Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

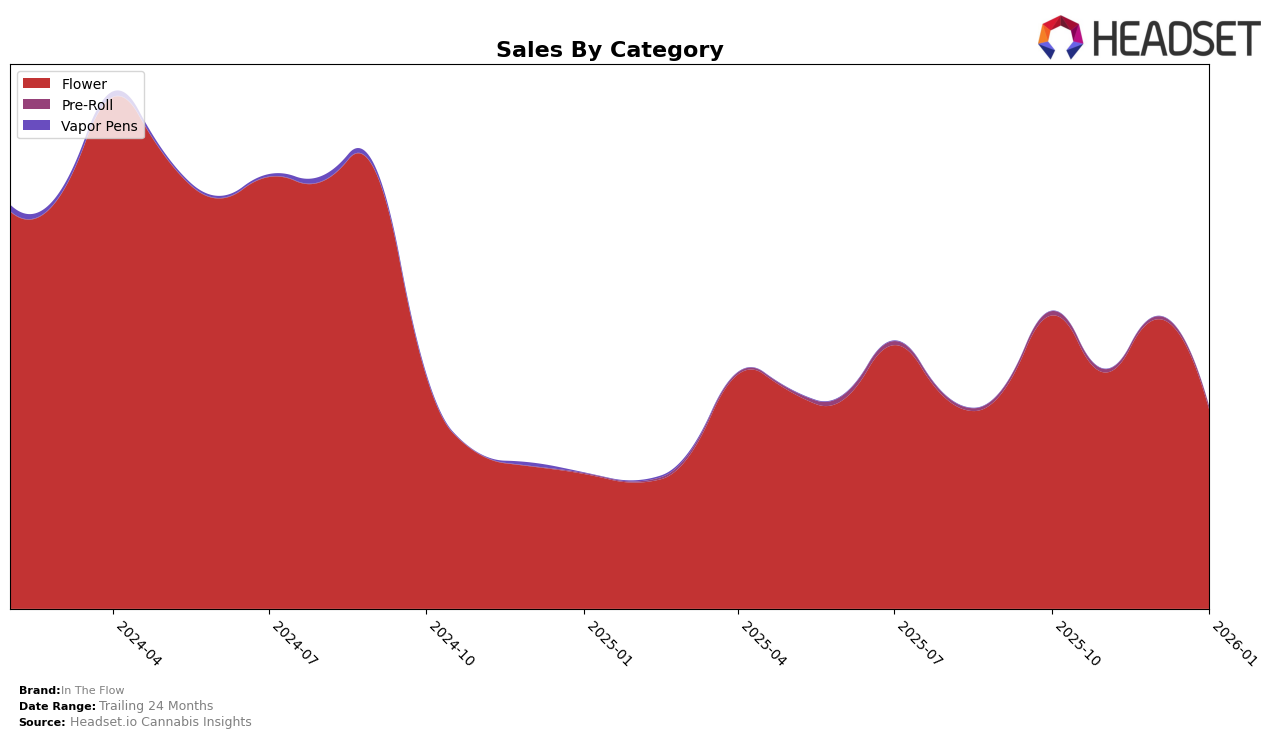

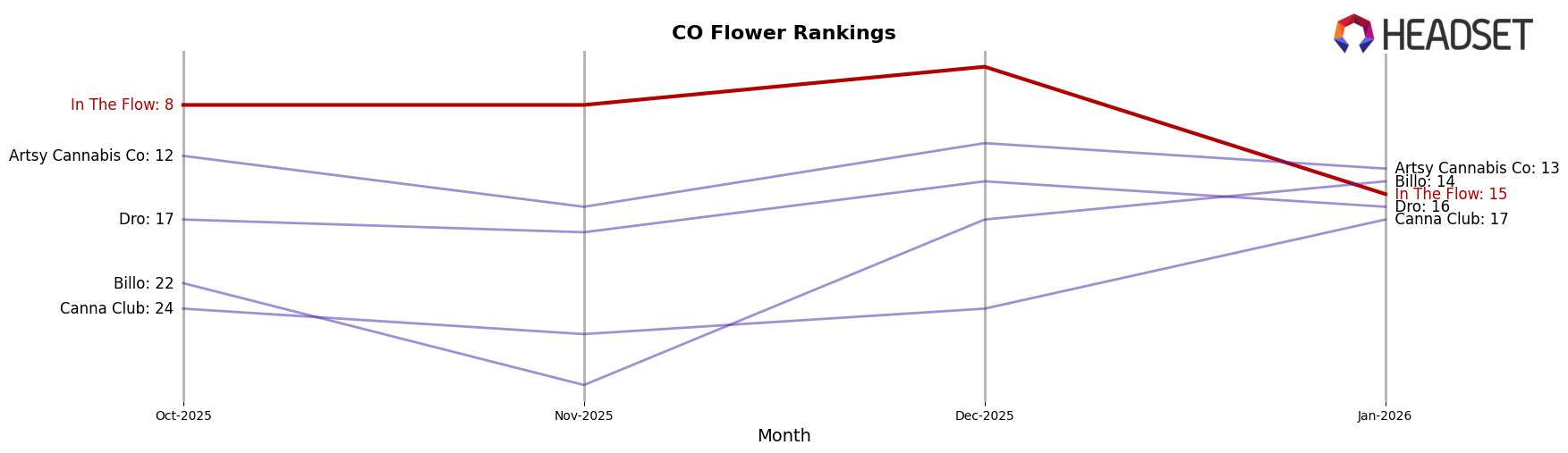

In The Flow has shown varied performance across different categories and states, with notable fluctuations in its rankings. In the Colorado market, the brand has maintained a presence in the Flower category, although its position has seen significant shifts. Starting from a ranking of 8th in both October and November 2025, the brand climbed to 5th place in December 2025. However, by January 2026, it experienced a drop to 15th place. This movement indicates a competitive landscape in the Flower category within Colorado, where In The Flow is striving to maintain its footing amidst dynamic market conditions.

The sales trends for In The Flow in Colorado also reflect these ranking shifts. Despite a dip in sales from October to November 2025, there was a recovery in December, followed by another decline in January 2026. This pattern suggests that while the brand can capture increased market share, sustaining that growth is challenging. The absence of In The Flow from the top 30 in other states or categories could be seen as a potential area for growth or a reflection of strategic focus on specific markets. Understanding these dynamics is crucial for stakeholders looking to navigate the competitive cannabis landscape.