Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

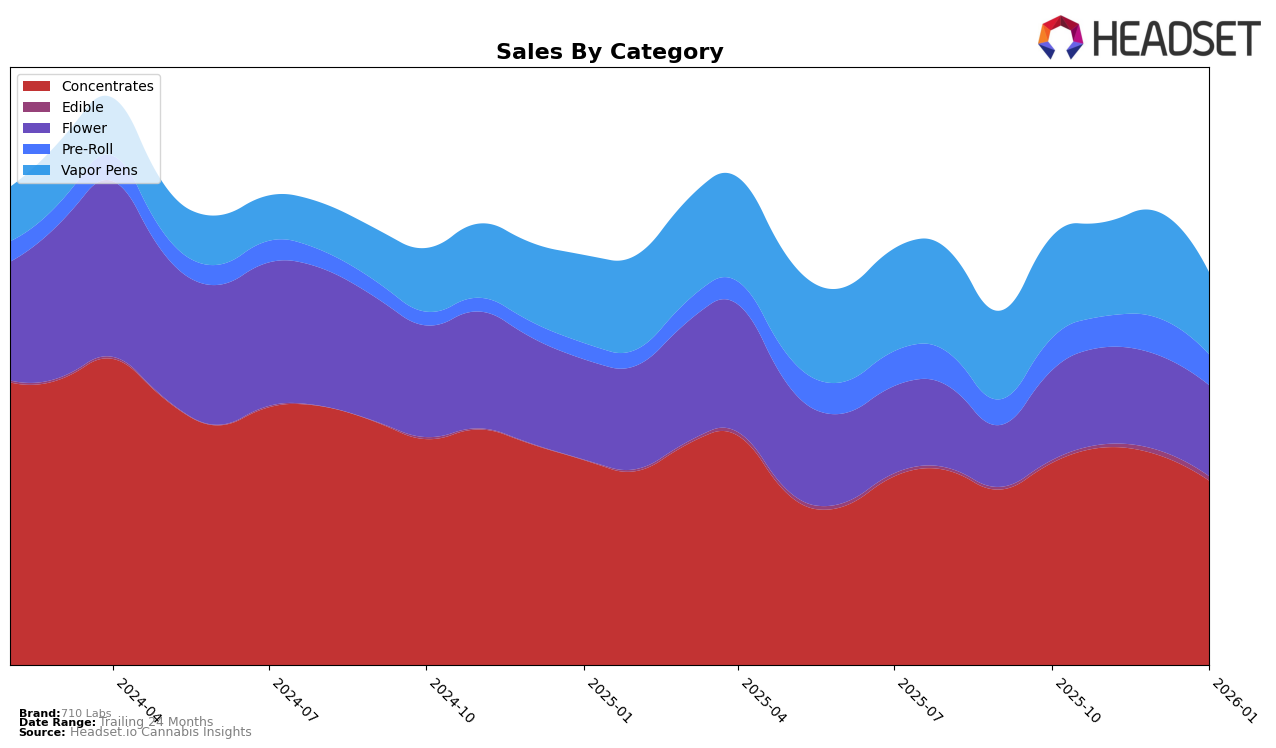

In the California market, 710 Labs has maintained a consistent presence in the concentrates category, holding steady at the third position from October 2025 to January 2026. However, their performance in other categories such as flower, pre-rolls, and vapor pens has not been as strong, with rankings not breaching the top 30, except for a slight decline in the pre-roll category from 42nd to 49th. This suggests a stronghold in the concentrates market while indicating potential areas for growth in other categories.

In Colorado, 710 Labs has shown resilience, especially in concentrates where they consistently rank second. The flower category has seen a notable improvement, with the brand climbing from 10th to 5th position by January 2026. On the other hand, their presence in the vapor pen category remains modest, maintaining a rank around the mid-20s. Meanwhile, in New Jersey, the brand has made impressive strides in concentrates, rising to the second position by the end of the period. Their performance in Michigan has been more challenging, with a decline in the concentrates category from 7th to 11th and vapor pens slipping out of the top 40, indicating competitive pressures in these markets.

Competitive Landscape

In the competitive landscape of California's concentrates market, 710 Labs consistently holds a strong position, maintaining a steady rank of 3rd place from October 2025 to January 2026. Despite a notable drop in sales from December 2025 to January 2026, 710 Labs remains a formidable player, closely trailing behind the industry leaders. Raw Garden dominates the top spot with significantly higher sales figures, while STIIIZY consistently ranks 2nd, showcasing a robust upward sales trend. Meanwhile, Punch Extracts / Punch Edibles and CannaBiotix (CBX) remain in the 4th and 5th positions, respectively, with sales figures that are generally lower than those of 710 Labs. This competitive environment highlights the need for 710 Labs to innovate and potentially expand its market strategies to close the gap with the top two brands and counteract any downward sales trends.

Notable Products

In January 2026, the top-performing product for 710 Labs was the Terp Quest RSO Syringe (1g) in the Concentrates category, securing the number one rank with sales of 3680 units. The Super Freak (Bulk) from the Flower category maintained a strong presence, moving to the second position, although it previously held the top spot in November 2025. Lemon Tart Pucker #1 Pre-Roll (1g) ranked third, showing a slight decline from its second position in December 2025. Cold Creek Kush Pre-Roll (1g) made its way to the fourth position, while Zimosa #2 (Bulk) rounded out the top five. These rankings indicate a dynamic shift in consumer preferences, particularly in the Pre-Roll and Concentrates categories.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.