipping to 12th in January 2026, and then slightly recovering to 11th in February. This pattern suggests a struggle to maintain a stable position amidst strong competitors. Notably, Kanha / Sunderstorm consistently outperformed Good News, maintaining a higher rank, though it experienced a decline from 7th to 13th by February. Meanwhile, Savvy showcased impressive performance, climbing from 8th to 6th in January before settling at 9th in February, indicating a robust competitive edge. Betty's Eddies showed improvement, ending February ahead of Good News at 10th position, while Camino remained close, fluctuating around the same ranks. These dynamics highlight the need for Good News to strategize effectively to regain and sustain a higher market position in this competitive edible market.

Notable Products

In February 2026, Good News' top-performing product was Me Time - Indica Blue Raspberry Gummies 20-Pack, which rose to the first rank from its consistent second position in the preceding months, achieving sales of 7,763 units. Friyay - Sour Watermelon Gummies 10-Pack, previously the top-ranked product, slipped to second place with a notable decrease in sales compared to January 2026. Counting Sheep - THC/CBN 2:1 Black Cherry Gummies 10-Pack maintained its third position throughout the months, indicating stable performance. Brunch - Orange Gummies 10-Pack held its fourth place, showing a slight increase in sales from January to February 2026. Day Off - CBD/THC 1:1 Peach Gummies 10-Pack remained in the fifth position since debuting in January, suggesting a steady market entry.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.