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, In The Flow has experienced notable fluctuations in its ranking over the past few months. Starting strong in October and November 2025 with a consistent rank of 8th, In The Flow saw a significant improvement in December 2025, climbing to 5th place. However, by January 2026, the brand experienced a sharp decline, dropping to 15th place. This decline in rank is contrasted by the performance of competitors like Billo, which improved from being outside the top 20 in October and November to 14th place by January 2026, and Artsy Cannabis Co, which maintained a relatively stable position, peaking at 11th in December. Meanwhile, Dro and Canna Club have shown gradual improvements, with Dro consistently ranking higher than Canna Club. These dynamics suggest that while In The Flow has demonstrated potential for high performance, the brand faces increasing competition and must strategize to regain its higher ranking and stabilize sales.

Notable Products

In The Flow's top-performing product for January 2026 is Chemmy Jones (Bulk) in the Flower category, maintaining its first-place ranking consistently since October 2025, with a notable sales figure of 14,690. Durban Poison (Bulk) made a significant leap to second place, having been unranked in December 2025. Donny Burger (3.5g) held steady in third place, showing a gradual increase in sales over the months. Blue Dream (Bulk) entered the rankings for the first time in January 2026, securing the fourth position. WiFi OG (Bulk) experienced a drop to fifth place after being ranked third in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.